Arrival Results Presentation Deck

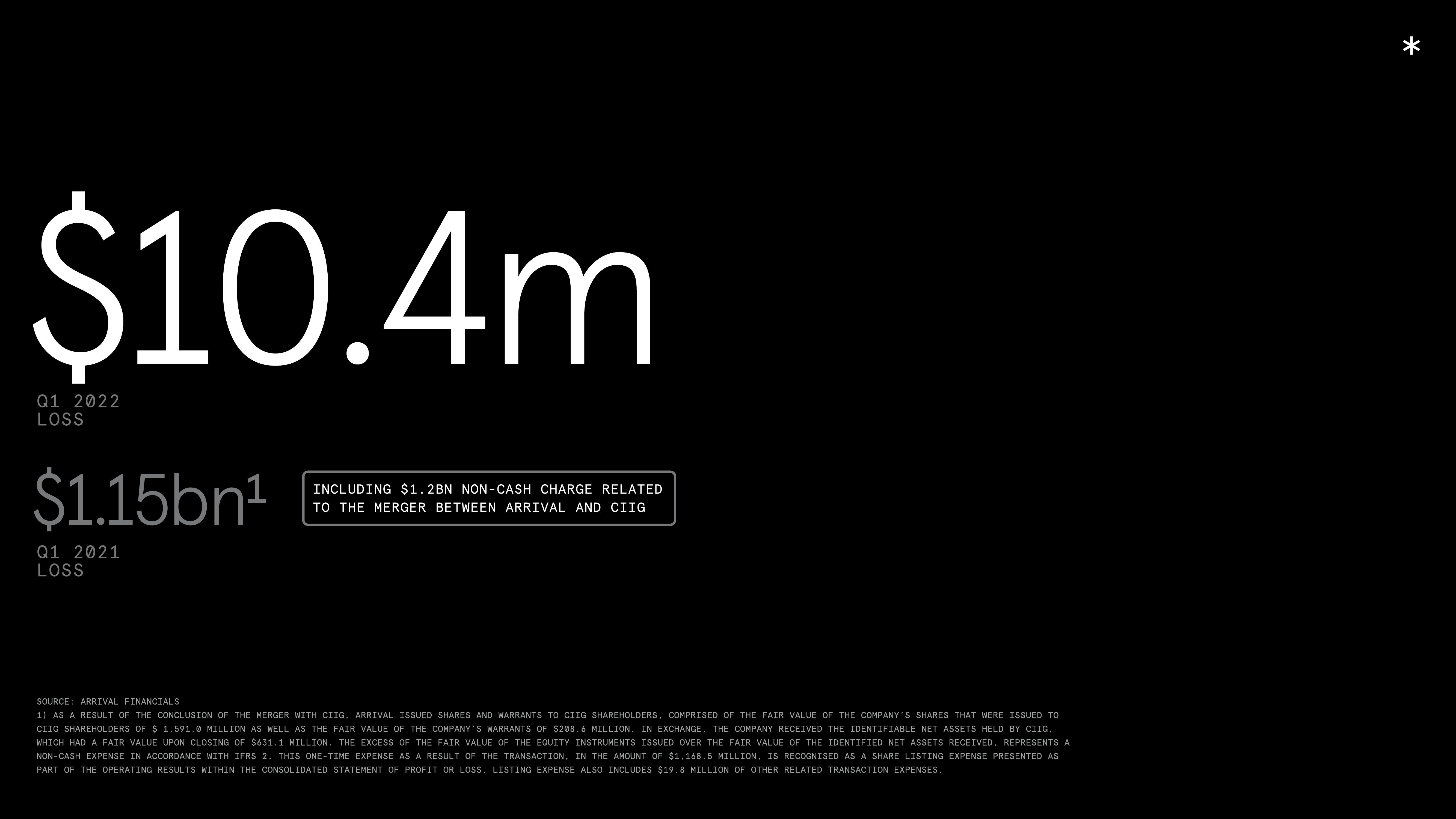

$10.4m

Q1 2022

LOSS

$1.15bn¹

Q1 2021

LOSS

INCLUDING $1.2BN NON-CASH CHARGE RELATED

TO THE MERGER BETWEEN ARRIVAL AND CIIG

SOURCE: ARRIVAL FINANCIALS

1) AS A RESULT OF THE CONCLUSION OF THE MERGER WITH CIIG, ARRIVAL ISSUED SHARES AND WARRANTS TO CIIG SHAREHOLDERS, COMPRISED OF THE FAIR VALUE OF THE COMPANY'S SHARES THAT WERE ISSUED TO

CIIG SHAREHOLDERS OF $ 1,591.0 MILLION AS WELL AS THE FAIR VALUE OF THE COMPANY'S WARRANTS OF $208.6 MILLION. IN EXCHANGE, THE COMPANY RECEIVED THE IDENTIFIABLE NET ASSETS HELD BY CIIG,

WHICH HAD A FAIR VALUE UPON CLOSING OF $631.1 MILLION. THE EXCESS OF THE FAIR VALUE OF THE EQUITY INSTRUMENTS ISSUED OVER THE FAIR VALUE OF THE IDENTIFIED NET ASSETS RECEIVED, REPRESENTS A

NON-CASH EXPENSE IN ACCORDANCE WITH IFRS 2 THIS ONE-TIME EXPENSE AS A RESULT OF THE TRANSACTION, IN THE AMOUNT OF $1,168.5 MILLION, IS RECOGNISED AS A SHARE LISTING EXPENSE PRESENTED AS

PART OF THE OPERATING RESULTS WITHIN THE CONSOLIDATED STATEMENT OF PROFIT OR LOSS. LISTING EXPENSE ALSO INCLUDES $19.8 MILLION OF OTHER RELATED TRANSACTION EXPENSES.View entire presentation