Pershing Square Activist Presentation Deck

Hilton Worldwide ("HLT")

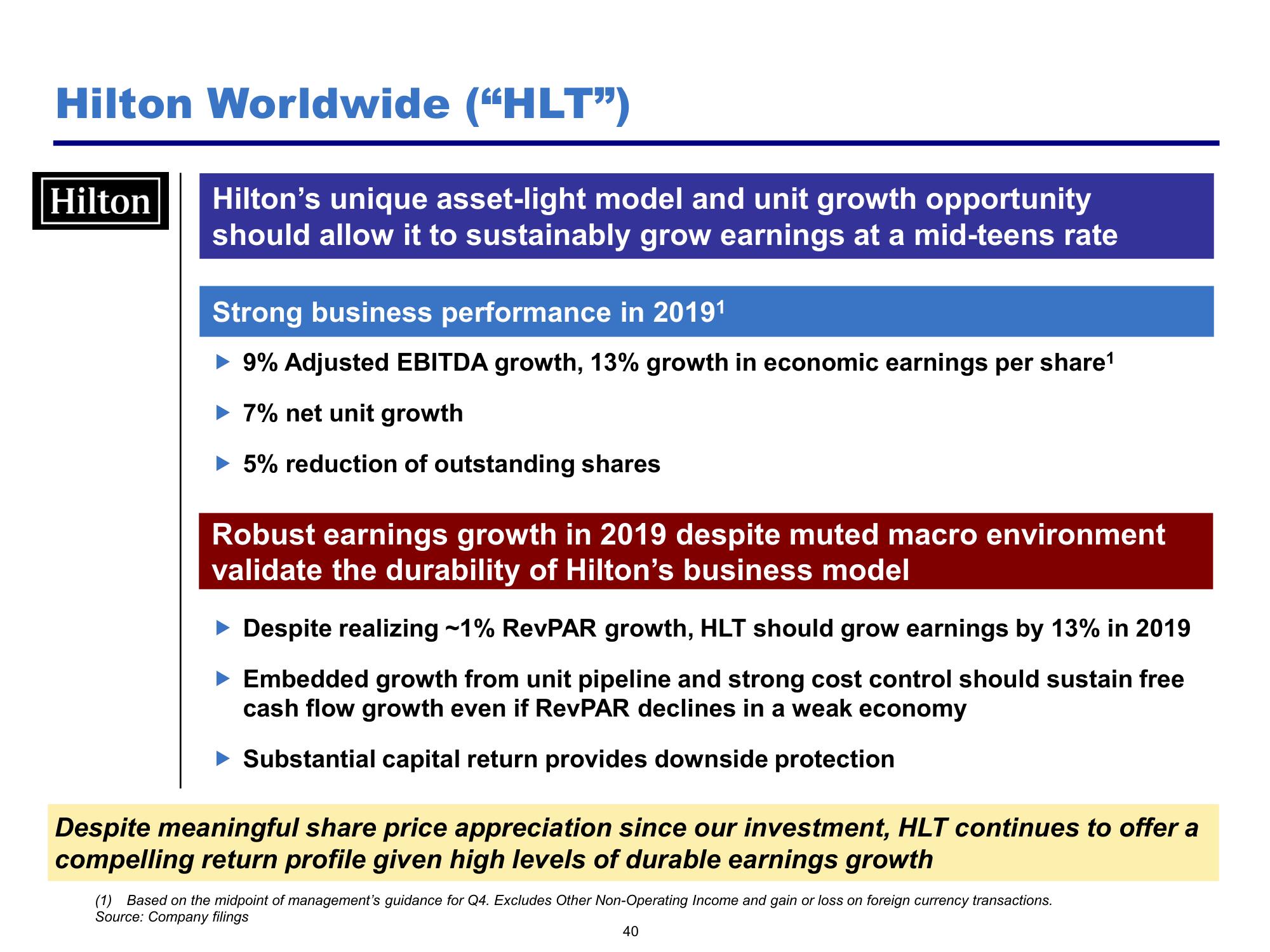

Hilton Hilton's unique asset-light model and unit growth opportunity

should allow it to sustainably grow earnings at a mid-teens rate

Strong business performance in 2019¹

9% Adjusted EBITDA growth, 13% growth in economic earnings per share¹

► 7% net unit growth

► 5% reduction of outstanding shares

Robust earnings growth in 2019 despite muted macro environment

validate the durability of Hilton's business model

► Despite realizing -1% RevPAR growth, HLT should grow earnings by 13% in 2019

► Embedded growth from unit pipeline and strong cost control should sustain free

cash flow growth even if RevPAR declines in a weak economy

► Substantial capital return provides downside protection

Despite meaningful share price appreciation since our investment, HLT continues to offer a

compelling return profile given high levels of durable earnings growth

(1) Based on the midpoint of management's guidance for Q4. Excludes Other Non-Operating Income and gain or loss on foreign currency transactions.

Source: Company filings

40View entire presentation