Pershing Square Activist Presentation Deck

Wendy's / Arby's Combination

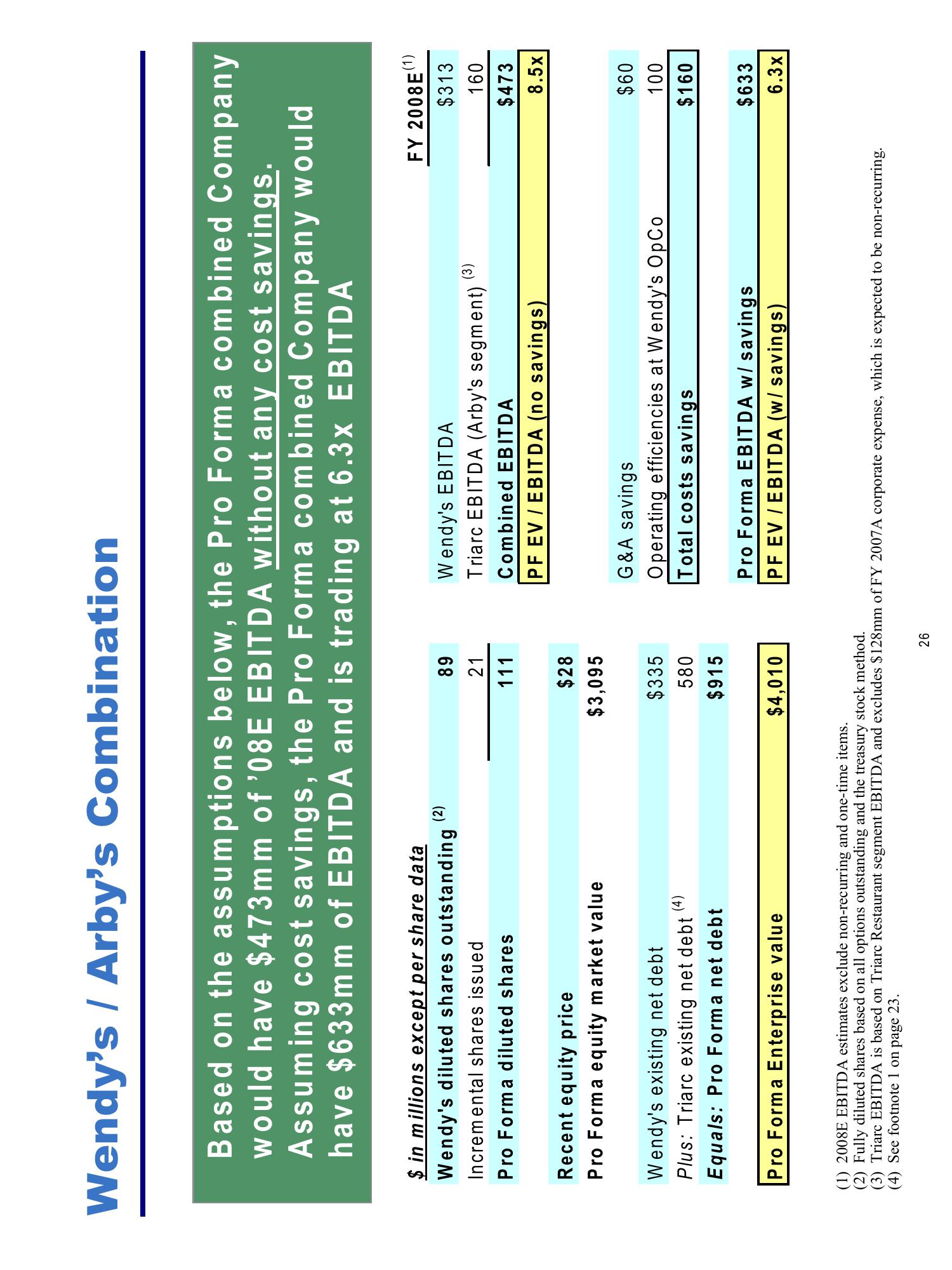

Based on the assumptions below, the Pro Forma combined Company

would have $473mm of '08E EBITDA without any cost savings.

Assuming cost savings, the Pro Forma combined Company would

have $633mm of EBITDA and is trading at 6.3x EBITDA

$ in millions except per share data

Wendy's diluted shares outstanding

Incremental shares issued

Pro Forma diluted shares

Recent equity price

Pro Forma equity market value

Wendy's existing net debt

Plus: Triarc existing net debt (4)

Equals: Pro Forma net debt

Pro Forma Enterprise value

89

21

111

$28

$3,095

$335

580

$915

$4,010

Wendy's EBITDA

Triarc EBITDA (Arby's segment)

Combined EBITDA

PF EV / EBITDA (no savings)

26

(3)

G&A savings

Operating efficiencies at Wendy's OpCo

Total costs savings

Pro Forma EBITDA w/ savings

PF EV / EBITDA (w/ savings)

FY 2008E

(1) 2008E EBITDA estimates exclude non-recurring and one-time items.

(2) Fully diluted shares based on all options outstanding and the treasury stock method.

(3) Triarc EBITDA is based on Triarc Restaurant segment EBITDA and excludes $128mm of FY 2007A corporate expense, which is expected to be non-recurring.

(4) See footnote 1 on page 23.

$313

160

$473

8.5x

$60

100

$160

$633

6.3xView entire presentation