Grab Results Presentation Deck

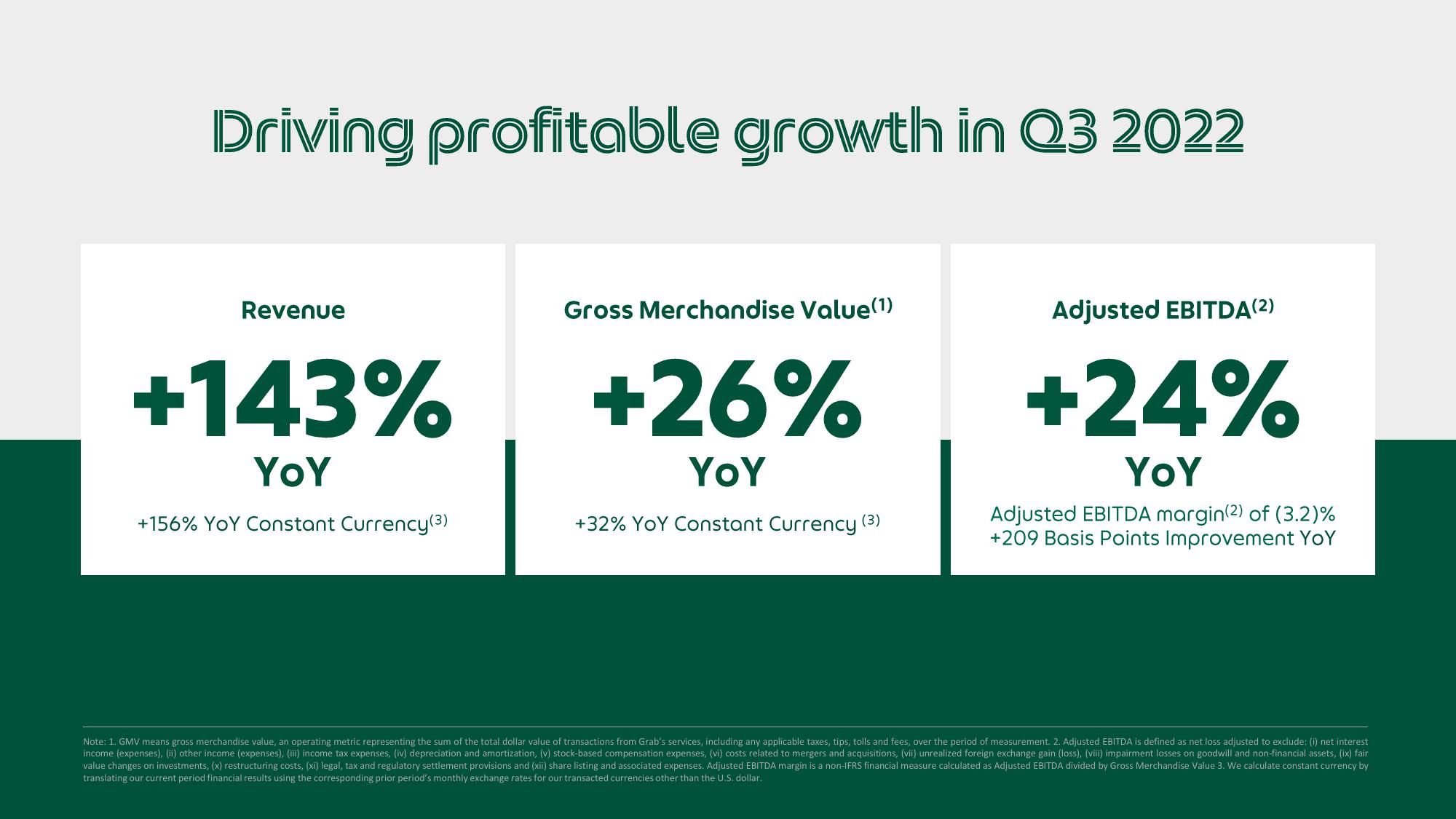

Driving profitable growth in Q3 2022

Revenue

+143%

YOY

+156% YoY Constant Currency (3)

Gross Merchandise Value(1)

+26%

YOY

+32% YoY Constant Currency (3)

Adjusted EBITDA (2)

+24%

YoY

Adjusted EBITDA margin(2) of (3.2)%

+209 Basis Points Improvement YoY

Note: 1. GMV means gross merchandise value, an operating metric representing the sum of the total dollar value of transactions from Grab's services, including any applicable taxes, tips, tolls and fees, over the period of measurement. 2. Adjusted EBITDA is defined as net loss adjusted to exclude: (i) net interest

income (expenses), (ii) other income (expenses), (iii) income tax expenses, (iv) depreciation and amortization, (v) stock-based compensation expenses, (vi) costs related to mergers and acquisitions, (vii) unrealized foreign exchange gain (loss), (viii) impairment losses on goodwill and non-financial assets, (ix) fair

value changes on investments, (x) restructuring costs, (xi) legal, tax and regulatory settlement provisions and (xii) share listing and associated expenses. Adjusted EBITDA margin is a non-IFRS financial measure calculated as Adjusted EBITDA divided by Gross Merchandise Value 3. We calculate constant currency by

translating our current period financial results using the corresponding prior period's monthly exchange rates for our transacted currencies other than the U.S. dollar.View entire presentation