Despegar Results Presentation Deck

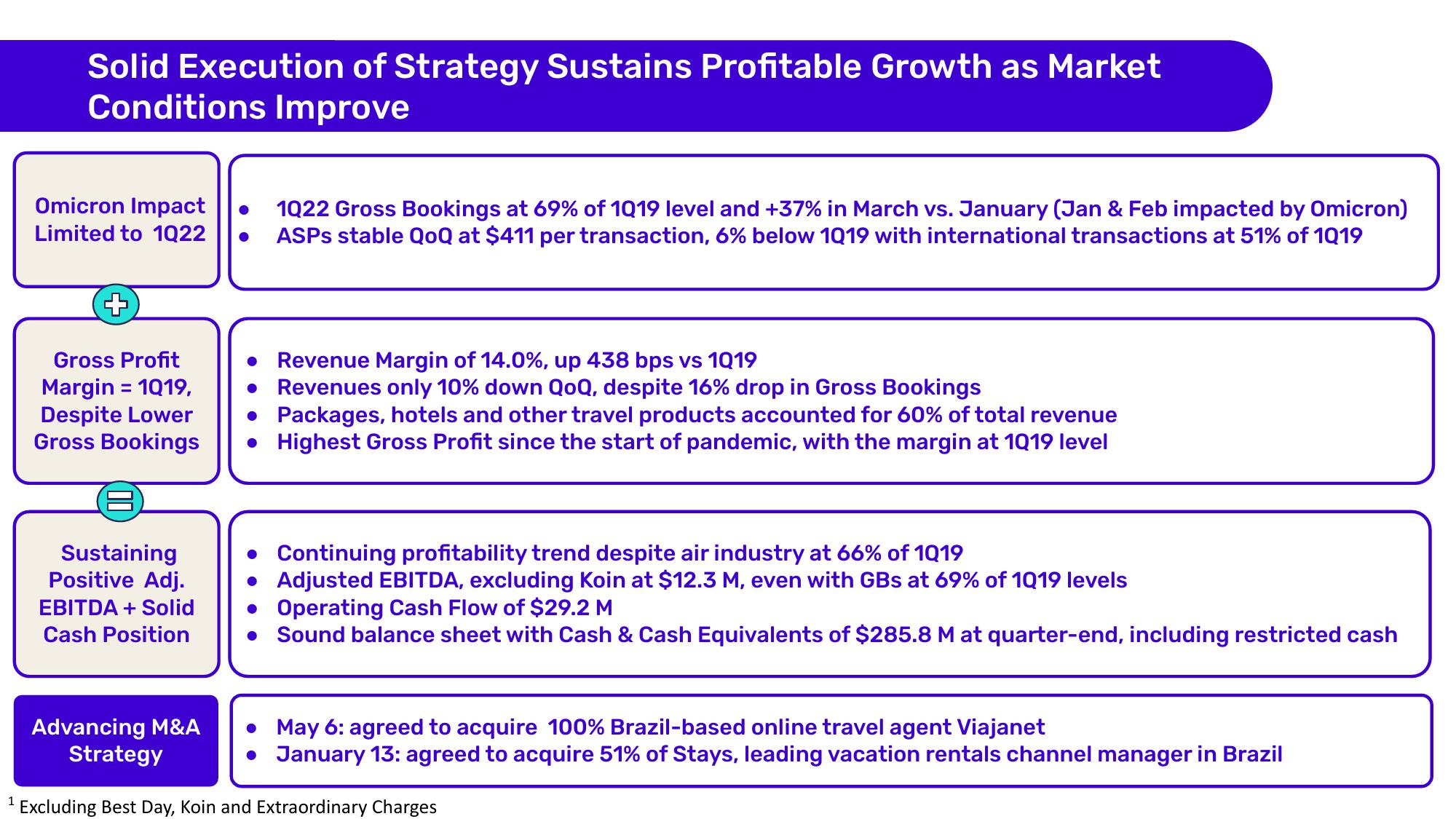

Solid Execution of Strategy Sustains Profitable Growth as Market

Conditions Improve

Omicron Impact 1022 Gross Bookings at 69% of 1019 level and +37% in March vs. January (Jan & Feb impacted by Omicron)

Limited to 1022 ● ASPs stable QoQ at $411 per transaction, 6% below 1019 with international transactions at 51% of 1019

Gross Profit

Margin = 1019,

Despite Lower

Gross Bookings

Sustaining

Positive Adj.

EBITDA + Solid

Cash Position

Revenue Margin of 14.0%, up 438 bps vs 1019

Revenues only 10% down QoQ, despite 16% drop in Gross Bookings

• Packages, hotels and other travel products accounted for 60% of total revenue

• Highest Gross Profit since the start of pandemic, with the margin at 1019 level

Continuing profitability trend despite air industry at 66% of 1019

• Adjusted EBITDA, excluding Koin at $12.3 M, even with GBs at 69% of 1019 levels

Operating Cash Flow of $29.2 M

• Sound balance sheet with Cash & Cash Equivalents of $285.8 M at quarter-end, including restricted cash

Advancing M&A

Strategy

1 Excluding Best Day, Koin and Extraordinary Charges

May 6: agreed to acquire 100% Brazil-based online travel agent Viajanet

January 13: agreed to acquire 51% of Stays, leading vacation rentals channel manager in BrazilView entire presentation