jetBlue Results Presentation Deck

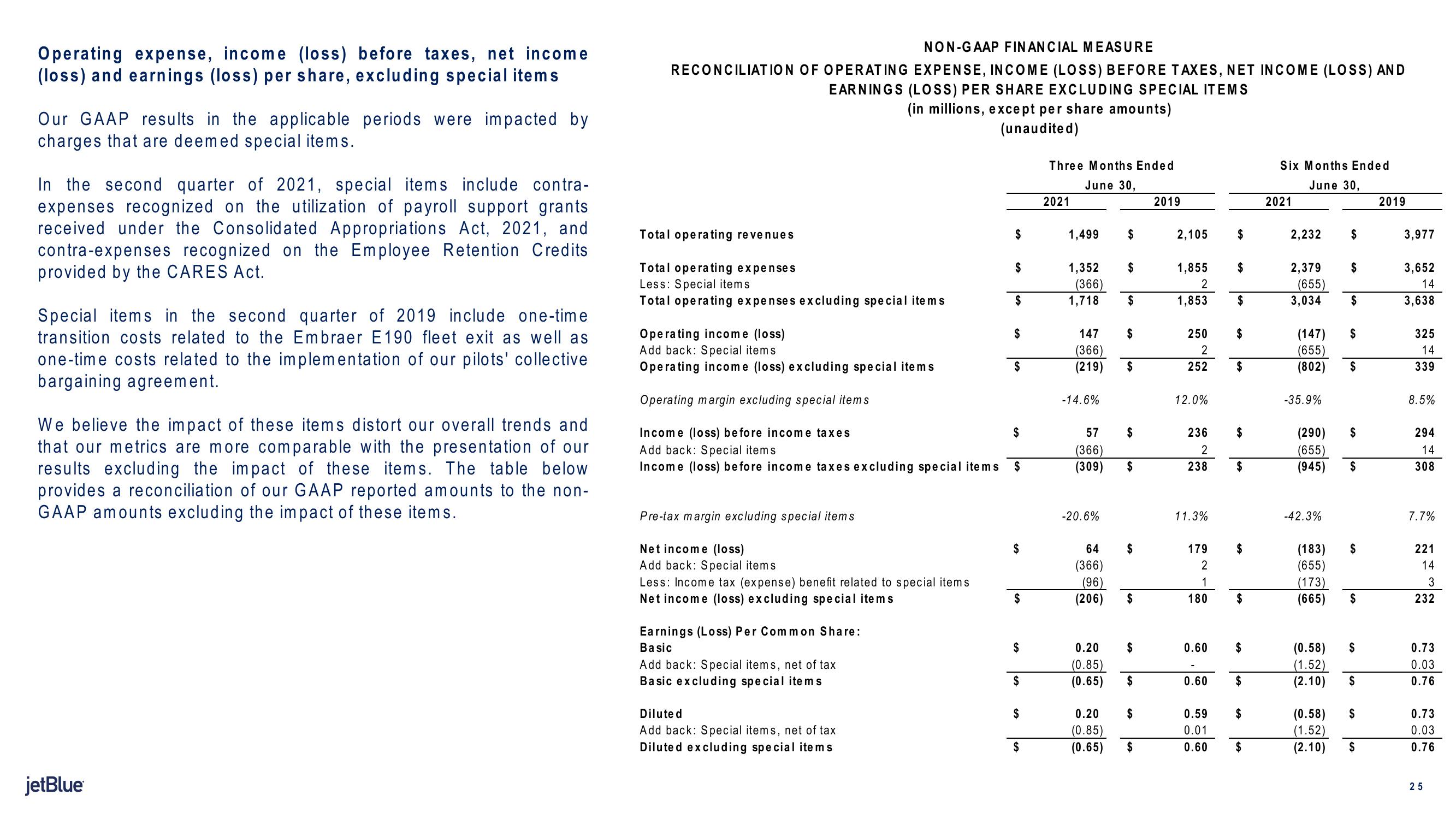

Operating expense, income (loss) before taxes, net income

(loss) and earnings (loss) per share, excluding special items

Our GAAP results in the applicable periods were impacted by

charges that are deemed special items.

In the second quarter of 2021, special items include contra-

expenses recognized on the utilization of payroll support grants

received under the Consolidated Appropriations Act, 2021, and

contra-expenses recognized on the Employee Retention Credits

provided by the CARES Act.

Special items in the second quarter of 2019 include one-time

transition costs related to the Embraer E190 fleet exit as well as

one-time costs related to the implementation of our pilots' collective

bargaining agreement.

We believe the impact of these items distort our overall trends and

that our metrics are more comparable with the presentation of our

results excluding the impact of these items. The table below

provides a reconciliation of our GAAP reported amounts to the non-

GAAP amounts excluding the impact of these items.

jetBlue

NON-GAAP FINANCIAL MEASURE

RECONCILIATION OF OPERATING EXPENSE, INCOME (LOSS) BEFORE TAXES, NET INCOME (LOSS) AND

EARNINGS (LOSS) PER SHARE EXCLUDING SPECIAL ITEMS

(in millions, except per share amounts)

(unaudited)

Total operating revenues

Total operating expenses

Less: Special items

Total operating expenses excluding special items

Operating income (loss)

Add back: Special items

Operating income (loss) excluding special items

Operating margin excluding special items

Income (loss) before income taxes

Add back: Special items

Income (loss) before income taxes excluding special items

Pre-tax margin excluding special items

Net income (loss)

Add back: Special items

Less: Income tax (expense) benefit related to special items

Net income (loss) excluding special items

Earnings (Loss) Per Common Share:

Basic

Add back: Special items, net of tax

Basic excluding special items

Diluted

Add back: Special items, net of tax

Diluted excluding special items

$

$

$

$

$

$

$

$

$

$

$

$

$

Three Months Ended

June 30,

2021

1,499 $

1,352

(366)

1,718 $

147

(366)

(219)

-14.6%

-20.6%

$

64

(366)

(96)

(206)

57

(366)

(309) $

0.20

(0.85)

(0.65)

$

$

$

$

$

$

$

$

0.20

(0.85)

(0.65) $

2019

2,105

1,855

2

1,853

250

2

252

12.0%

236

2

238

11.3%

179

2

1

180

0.60

0.60

0.59

0.01

0.60

$

$

$

$

$

$

$

$

$

$

$

$

$

Six Months Ended

June 30,

2021

2,232 $

2,379

(655)

3,034

(147)

(655)

(802)

-35.9%

(290)

(655)

(945)

-42.3%

(183)

(655)

(173)

(665)

$

(0.58)

(1.52)

(2.10)

$

$

$

$

$

$

(0.58) $

(1.52)

(2.10)

$

$

$

2019

3,977

3,652

14

3,638

325

14

339

8.5%

294

14

308

7.7%

221

14

3

232

0.73

0.03

0.76

0.73

0.03

0.76

25View entire presentation