UBS Shareholder Engagement Presentation Deck

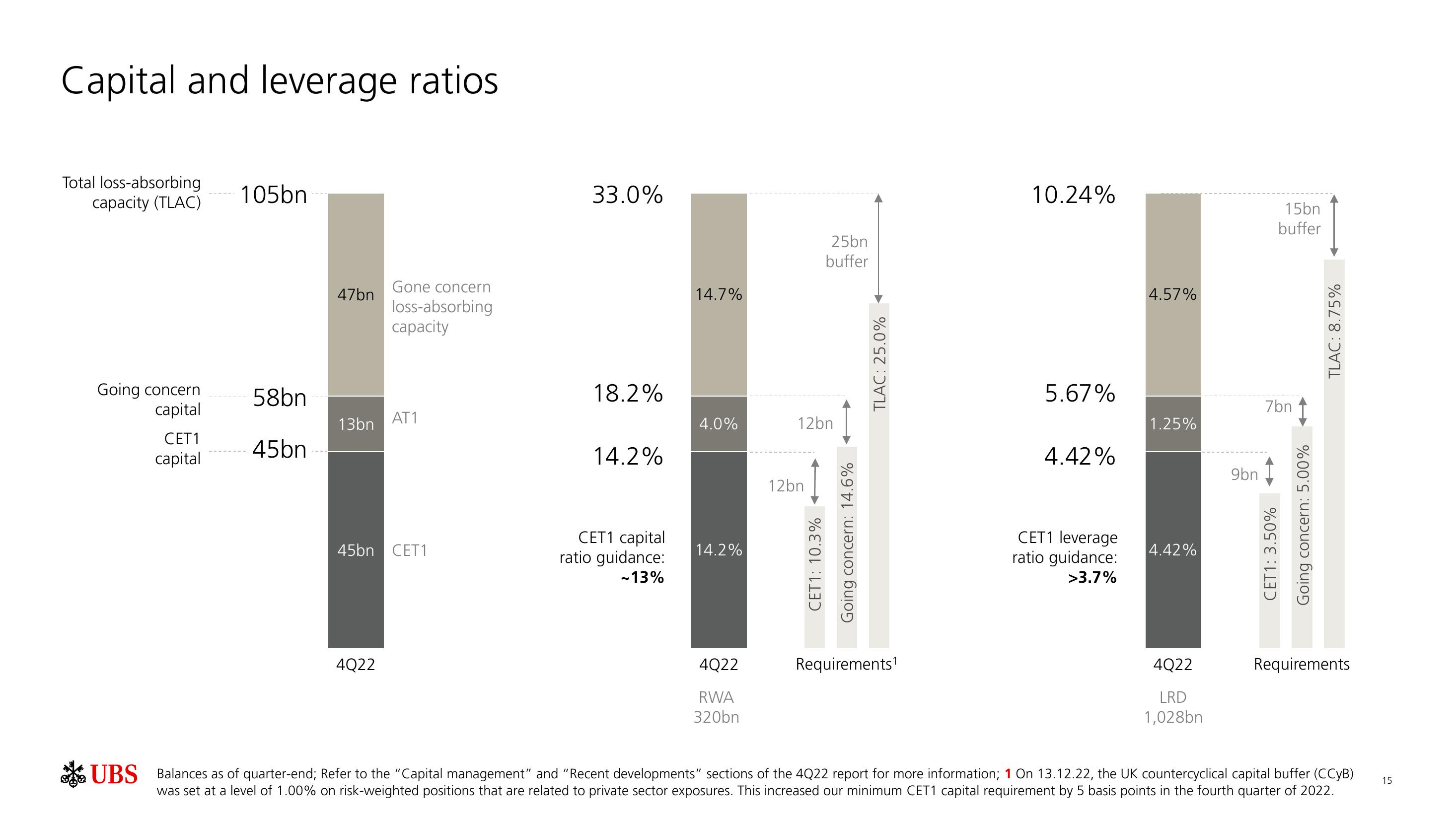

Capital and leverage ratios

Total loss-absorbing

capacity (TLAC)

Going concern

capital

UBS

CET1

capital

105bn

58bn

45bn

47bn

13bn

Gone concern

loss-absorbing

capacity

4Q22

AT1

45bn CET1

33.0%

18.2%

14.2%

CET1 capital

ratio guidance:

~13%

14.7%

4.0%

14.2%

4Q22

RWA

320bn

25bn

buffer

12bn

12bn

CET1: 10.3%

Going concern: 14.6%

TLAC: 25.0%

Requirements¹

10.24%

5.67%

4.42%

CET1 leverage

ratio guidance:

>3.7%

4.57%

1.25%

4.42%

4Q22

LRD

1,028bn

9bn

15bn

buffer

7bn

CET1: 3.50%

Going concern: 5.00%

TLAC: 8.75%

Requirements

Balances as of quarter-end; Refer to the "Capital management" and "Recent developments" sections of the 4Q22 report for more information; 1 On 13.12.22, the UK countercyclical capital buffer (CCyB)

was set at a level of 1.00% on risk-weighted positions that are related to private sector exposures. This increased our minimum CET1 capital requirement by 5 basis points in the fourth quarter of 2022.

15View entire presentation