AngloAmerican Results Presentation Deck

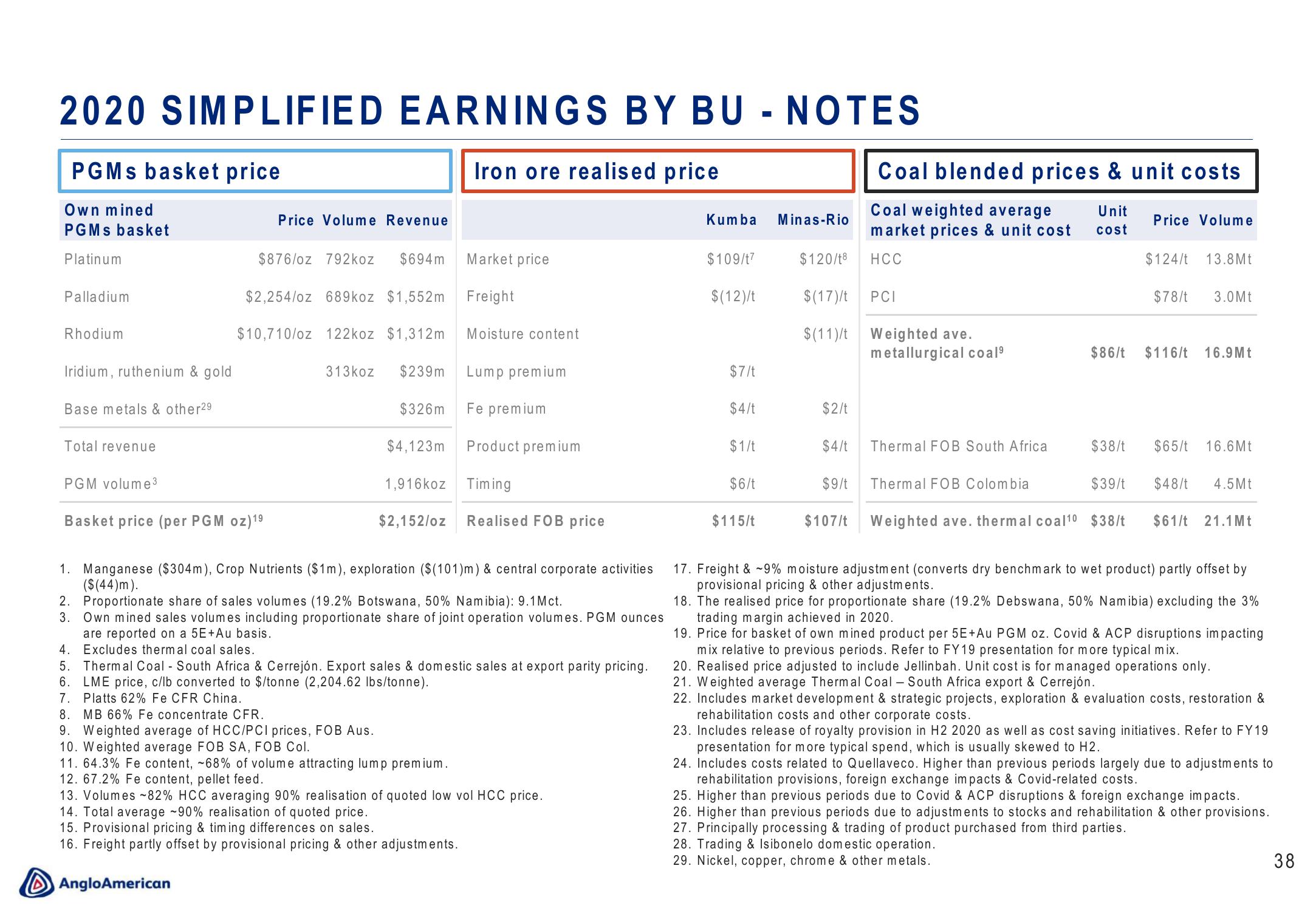

2020 SIMPLIFIED EARNINGS BY BU - NOTES

PGMs basket price

Iron ore realised price

Own mined

PGMs basket

Platinum

Palladium

Rhodium

Iridium, ruthenium & gold

Base metals & other²9

Total revenue

PGM volume ³

Price Volume Revenue

Market price

$2,254/oz 689koz $1,552m

Freight

$10,710/oz 122koz $1,312m Moisture content

$876/oz 792koz $694m

Basket price (per PGM oz) 1⁹

313koz $239m

Lump premium

Fe premium

$4,123m Product premium

1,916koz Timing

$2,152/oz Realised FOB price

$326m

1. Manganese ($304m), Crop Nutrients ($1m), exploration ($(101)m) & central corporate activities

($ (44)m).

2. Proportionate share of sales volumes (19.2% Botswana, 50% Namibia): 9.1 Mct.

3. Own mined sales volumes including proportionate share of joint operation volumes. PGM ounces

are reported on a 5E+Au basis.

4. Excludes thermal coal sales.

5. Thermal Coal - South Africa & Cerrejón. Export sales & domestic sales at export parity pricing.

6. LME price, c/lb converted to $/tonne (2,204.62 lbs/tonne).

7. Platts 62% Fe CFR China.

8. MB 66% Fe concentrate CFR.

9. Weighted average of HCC/PCI prices, FOB Aus.

10. Weighted average FOB SA, FOB Col.

11. 64.3% Fe content, -68% of volume attracting lump premium.

12. 67.2% Fe content, pellet feed.

13. Volumes 82% HCC averaging 90% realisation of quoted low vol HCC price.

14. Total average ~90% realisation of quoted price.

15. Provisional pricing & timing differences on sales.

16. Freight partly offset by provisional pricing & other adjustments.

Anglo American

Kumba

$109/t7

$(12)/t

$7/t

$4/t

$1/t

$6/t

$115/t

Minas-Rio

$120/18 HCC

$(17)/t PCI

$(11)/t Weighted ave.

$2/t

Coal blended prices & unit costs

Coal weighted average

Unit

cost

market prices & unit cost

$4/t

$9/t

metallurgical coal⁹

Thermal FOB South Africa

$86/t

Thermal FOB Colombia

Price Volume

$124/t 13.8Mt

$38/t $65/t

$39/t $48/t

$107/t Weighted ave. thermal coal 10 $38/t $61/t 21.1Mt

$78/t

3.0 Mt

$116/t 16.9 Mt

16.6Mt

4.5Mt

17. Freight & -9% moisture adjustment (converts dry benchmark to wet product) partly offset by

provisional pricing & other adjustments.

18. The realised price for proportionate share (19.2% Debswana, 50% Namibia) excluding the 3%

trading margin achieved in 2020.

19. Price for basket of own mined product per 5E+Au PGM oz. Covid & ACP disruptions impacting

mix relative to previous periods. Refer to FY 19 presentation for more typical mix.

20. Realised price adjusted to include Jellinbah. Unit cost is for managed operations only.

21. Weighted average Thermal Coal - South Africa export & Cerrejón.

22. Includes market development & strategic projects, exploration & evaluation costs, restoration &

rehabilitation costs and other corporate costs.

23. Includes release of royalty provision in H2 2020 as well as cost saving initiatives. Refer to FY 19

presentation for more typical spend, which is usually skewed to H2.

24. Includes costs related to Quellaveco. Higher than previous periods largely due to adjustments to

rehabilitation provisions, foreign exchange impacts & Covid-related costs.

25. Higher than previous periods due to Covid & ACP disruptions & foreign exchange impacts.

26. Higher than previous periods due to adjustments to stocks and rehabilitation & other provisions.

27. Principally processing & trading of product purchased from third parties.

28. Trading & Isibonelo domestic operation.

29. Nickel, copper, chrome & other metals.

38View entire presentation