OppFi SPAC Presentation Deck

23

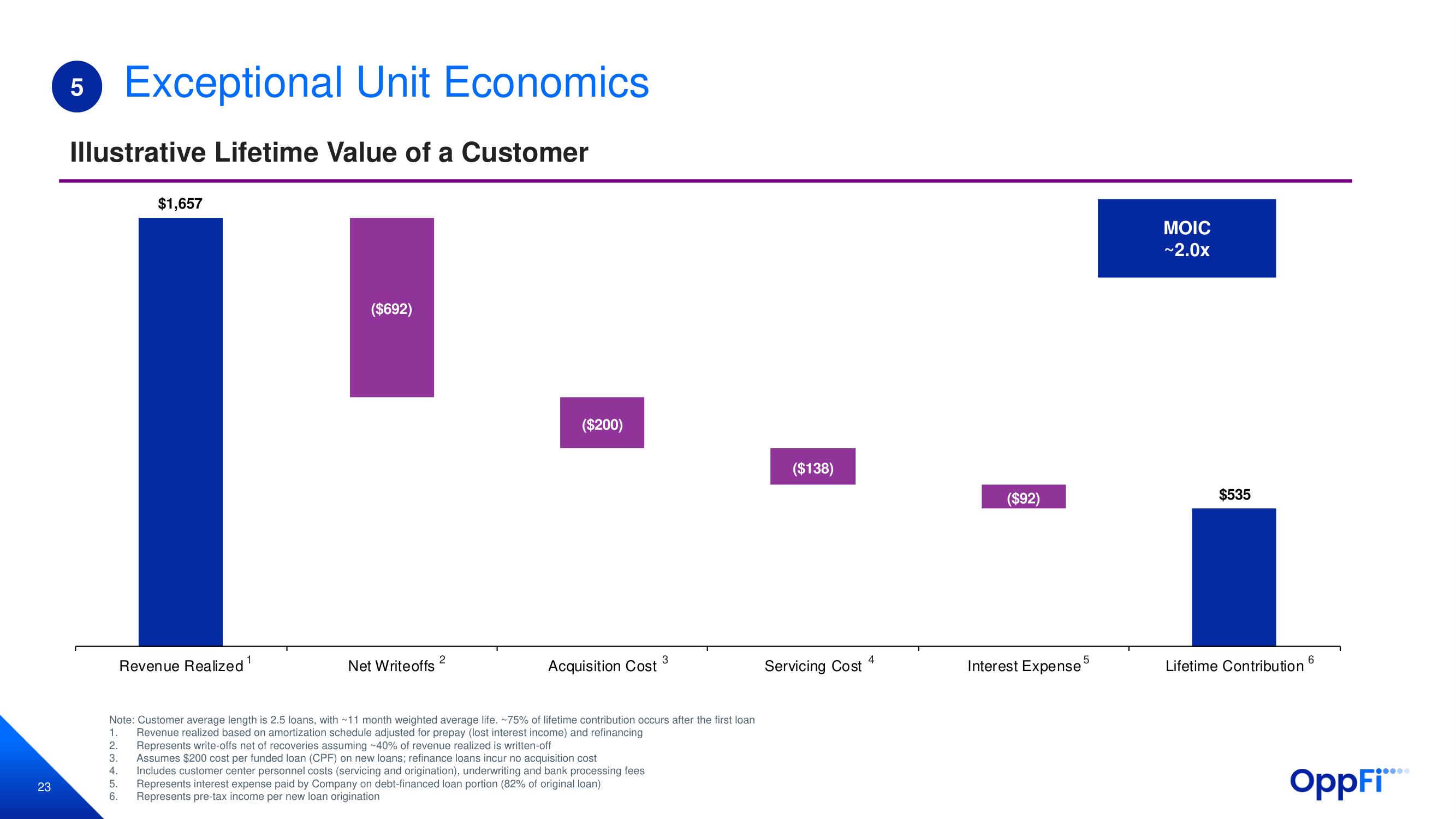

5 Exceptional Unit Economics

Illustrative Lifetime Value of a Customer

$1,657

2.

3.

4.

5.

6.

Revenue Realized ¹

($692)

Net Write offs

2

($200)

3

Acquisition Cost

Note: Customer average length is 2.5 loans, with ~11 month weighted average life. ~75% of lifetime contribution occurs after the first loan

1. Revenue realized based on amortization schedule adjusted for prepay (lost interest income) and refinancing

Represents write-offs net of recoveries assuming ~40% of revenue realized is written-off

Assumes $200 cost per funded loan (CPF) on new loans; refinance loans incur no acquisition cost

Includes customer center personnel costs (servicing and origination), underwriting and bank processing fees

Represents interest expense paid by Company on debt-financed loan portion (82% of original loan)

Represents pre-tax income per new loan origination

($138)

Servicing Cost

4

($92)

Interest Expense

5

MOIC

~2.0x

$535

Lifetime Contribution

6

OppFi****View entire presentation