Bausch+Lomb Results Presentation Deck

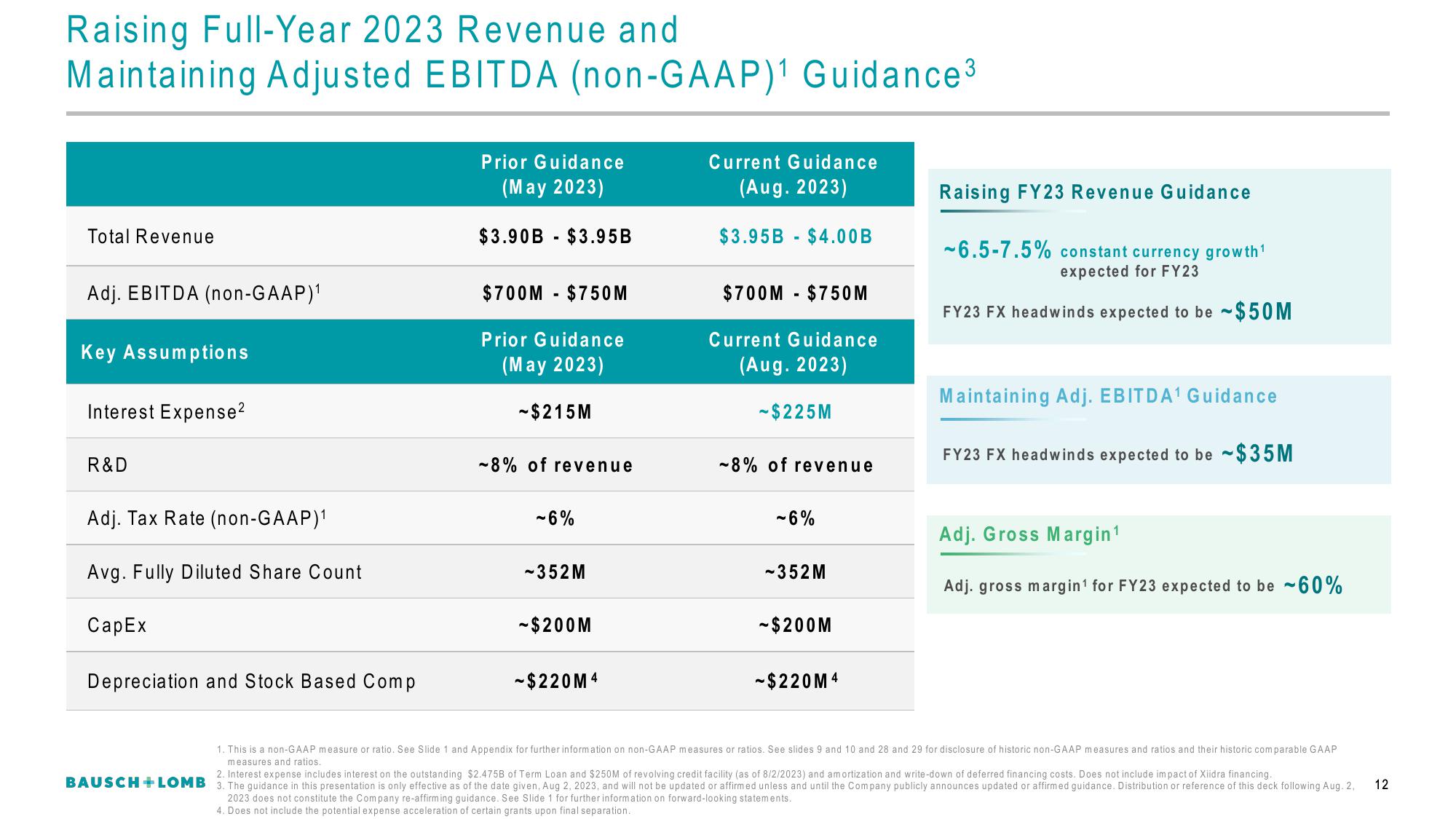

Raising Full-Year 2023 Revenue and

Maintaining Adjusted EBITDA (non-GAAP)1 Guidance³

Total Revenue

Adj. EBITDA (non-GAAP)¹

Key Assumptions

Interest Expense²

R&D

Adj. Tax Rate (non-GAAP)¹

Avg. Fully Diluted Share Count

CapEx

Depreciation and Stock Based Comp

Prior Guidance

(May 2023)

$3.90B $3.95B

$700M $750M

Prior Guidance

(May 2023)

-$215M

-8% of revenue

-6%

-352M

-$200M

-$220M4

Current Guidance

(Aug. 2023)

$3.95B $4.00B

$700M $750M

Current Guidance

(Aug. 2023)

-$225M

-8% of revenue

-6%

-352M

-$200M

-$220M4

Raising FY23 Revenue Guidance

-6.5-7.5% constant currency growth¹

expected for FY23

FY23 FX headwinds expected to be ~$50M

Maintaining Adj. EBITDA¹ Guidance

FY23 FX headwinds expected to be ~$35M

Adj. Gross Margin ¹

Adj. gross margin¹ for FY23 expected to be 60%

1. This is a non-GAAP measure or ratio. See Slide 1 and Appendix for further information on non-GAAP measures or ratios. See slides 9 and 10 and 28 and 29 for disclosure of historic non-GAAP measures and ratios and their historic comparable GAAP

measures and ratios.

2. Interest expense includes interest on the outstanding $2.475B of Term Loan and $250M of revolving credit facility (as of 8/2/2023) and amortization and write-down of deferred financing costs. Does not include impact of Xiidra financing.

BAUSCH+LOMB 3. The guidance in this presentation is only effective as of the date given, Aug 2, 2023, and will not be updated or affirmed unless and until the Company publicly announces updated or affirmed guidance. Distribution or reference of this deck following Aug. 2,

2023 does not constitute the Company re-affirming guidance. See Slide 1 for further information on forward-looking statements.

4. Does not include the potential expense acceleration of certain grants upon final separation.

12View entire presentation