LanzaTech SPAC Presentation Deck

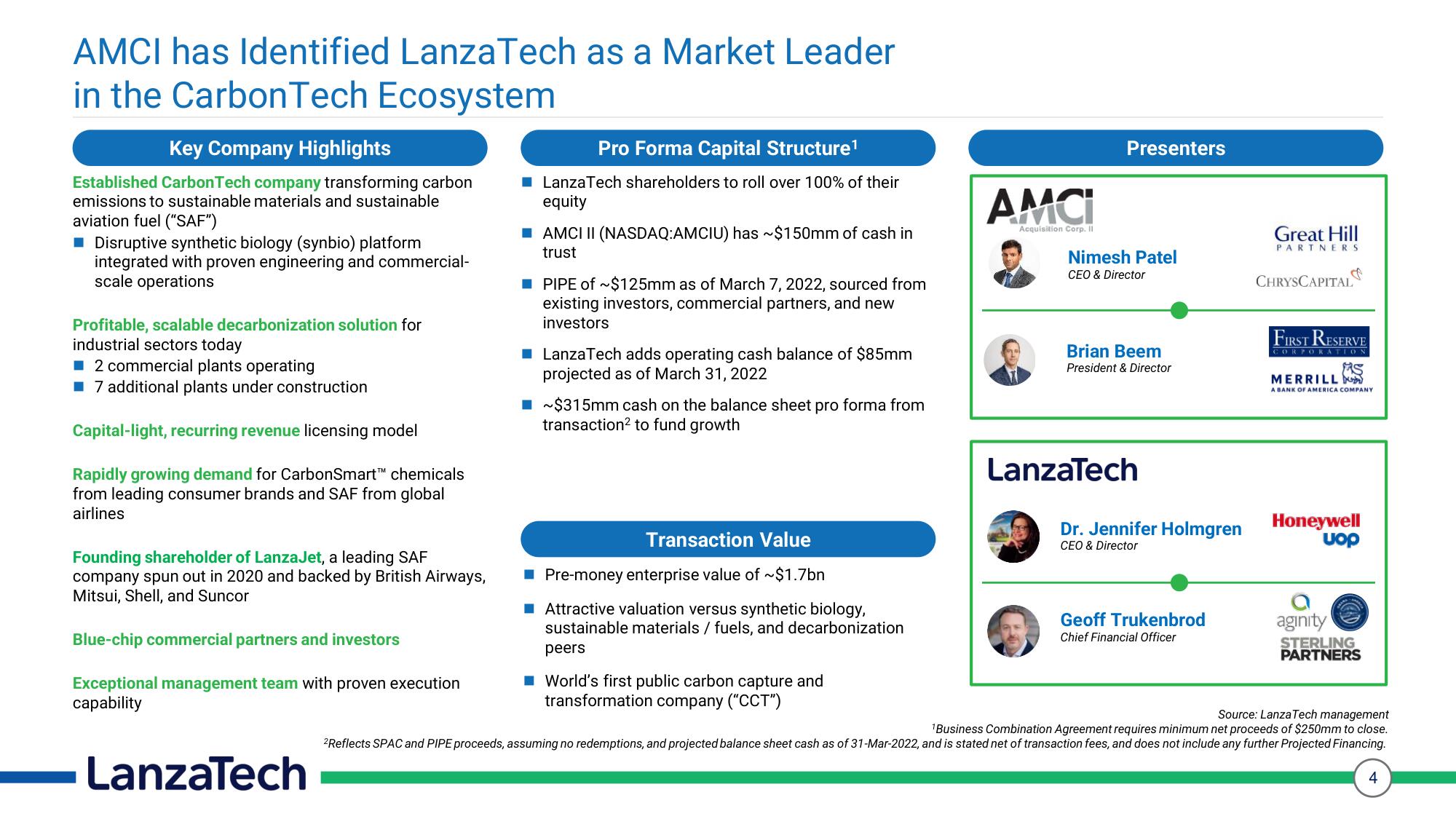

AMCI has Identified LanzaTech as a Market Leader

in the CarbonTech Ecosystem

Key Company Highlights

Established Carbon Tech company transforming carbon

emissions to sustainable materials and sustainable

aviation fuel ("SAF")

■ Disruptive synthetic biology (synbio) platform

integrated with proven engineering and commercial-

scale operations

Profitable, scalable decarbonization solution for

industrial sectors today

2 commercial plants operating

■ 7 additional plants under construction

Capital-light, recurring revenue licensing model

Rapidly growing demand for CarbonSmart™ chemicals

from leading consumer brands and SAF from global

airlines

Founding shareholder of LanzaJet, a leading SAF

company spun out in 2020 and backed by British Airways,

Mitsui, Shell, and Suncor

Blue-chip commercial partners and investors

Exceptional management team with proven execution

capability

LanzaTech

Pro Forma Capital Structure¹

■ LanzaTech shareholders to roll over 100% of their

equity

■AMCI II (NASDAQ:AMCIU) has ~$150mm of cash in

trust

■ PIPE of ~$125mm as of March 7, 2022, sourced from

existing investors, commercial partners, and new

investors

■ LanzaTech adds operating cash balance of $85mm

projected as of March 31, 2022

~$315mm cash on the balance sheet pro forma from

transaction² to fund growth

Transaction Value

■ Pre-money enterprise value of ~$1.7bn

■ Attractive valuation versus synthetic biology,

sustainable materials / fuels, and decarbonization

peers

World's first public carbon capture and

transformation company ("CCT")

AMCI

Acquisition Corp. II

Presenters

Nimesh Patel

CEO & Director

Brian Beem

President & Director

LanzaTech

Dr. Jennifer Holmgren

CEO & Director

Geoff Trukenbrod

Chief Financial Officer

Great Hill

PARTNERS

CA

CHRYSCAPITAL

FIRST RESERVE

CORPORATION

AS

MERRILL

A BANK OF AMERICA COMPANY

Honeywell

Uop

aginity

STERLING

PARTNERS

Source: LanzaTech management

¹Business Combination Agreement requires minimum net proceeds of $250mm to close.

2Reflects SPAC and PIPE proceeds, assuming no redemptions, and projected balance sheet cash as of 31-Mar-2022, and is stated net of transaction fees, and does not include any further Projected Financing.

4View entire presentation