OppFi SPAC Presentation Deck

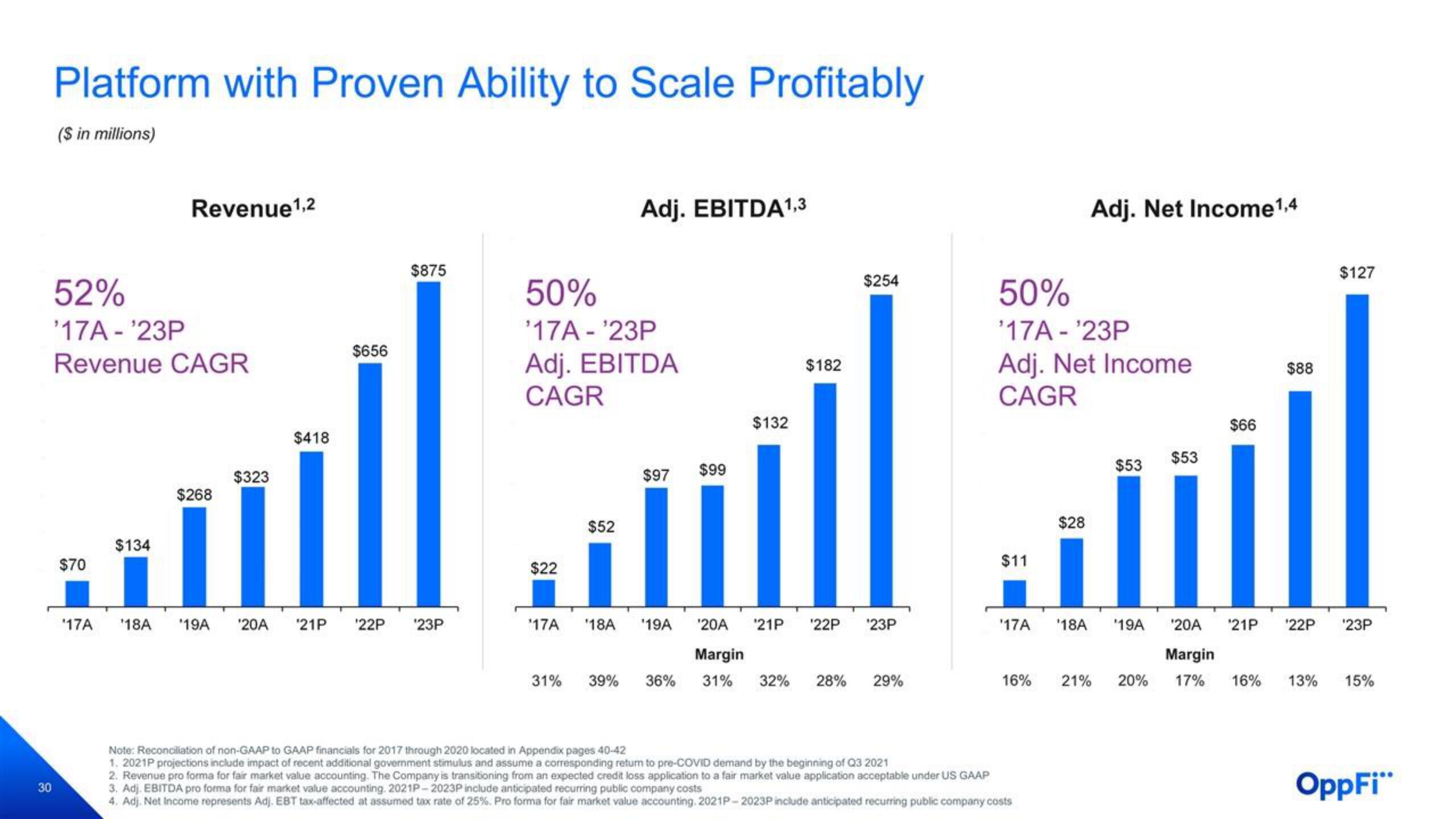

Platform with Proven Ability to Scale Profitably

($ in millions)

30

52%

'17A - ¹23P

Revenue CAGR

$70

'17A

Revenue ¹,2

$134

$268

$323

$418

$656

$875

'18A '19A '20A '21P '22P ¹23P

50%

¹17A - ¹23P

Adj. EBITDA

CAGR

$22

'17A

Adj. EBITDA1,3

$52

$97

'18A '19A

31% 39% 36%

$99

$132

$182

$254

¹20A '21P '22P

Margin

31% 32% 28% 29%

¹23P

50%

¹17A - ¹23P

Adj. Net Income

CAGR

$11

'17A

16%

Note: Reconciliation of non-GAAP to GAAP financials for 2017 through 2020 located in Appendix pages 40-42

1. 2021P projections include impact of recent additional government stimulus and assume a corresponding return to pre-COVID demand by the beginning of Q3 2021

2. Revenue pro forma for fair market value accounting. The Company is transitioning from an expected credit loss application to a fair market value application acceptable under US GAAP

3. Adj. EBITDA pro forma for fair market value accounting. 2021P-2023P include anticipated recurring public company costs

4. Adj. Net Income represents Adj. EBT tax-affected at assumed tax rate of 25%. Pro forma for fair market value accounting. 2021P-2023P include anticipated recurring public company costs

$28

Adj. Net Income ¹,4

'18A

$53

$53

11

'19A

$66

$88

$127

'20A '21P '¹22P ¹23P

Margin

21% 20% 17% 16% 13%

15%

OppFi"View entire presentation