Bausch+Lomb Results Presentation Deck

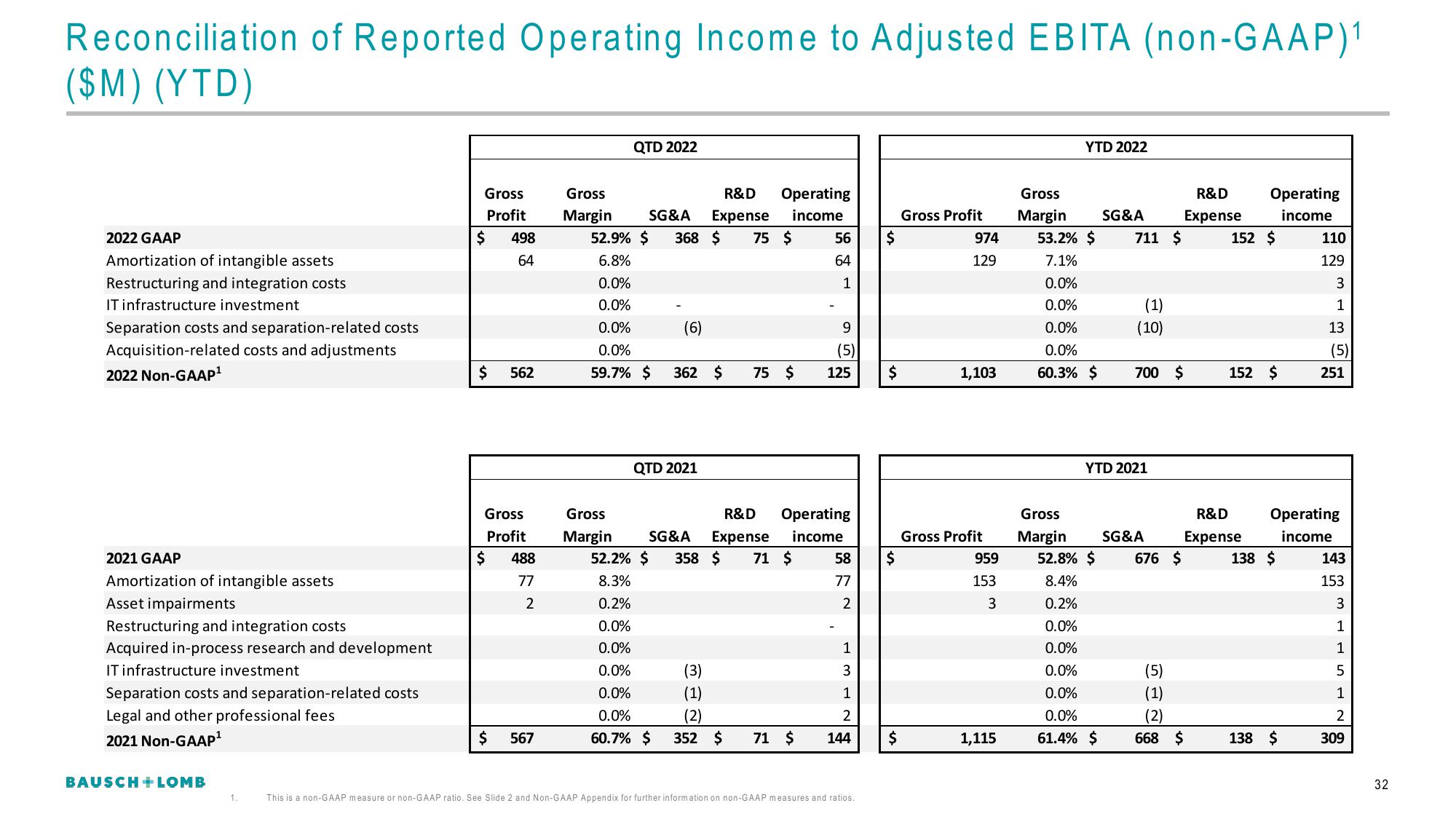

Reconciliation of Reported Operating Income to Adjusted EBITA (non-GAAP)1

($M) (YTD)

2022 GAAP

Amortization of intangible assets

Restructuring and integration costs

IT infrastructure investment

Separation costs and separation-related costs

Acquisition-related costs and adjustments

2022 Non-GAAP¹

2021 GAAP

Amortization of intangible assets

Asset impairments

Restructuring and integration costs

Acquired in-process research and development

IT infrastructure investment

Separation costs and separation-related costs

Legal and other professional fees

2021 Non-GAAP¹

BAUSCH + LOMB

1.

Gross

Profit

498

64

$

$

Gross

Profit

488

77

2

$

562

$

567

QTD 2022

R&D

Gross

Operating

Margin SG&A Expense income

52.9% $ 368 $ 75 $

6.8%

0.0%

0.0%

0.0%

0.0%

59.7% $

Gross

Margin

(6)

362 $

QTD 2021

75 $

R&D

SG&A Expense

52.2% $ 358 $ 71 $

8.3%

0.2%

0.0%

0.0%

0.0%

0.0%

0.0%

60.7% $

56

64

1

(3)

(1)

(2)

352 $ 71 $

9

(5)

Operating

income

125

58

77

2

1

3

1

2

144

This is a non-GAAP measure or non-GAAP ratio. See Slide 2 and Non-GAAP Appendix for further information on non-GAAP measures and ratios.

$

$

$

$

Gross Profit

974

129

1,103

Gross Profit

959

153

3

1,115

YTD 2022

Gross

Margin SG&A

53.2% $ 711 $

7.1%

0.0%

0.0%

0.0%

0.0%

60.3% $

(1)

(10)

Gross

Margin

52.8% $

8.4%

0.2%

0.0%

0.0%

0.0%

0.0%

0.0%

61.4% $

700 $

YTD 2021

SG&A

676 $

R&D

Expense

(5)

(1)

(2)

668 $

Operating

income

152 $

R&D

Expense

152 $

138 $

110

129

3

1

138 $

13

(5)

Operating

income

251

143

153

3

1

1

5

1

2

309

32View entire presentation