SoftBank Results Presentation Deck

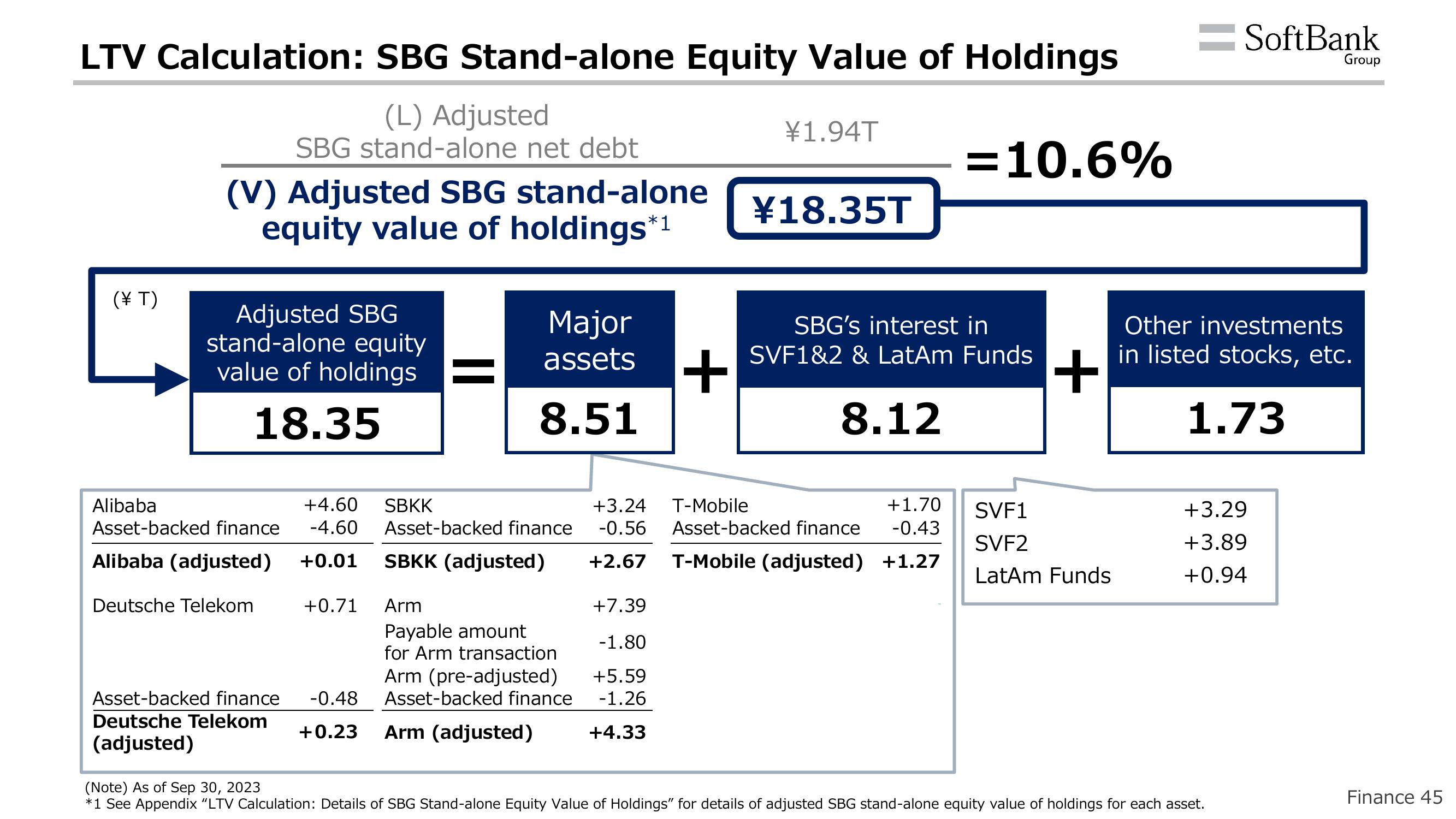

LTV Calculation: SBG Stand-alone Equity Value of Holdings

(L) Adjusted

SBG stand-alone net debt

=10.6%

(V) Adjusted SBG stand-alone

equity value of holdings*1

(¥ T)

Adjusted SBG

stand-alone equity

value of holdings

18.35

Alibaba

+4.60 SBKK

Asset-backed finance -4.60 Asset-backed finance -0.56

Alibaba (adjusted) +0.01 SBKK (adjusted) +2.67

Deutsche Telekom

Asset-backed finance

Deutsche Telekom

(adjusted)

+0.71

Major

assets

8.51

Arm

Payable amount

for Arm transaction

Arm (pre-adjusted)

Asset-backed finance

-0.48

+0.23 Arm (adjusted)

+

+3.24 T-Mobile

+7.39

-1.80

+5.59

-1.26

+4.33

¥1.94T

¥18.35T

SBG's interest in

SVF1&2 & LatAm Funds

8.12

+1.70

Asset-backed finance -0.43

T-Mobile (adjusted) +1.27

+

SVF1

SVF2

LatAm Funds

SoftBank

Other investments

in listed stocks, etc.

1.73

+3.29

+3.89

+0.94

(Note) As of Sep 30, 2023

*1 See Appendix "LTV Calculation: Details of SBG Stand-alone Equity Value of Holdings" for details of adjusted SBG stand-alone equity value of holdings for each asset.

Group

Finance 45View entire presentation