Allwyn Results Presentation Deck

Q1 2023 highlights

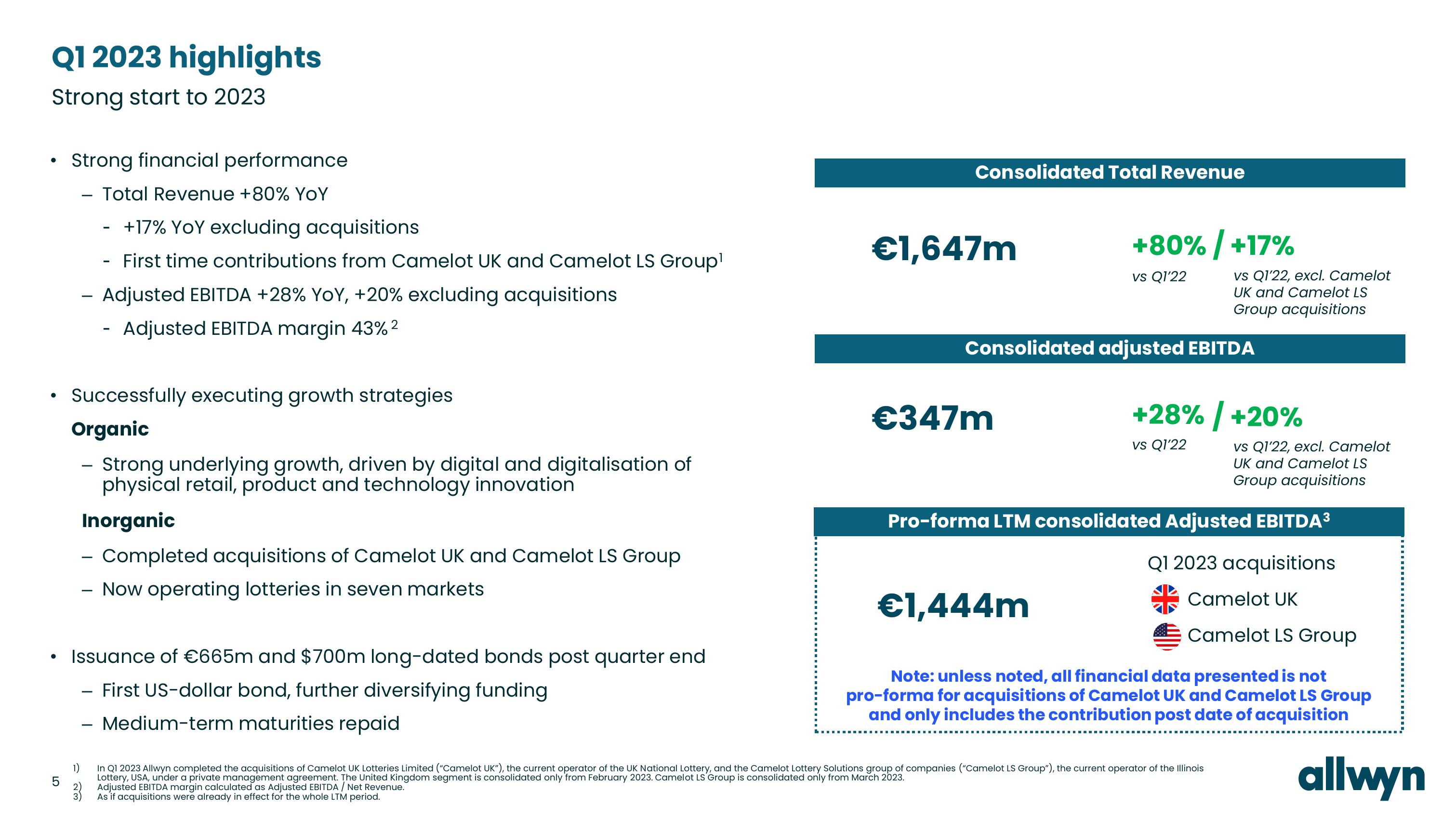

Strong start to 2023

●

●

5

Strong financial performance

- Total Revenue +80% YOY

-

-

+17% YOY excluding acquisitions

First time contributions from Camelot UK and Camelot LS Group¹

- Adjusted EBITDA +28% YOY, +20% excluding acquisitions

Adjusted EBITDA margin 43%²

Successfully executing growth strategies

Organic

Strong underlying growth, driven by digital and digitalisation of

physical retail, product and technology innovation

Inorganic

Completed acquisitions of Camelot UK and Camelot LS Group

- Now operating lotteries in seven markets

Issuance of €665m and $700m long-dated bonds post quarter end

- First US-dollar bond, further diversifying funding

- Medium-term maturities repaid

Consolidated Total Revenue

€1,647m

+80% / +17%

vs Q1'22

€347m

Consolidated adjusted EBITDA

vs Q1'22, excl. Camelot

UK and Camelot LS

Group acquisitions

+28% / +20%

vs Q1'22

vs Q1'22, excl. Camelot

UK and Camelot LS

Group acquisitions

Pro-forma LTM consolidated Adjusted EBITDA³

Q1 2023 acquisitions

Camelot UK

Camelot LS Group

1)

In Q1 2023 Allwyn completed the acquisitions of Camelot UK Lotteries Limited ("Camelot UK"), the current operator of the UK National Lottery, and the Camelot Lottery Solutions group of companies ("Camelot LS Group"), the current operator of the Illinois

Lottery, USA, under a private management agreement. The United Kingdom segment is consolidated only from February 2023. Camelot LS Group is consolidated only from March 2023.

Adjusted EBITDA margin calculated as Adjusted EBITDA / Net Revenue.

As if acquisitions were already in effect for the whole LTM period.

€1,444m

Note: unless noted, all financial data presented is not

pro-forma for acquisitions of Camelot UK and Camelot LS Group

and only includes the contribution post date of acquisition

allwynView entire presentation