Allwyn Investor Conference Presentation Deck

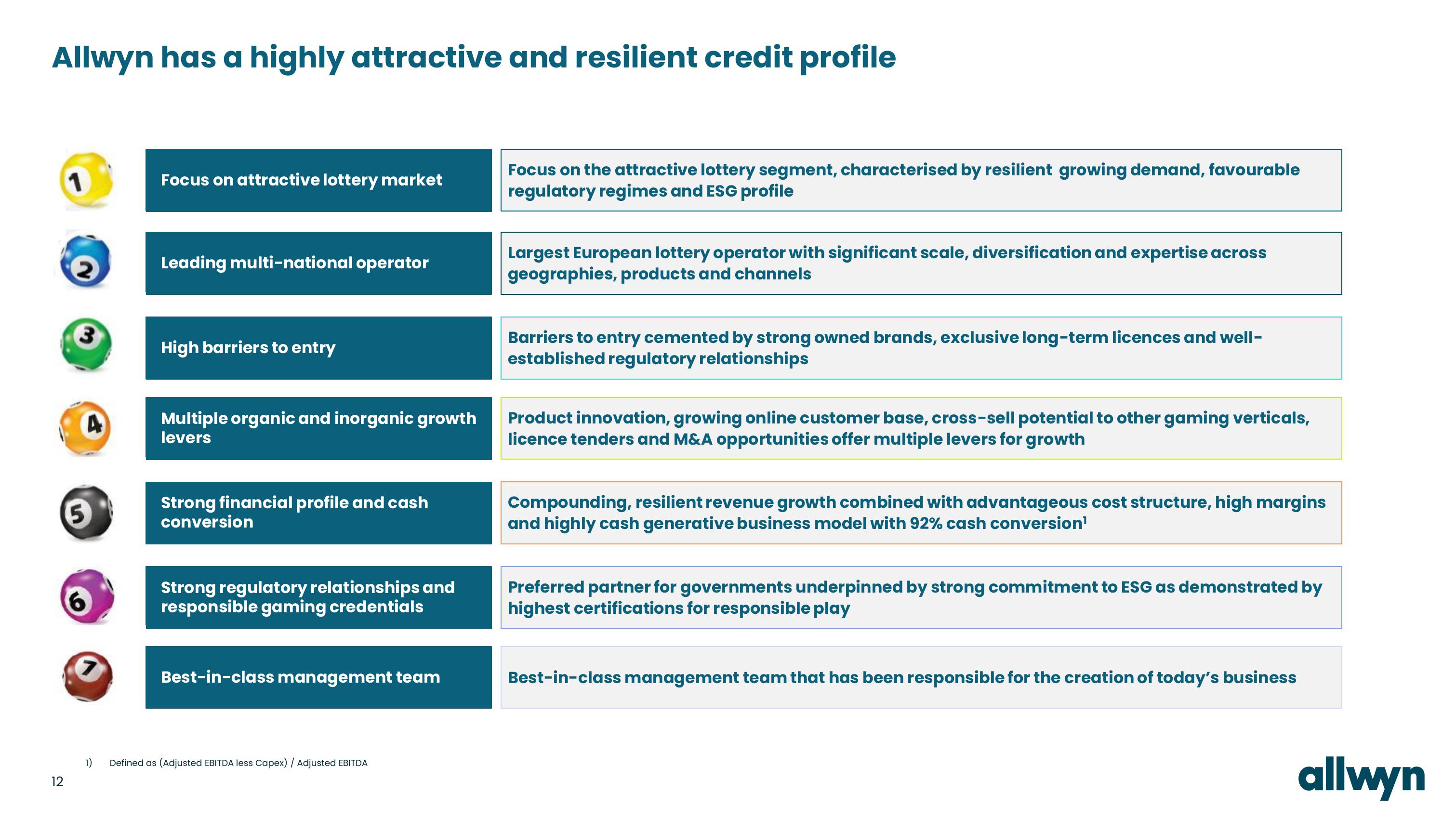

Allwyn has a highly attractive and resilient credit profile

12

1

2

3

5

4

Focus on attractive lottery market

Leading multi-national operator

High barriers to entry

Multiple organic and inorganic growth

levers

Strong financial profile and cash

conversion

Strong regulatory relationships and

responsible gaming credentials

Best-in-class management team

1) Defined as (Adjusted EBITDA less Capex) / Adjusted EBITDA

Focus on the attractive lottery segment, characterised by resilient growing demand, favourable

regulatory regimes and ESG profile

Largest European lottery operator with significant scale, diversification and expertise across

geographies, products and channels

Barriers to entry cemented by strong owned brands, exclusive long-term licences and well-

established regulatory relationships

Product innovation, growing online customer base, cross-sell potential to other gaming verticals,

licence tenders and M&A opportunities offer multiple levers for growth

Compounding, resilient revenue growth combined with advantageous cost structure, high margins

and highly cash generative business model with 92% cash conversion¹

Preferred partner for governments underpinned by strong commitment to ESG as demonstrated by

highest certifications for responsible play

Best-in-class management team that has been responsible for the creation of today's business

allwynView entire presentation