OpenText Investor Presentation Deck

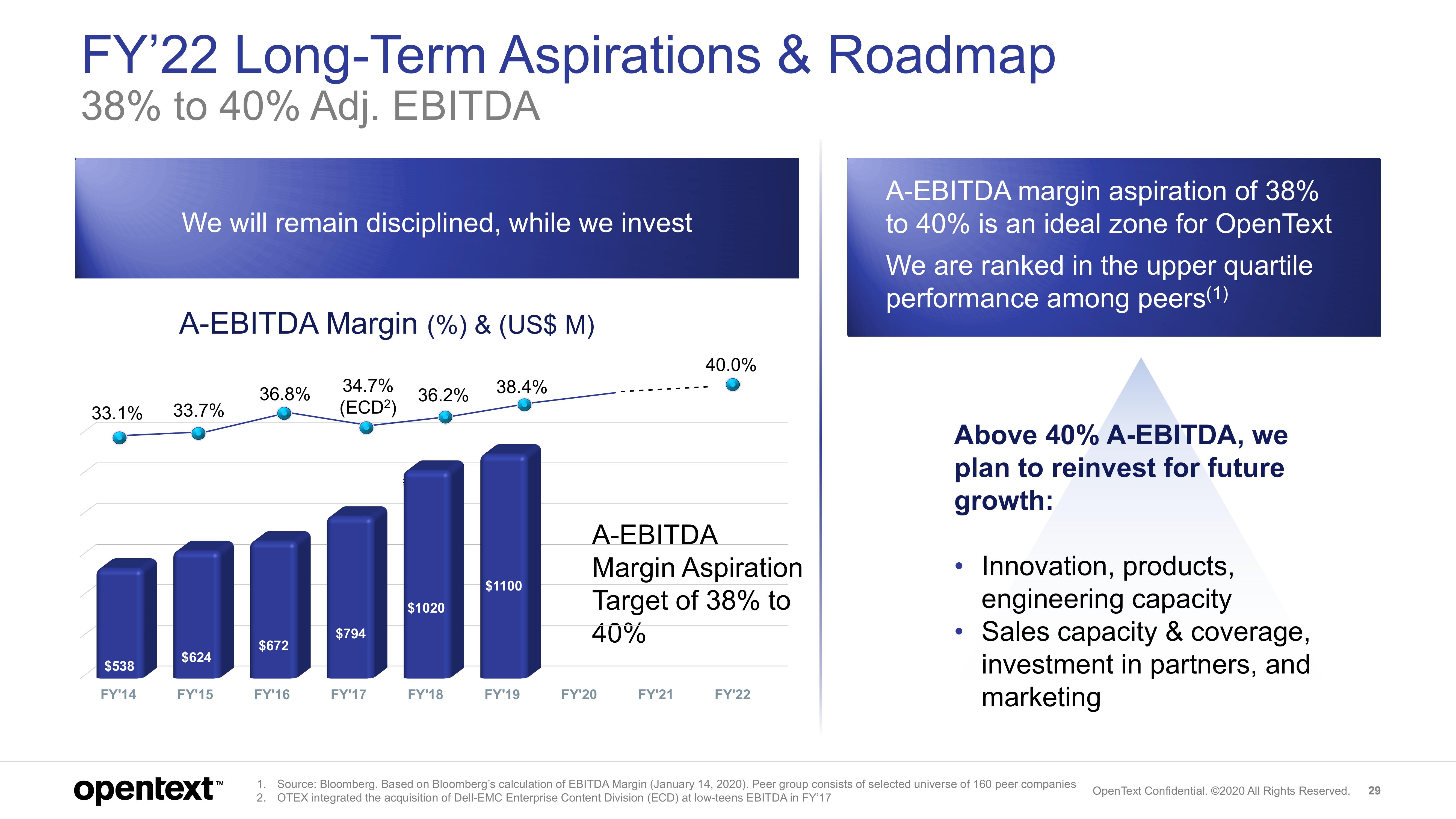

FY'22 Long-Term Aspirations & Roadmap

38% to 40% Adj. EBITDA

We will remain disciplined, while we invest

$538

FY'14

A-EBITDA Margin (%) & (US$ M)

34.7%

(ECD²)

33.1% 33.7%

$624

FY'15

opentext

36.8%

$672

FY'16

$794

FY'17

36.2%

$1020

FY'18

38.4%

$1100

FY'19

A-EBITDA

Margin Aspiration

Target of 38% to

40%

FY'20

40.0%

FY'21

FY'22

A-EBITDA margin aspiration of 38%

to 40% is an ideal zone for Open Text

We are ranked in the upper quartile

performance among peers(1)

Above 40% A-EBITDA, we

plan to reinvest for future

growth:

●

Innovation, products,

engineering capacity

Sales capacity & coverage,

investment in partners, and

marketing

1 Source: Bloomberg. Based on Bloomberg's calculation of EBITDA Margin (January 14, 2020). Peer group consists of selected universe of 160 peer companies

2. OTEX integrated the acquisition of Dell-EMC Enterprise Content Division (ECD) at low-teens EBITDA in FY'17

Open Text Confidential. ©2020 All Rights Reserved. 29View entire presentation