Aptiv Overview

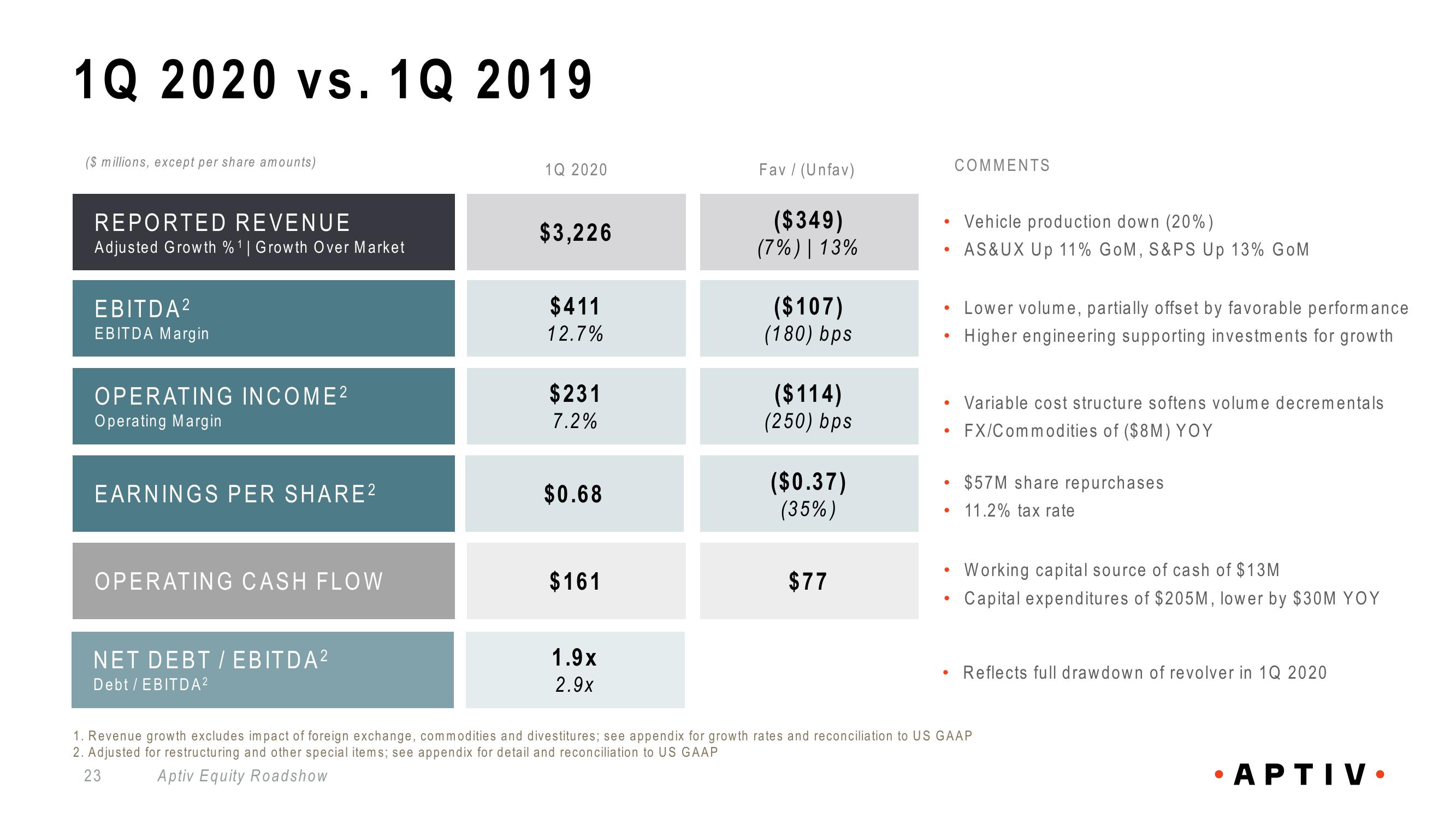

1Q 2020 vs. 1Q 2019

($ millions, except per share amounts)

REPORTED REVENUE

Adjusted Growth %1 | Growth Over Market

EBITDA²

EBITDA Margin

OPERATING INCOME²

Operating Margin

EARNINGS PER SHARE²

OPERATING CASH FLOW

NET DEBT / EBITDA²

Debt / EBITDA²

1Q 2020

$3,226

$411

12.7%

$231

7.2%

$0.68

$161

1.9x

2.9x

Fav / (Unfav)

($349)

(7%) | 13%

($107)

(180) bps

($114)

(250) bps

($0.37)

(35%)

$77

• Vehicle production down (20%)

AS&UX Up 11% GoM, S&PS Up 13% GoM

●

●

●

●

●

●

●

COMMENTS

●

Lower volume, partially offset by favorable performance

Higher engineering supporting investments for growth

Variable cost structure softens volume decrementals

FX/Commodities of ($8M) YOY

$57M share repurchases

11.2% tax rate

Working capital source of cash of $13M

Capital expenditures of $205M, lower by $30M YOY

Reflects full drawdown of revolver in 1Q 2020

1. Revenue growth excludes impact of foreign exchange, commodities and divestitures; see appendix for growth rates and reconciliation to US GAAP

2. Adjusted for restructuring and other special items; see appendix for detail and reconciliation to US GAAP

23

Aptiv Equity Roadshow

•APTIV.View entire presentation