Meyer Burger Investor Presentation

China 531: a disruptive announcement of the

Chinese government on May 31st, 2018

4

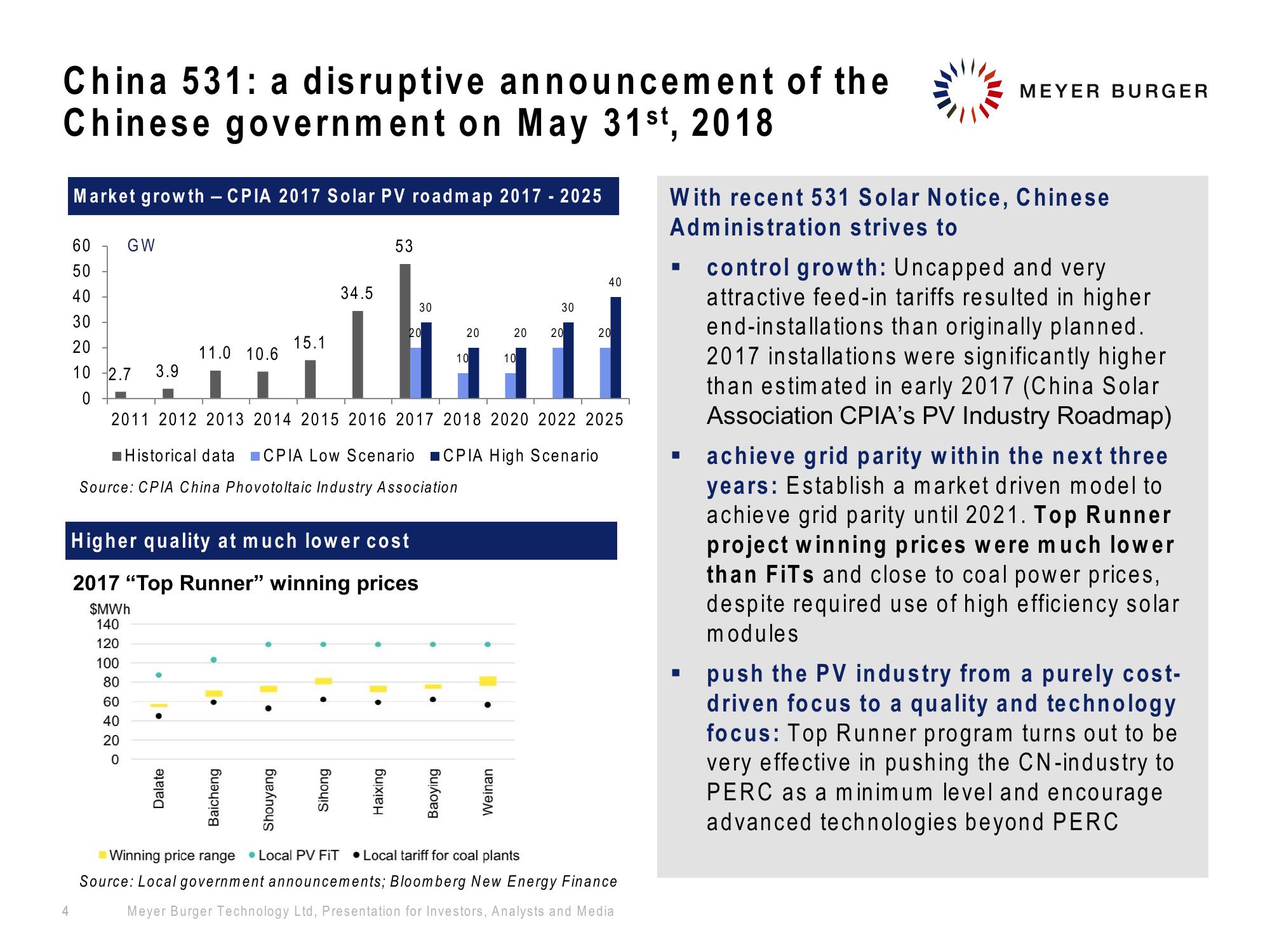

Market growth - CPIA 2017 Solar PV roadmap 2017 - 2025

60

GW

53

50

40

40

34.5

30

30

30

20

20

20 20

20

20

15.1

11.0 10.6

10

10

10

2.7 3.9

0

2011 2012 2013 2014 2015 2016 2017 2018 2020 2022 2025

Historical data ■CPIA Low Scenario ■CPIA High Scenario

Source: CPIA China Phovotoltaic Industry Association

Higher quality at much lower cost

2017 "Top Runner" winning prices

$MWh

140

120

100

80

60

420

Dalate

Baicheng

Shouyang

Sihong

Haixing

Baoying

Weinan

Winning price range • Local PV FIT Local tariff for coal plants

Source: Local government announcements; Bloomberg New Energy Finance

Meyer Burger Technology Ltd, Presentation for Investors, Analysts and Media

MEYER BURGER

With recent 531 Solar Notice, Chinese

Administration strives to

control growth: Uncapped and very

attractive feed-in tariffs resulted in higher

end-installations than originally planned.

2017 installations were significantly higher

than estimated in early 2017 (China Solar

Association CPIA's PV Industry Roadmap)

achieve grid parity within the next three

years: Establish a market driven model to

achieve grid parity until 2021. Top Runner

project winning prices were much lower

than FiTs and close to coal power prices,

despite required use of high efficiency solar

modules

push the PV industry from a purely cost-

driven focus to a quality and technology

focus: Top Runner program turns out to be

very effective in pushing the CN-industry to

PERC as a minimum level and encourage

advanced technologies beyond PERCView entire presentation