Repligen to Acquire Metenova AB

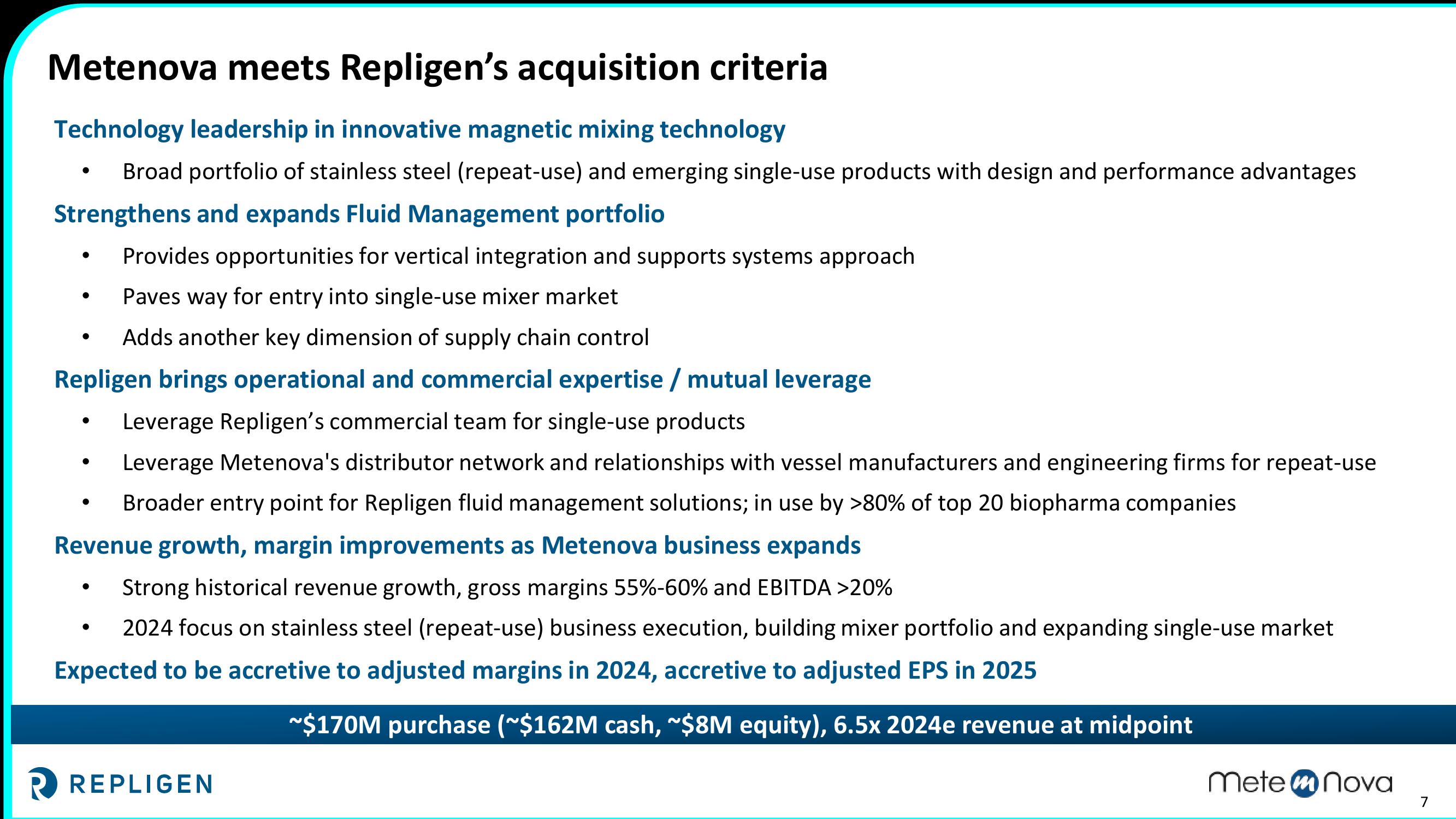

Metenova meets Repligen's acquisition criteria

Technology leadership in innovative magnetic mixing technology

Broad portfolio of stainless steel (repeat-use) and emerging single-use products with design and performance advantages

Strengthens and expands Fluid Management portfolio

Provides opportunities for vertical integration and supports systems approach

Paves way for entry into single-use mixer market

Adds another key dimension of supply chain control

Repligen brings operational and commercial expertise / mutual leverage

Leverage Repligen's commercial team for single-use products

Leverage Metenova's distributor network and relationships with vessel manufacturers and engineering firms for repeat-use

Broader entry point for Repligen fluid management solutions; in use by >80% of top 20 biopharma companies

Revenue growth, margin improvements as Metenova business expands

Strong historical revenue growth, gross margins 55%-60% and EBITDA >20%

2024 focus on stainless steel (repeat-use) business execution, building mixer portfolio and expanding single-use market

Expected to be accretive to adjusted margins in 2024, accretive to adjusted EPS in 2025

~$170M purchase (~$162M cash, ~$8M equity), 6.5x 2024e revenue at midpoint

●

●

●

●

R REPLIGEN

metem nova

7View entire presentation