Pershing Square Activist Presentation Deck

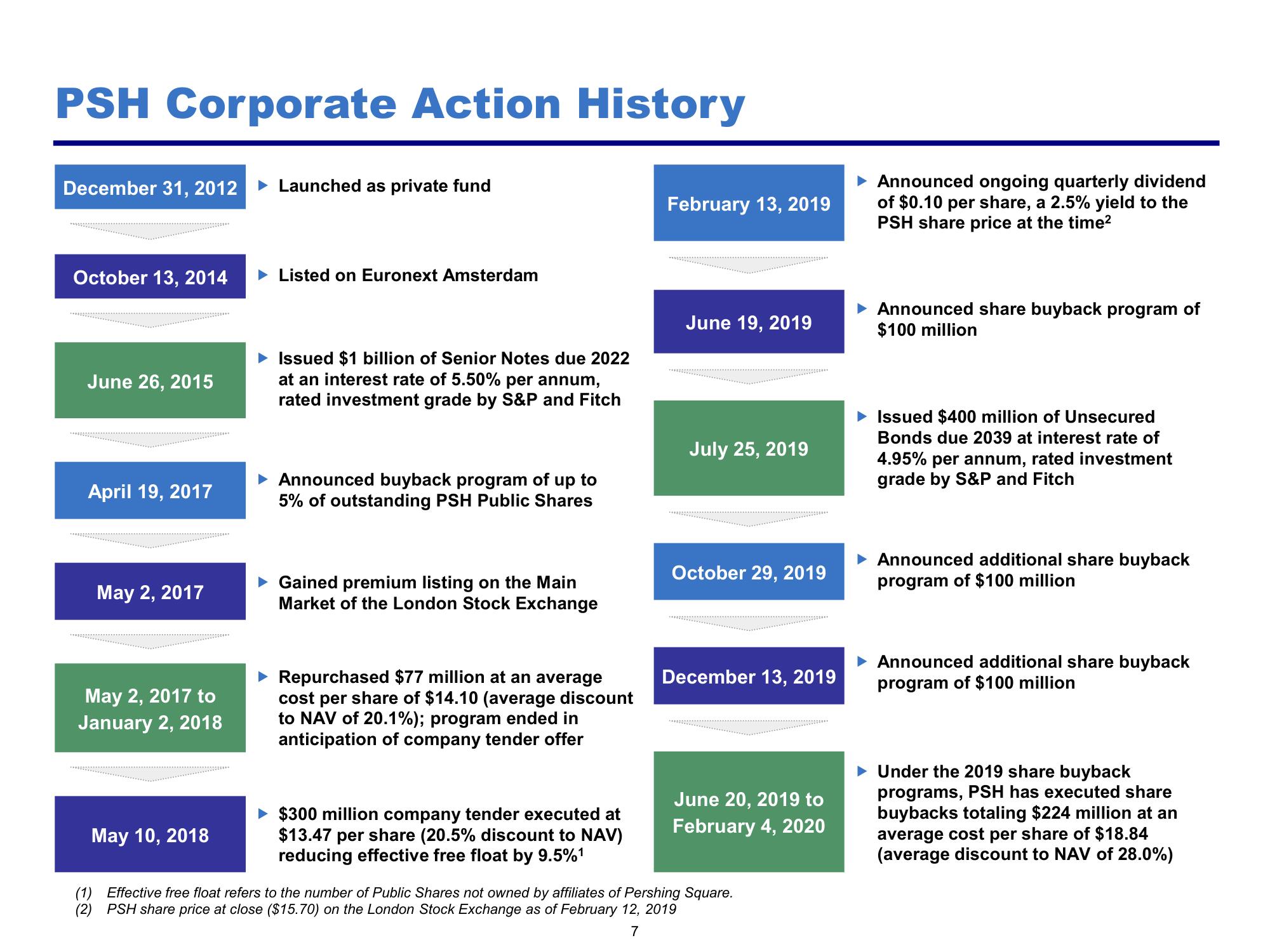

PSH Corporate Action History

December 31, 2012

October 13, 2014

June 26, 2015

April 19, 2017

May 2, 2017

May 2, 2017 to

January 2, 2018

May 10, 2018

► Launched as private fund

► Listed on Euronext Amsterdam

Issued $1 billion of Senior Notes due 2022

at an interest rate of 5.50% per annum,

rated investment grade by S&P and Fitch

▸ Announced buyback program of up to

5% of outstanding PSH Public Shares

► Gained premium listing on the Main

Market of the London Stock Exchange

► Repurchased $77 million at an average

cost per share of $14.10 (average discount

to NAV of 20.1%); program ended in

anticipation of company tender offer

► $300 million company tender executed at

$13.47 per share (20.5% discount to NAV)

reducing effective free float by 9.5%¹

February 13, 2019

June 19, 2019

July 25, 2019

October 29, 2019

December 13, 2019

June 20, 2019 to

February 4, 2020

(1) Effective free float refers to the number of Public Shares not owned by affiliates of Pershing Square.

(2) PSH share price at close ($15.70) on the London Stock Exchange as of February 12, 2019

7

Announced ongoing quarterly dividend

of $0.10 per share, a 2.5% yield to the

PSH share price at the time²

Announced share buyback program of

$100 million

Issued $400 million of Unsecured

Bonds due 2039 at interest rate of

4.95% per annum, rated investment

grade by S&P and Fitch

▸ Announced additional share buyback

program of $100 million

Announced additional share buyback

program of $100 million

▸ Under the 2019 share buyback

programs, PSH has executed share

buybacks totaling $224 million at an

average cost per share of $18.84

(average discount to NAV of 28.0%)View entire presentation