Kore Results Presentation Deck

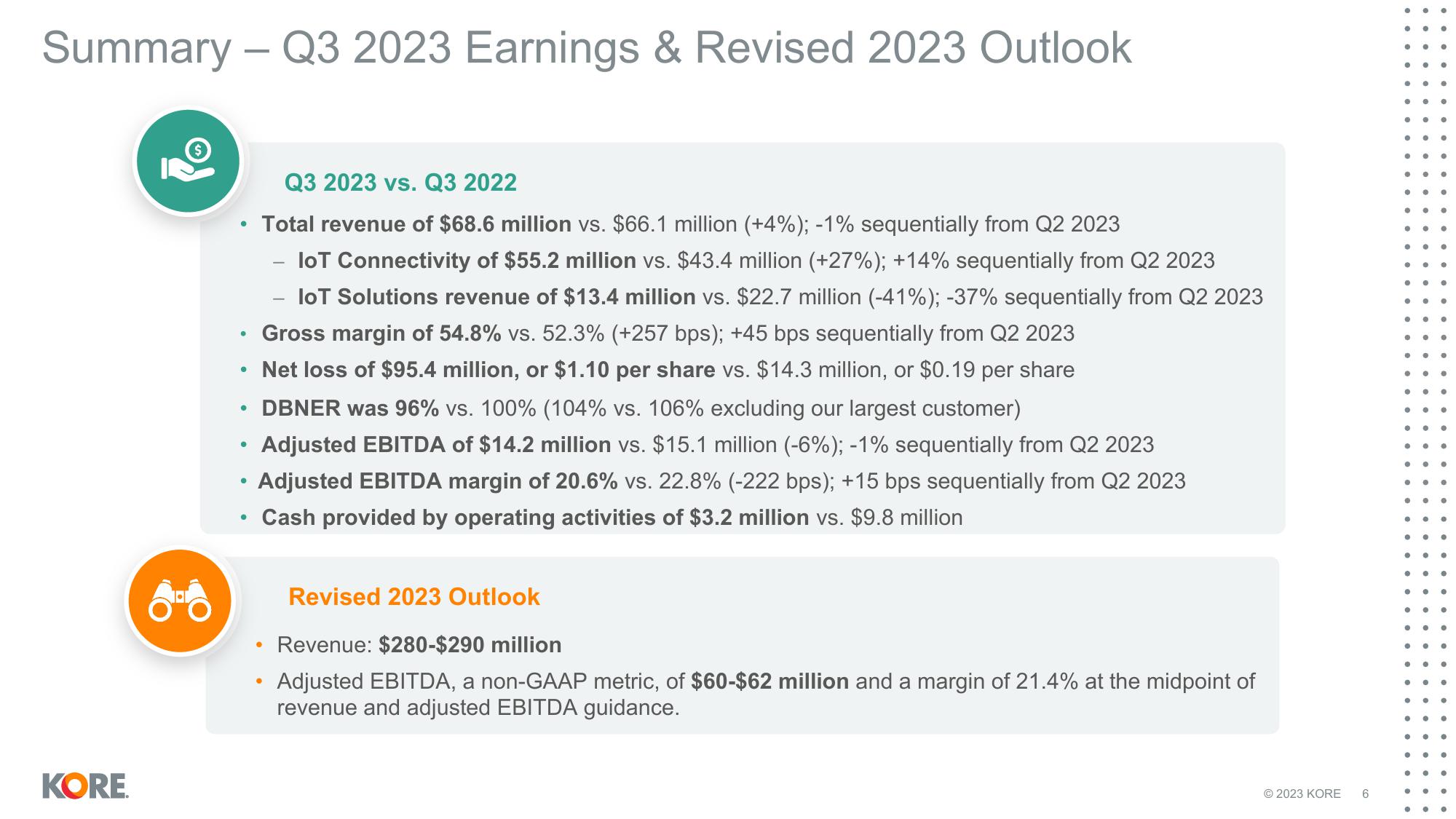

Summary - Q3 2023 Earnings & Revised 2023 Outlook

KORE

8

●

●

●

●

●

Q3 2023 vs. Q3 2022

Total revenue of $68.6 million vs. $66.1 million (+4%); -1% sequentially from Q2 2023

IoT Connectivity of $55.2 million vs. $43.4 million (+27%); +14% sequentially from Q2 2023

loT Solutions revenue of $13.4 million vs. $22.7 million (-41%); -37% sequentially from Q2 2023

Gross margin of 54.8% vs. 52.3% (+257 bps); +45 bps sequentially from Q2 2023

Net loss of $95.4 million, or $1.10 per share vs. $14.3 million, or $0.19 per share

DBNER was 96% vs. 100% (104% vs. 106% excluding our largest customer)

Adjusted EBITDA of $14.2 million vs. $15.1 million (-6%); -1% sequentially from Q2 2023

Adjusted EBITDA margin of 20.6% vs. 22.8% (-222 bps); +15 bps sequentially from Q2 2023

Cash provided by operating activities of $3.2 million vs. $9.8 million

●

●

Revised 2023 Outlook

Revenue: $280-$290 million

Adjusted EBITDA, a non-GAAP metric, of $60-$62 million and a margin of 21.4% at the midpoint of

revenue and adjusted EBITDA guidance.

© 2023 KORE 6

●

●

●

●

●

●

●

●

..

●

●

●

●

● ●

..

●

●

●

●

.

●

●

● ●

●

...

●View entire presentation