OppFi Results Presentation Deck

27

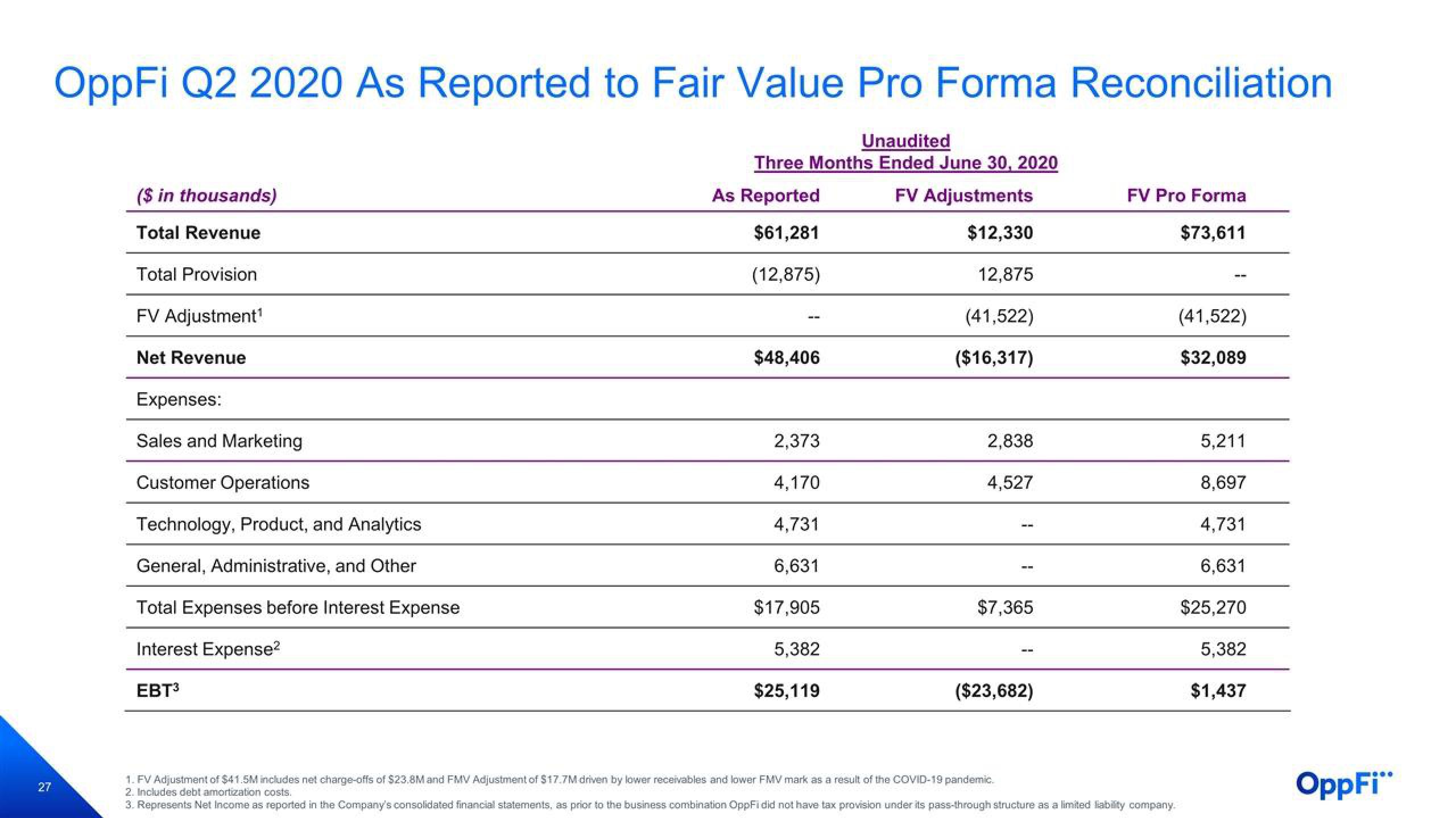

OppFi Q2 2020 As Reported to Fair Value Pro Forma Reconciliation

($ in thousands)

Total Revenue

Total Provision

FV Adjustment¹

Net Revenue

Expenses:

Sales and Marketing

Customer Operations

Technology, Product, and Analytics

General, Administrative, and Other

Total Expenses before Interest Expense

Interest Expense²

EBT3

Unaudited

Three Months Ended June 30, 2020

FV Adjustments

$12,330

12,875

(41,522)

($16,317)

As Reported

$61,281

(12,875)

$48,406

2,373

4,170

4,731

6,631

$17,905

5,382

$25,119

2,838

4,527

$7,365

($23,682)

FV Pro Forma

$73,611

(41,522)

$32,089

1. FV Adjustment of $41.5M includes net charge-offs of $23.8M and FMV Adjustment of $17.7M driven by lower receivables and lower FMV mark as a result of the COVID-19 pandemic.

2. Includes debt amortization costs.

3. Represents Net Income as reported in the Company's consolidated financial statements, as prior to the business combination OppFi did not have tax provision under its pass-through structure as a limited liability company.

5,211

8,697

4,731

6,631

$25,270

5,382

$1,437

OppFi"View entire presentation