OppFi SPAC Presentation Deck

36

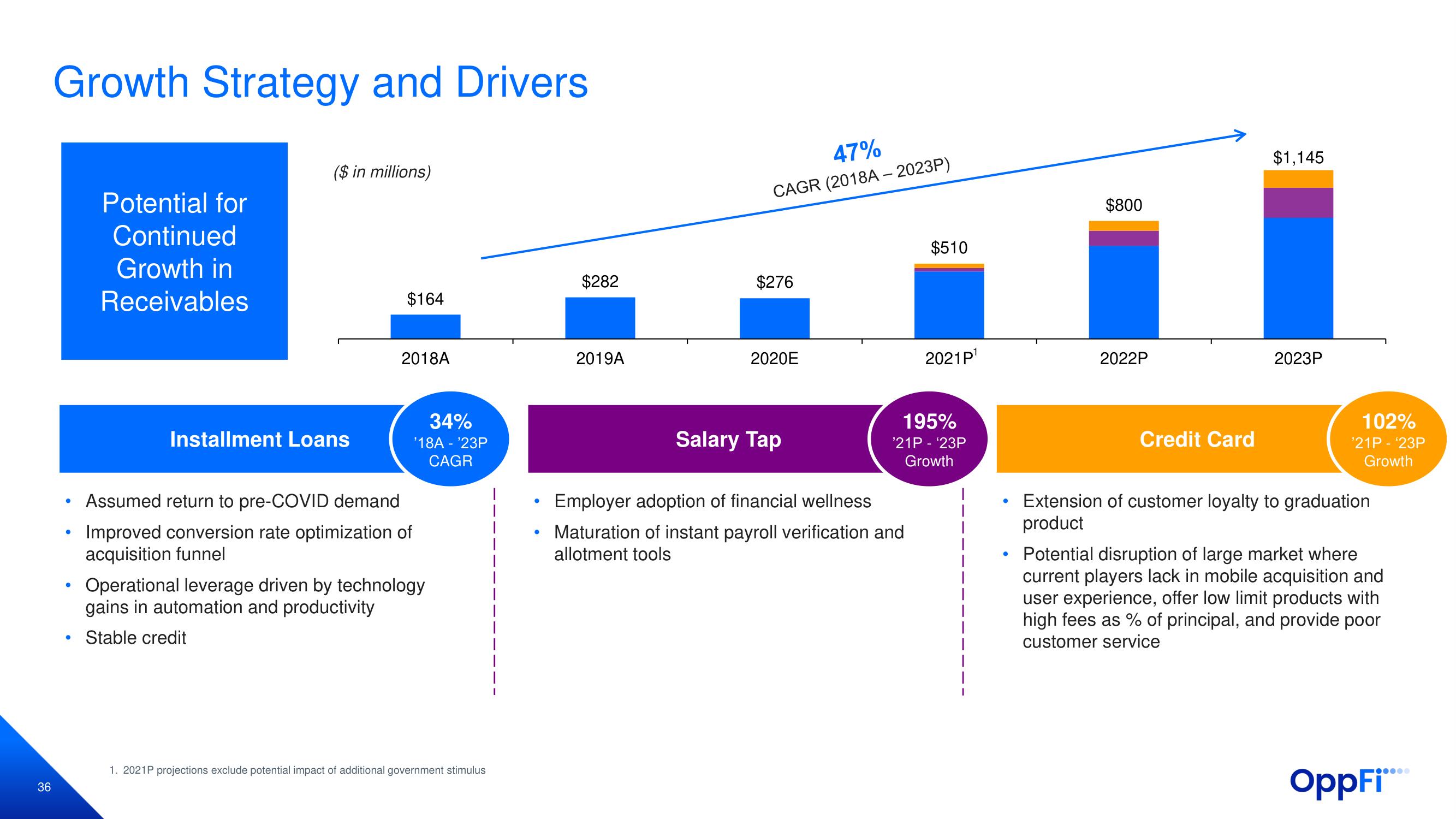

Growth Strategy and Drivers

●

●

●

●

Potential for

Continued

Growth in

Receivables

($ in millions)

Installment Loans

$164

2018A

Assumed return to pre-COVID demand

Improved conversion rate optimization of

acquisition funnel

34%

'18A - ¹23P

CAGR

Operational leverage driven by technology

gains in automation and productivity

Stable credit

1. 2021P projections exclude potential impact of additional government stimulus

●

●

$282

2019A

47%

CAGR (2018A-2023P)

$276

2020E

Salary Tap

$510

Employer adoption of financial wellness

Maturation of instant payroll verification and

allotment tools

2021P¹

195%

'21P - ¹23P

Growth

●

●

$800

2022P

Credit Card

$1,145

2023P

102%

¹21P - ¹23P

Growth

Extension of customer loyalty to graduation

product

Potential disruption of large market where

current players lack in mobile acquisition and

user experience, offer low limit products with

high fees as % of principal, and provide poor

customer service

OppFi****View entire presentation