TPG Results Presentation Deck

Quarterly Pro Forma GAAP Statements of Operations Footnotes

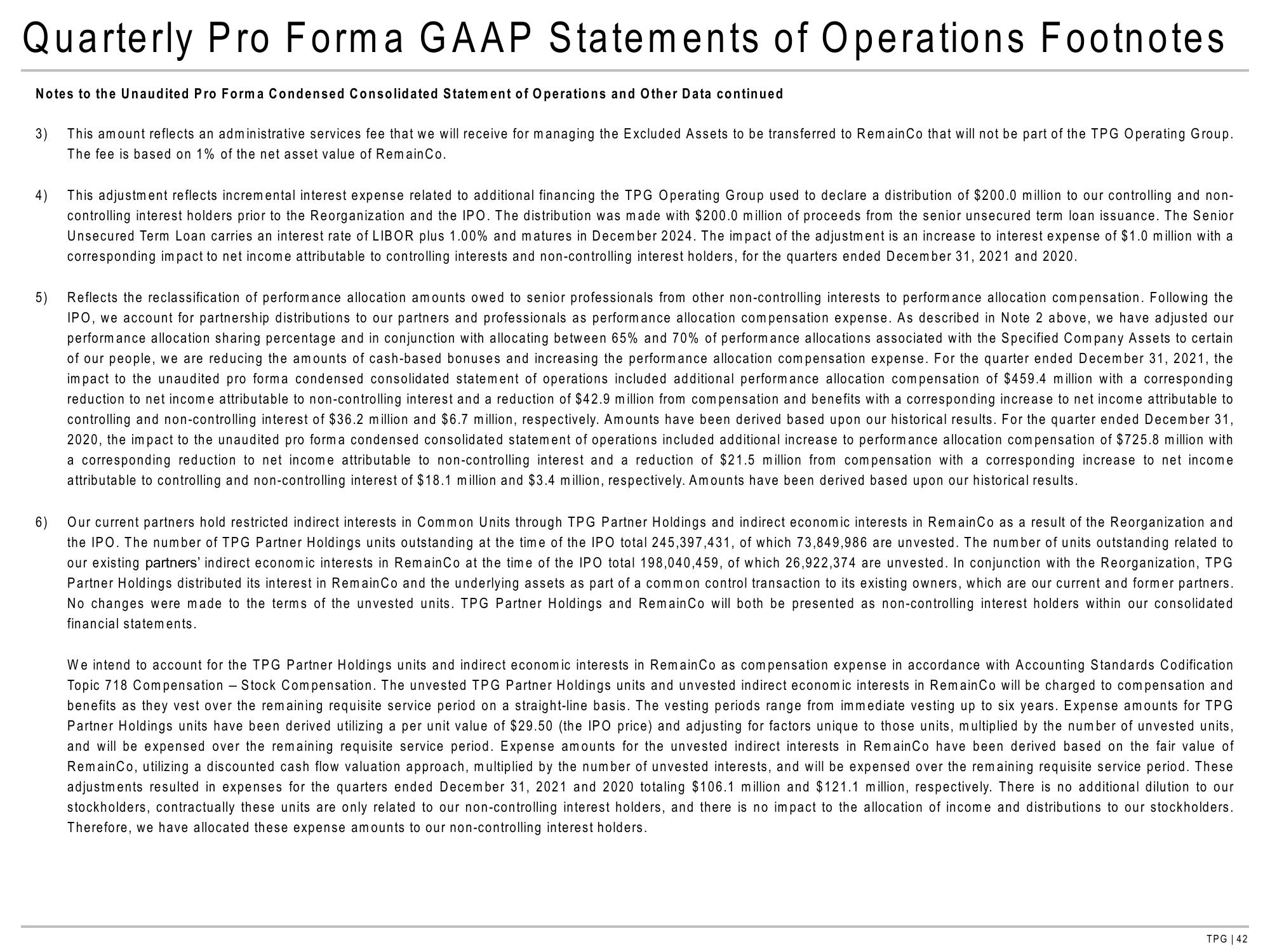

Notes to the Unaudited Pro Forma Condensed Consolidated Statement of Operations and Other Data continued

3)

This amount reflects an administrative services fee that we will receive for managing the Excluded Assets to be transferred to RemainCo that will not be part of the TPG Operating Group.

The fee is based on 1% of the net asset value of Remain Co.

4)

This adjustment reflects incremental interest expense related to additional financing the TPG Operating Group used to declare a distribution of $200.0 million to our controlling and non-

controlling interest holders prior to the Reorganization and the IPO. The distribution was made with $200.0 million of proceeds from the senior unsecured term loan issuance. The Senior

Unsecured Term Loan carries an interest rate of LIBOR plus 1.00% and matures in December 2024. The impact of the adjustment is an increase to interest expense of $1.0 million with a

corresponding impact to net income attributable to controlling interests and non-controlling interest holders, for the quarters ended December 31, 2021 and 2020.

5) Reflects the reclassification of performance allocation amounts owed to senior professionals from other non-controlling interests to performance allocation compensation. Following the

IPO, we account for partnership distributions to our partners and professionals as performance allocation compensation expense. As described in Note 2 above, we have adjusted our

performance allocation sharing percentage and in conjunction with allocating between 65% and 70% of performance allocations associated with the Specified Company Assets to certain

of our people, we are reducing the amounts of cash-based bonuses and increasing the performance allocation compensation expense. For the quarter ended December 31, 2021, the

impact to the unaudited pro forma condensed consolidated statement of operations included additional performance allocation compensation of $459.4 million with a corresponding

reduction to net income attributable to non-controlling interest and a reduction of $42.9 million from compensation and benefits with a corresponding increase to net income attributable to

controlling and non-controlling interest of $36.2 million and $6.7 million, respectively. Amounts have been derived based upon our historical results. For the quarter ended December 31,

2020, the impact to the unaudited pro forma condensed consolidated statement of operations included additional increase to performance allocation compensation of $725.8 million with

a corresponding reduction to net income attributable to non-controlling interest and a reduction of $21.5 million from compensation with a corresponding increase to net income

attributable to controlling and non-controlling interest of $18.1 million and $3.4 million, respectively. Amounts have been derived based upon our historical results.

6)

Our current partners hold restricted indirect interests in Common Units through TPG Partner Holdings and indirect economic interests in RemainCo as a result of the Reorganization and

the IPO. The number of TPG Partner Holdings units outstanding at the time of the IPO total 245,397,431, of which 73,849,986 are unvested. The number of units outstanding related to

our existing partners' indirect economic interests in RemainCo at the time of the IPO total 198,040,459, of which 26,922,374 are unvested. In conjunction with the Reorganization, TPG

Partner Holdings distributed its interest in RemainCo and the underlying assets as part of a common control transaction to its existing owners, which are our current and former partners.

No changes were made to the terms of the unvested units. TPG Partner Holdings and RemainCo will both be presented as non-controlling interest holders within our consolidated

financial statements.

We intend to account for the TPG Partner Holdings units and indirect economic interests in RemainCo as compensation expense in accordance with Accounting Standards Codification

Topic 718 Compensation - Stock Compensation. The unvested TPG Partner Holdings units and unvested indirect economic interests in RemainCo will be charged to compensation and

benefits as they vest over the remaining requisite service period on a straight-line basis. The vesting periods range from immediate vesting up to six years. Expense amounts for TPG

Partner Holdings units have been derived utilizing a per unit value of $29.50 (the IPO price) and adjusting for factors unique to those units, multiplied by the number of unvested units,

and will be expensed over the remaining requisite service period. Expense amounts for the unvested indirect interests in RemainCo have been derived based on the fair value of

RemainCo, utilizing a discounted cash flow valuation approach, multiplied by the number of unvested interests, and will be expensed over the remaining requisite service period. These

adjustments resulted in expenses for the quarters ended December 31, 2021 and 2020 totaling $106.1 million and $121.1 million, respectively. There is no additional dilution to our

stockholders, contractually these units are only related to our non-controlling interest holders, and there is no impact to the allocation of income and distributions to our stockholders.

Therefore, we have allocated these expense amounts to our non-controlling interest holders.

TPG | 42View entire presentation