Telia Company Results Presentation Deck

GROUP HIGHLIGHTS

N

●

●

●

●

●

●

●

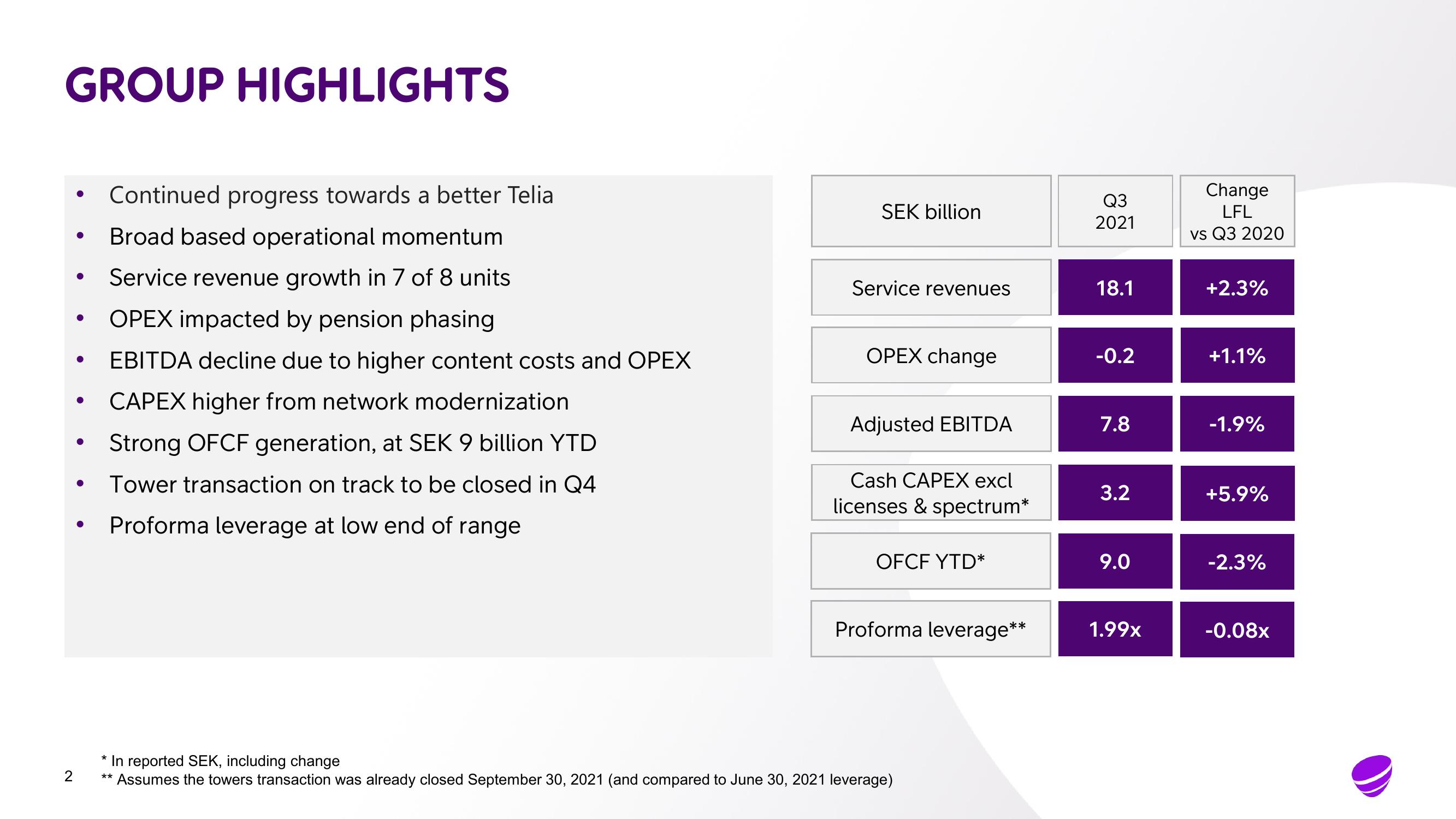

Continued progress towards a better Telia

Broad based operational momentum

Service revenue growth in 7 of 8 units

OPEX impacted by pension phasing

EBITDA decline due to higher content costs and OPEX

CAPEX higher from network modernization

Strong OFCF generation, at SEK 9 billion YTD

Tower transaction on track to be closed in Q4

Proforma leverage at low end of range

SEK billion

Service revenues

OPEX change

Adjusted EBITDA

Cash CAPEX excl

licenses & spectrum*

OFCF YTD*

Proforma leverage**

* In reported SEK, including change

**

Assumes the towers transaction was already closed September 30, 2021 (and compared to June 30, 2021 leverage)

Q3

2021

18.1

-0.2

7.8

3.2

9.0

1.99x

Change

LFL

vs Q3 2020

+2.3%

+1.1%

-1.9%

+5.9%

-2.3%

-0.08xView entire presentation