Flutter Results Presentation Deck

Financial Review

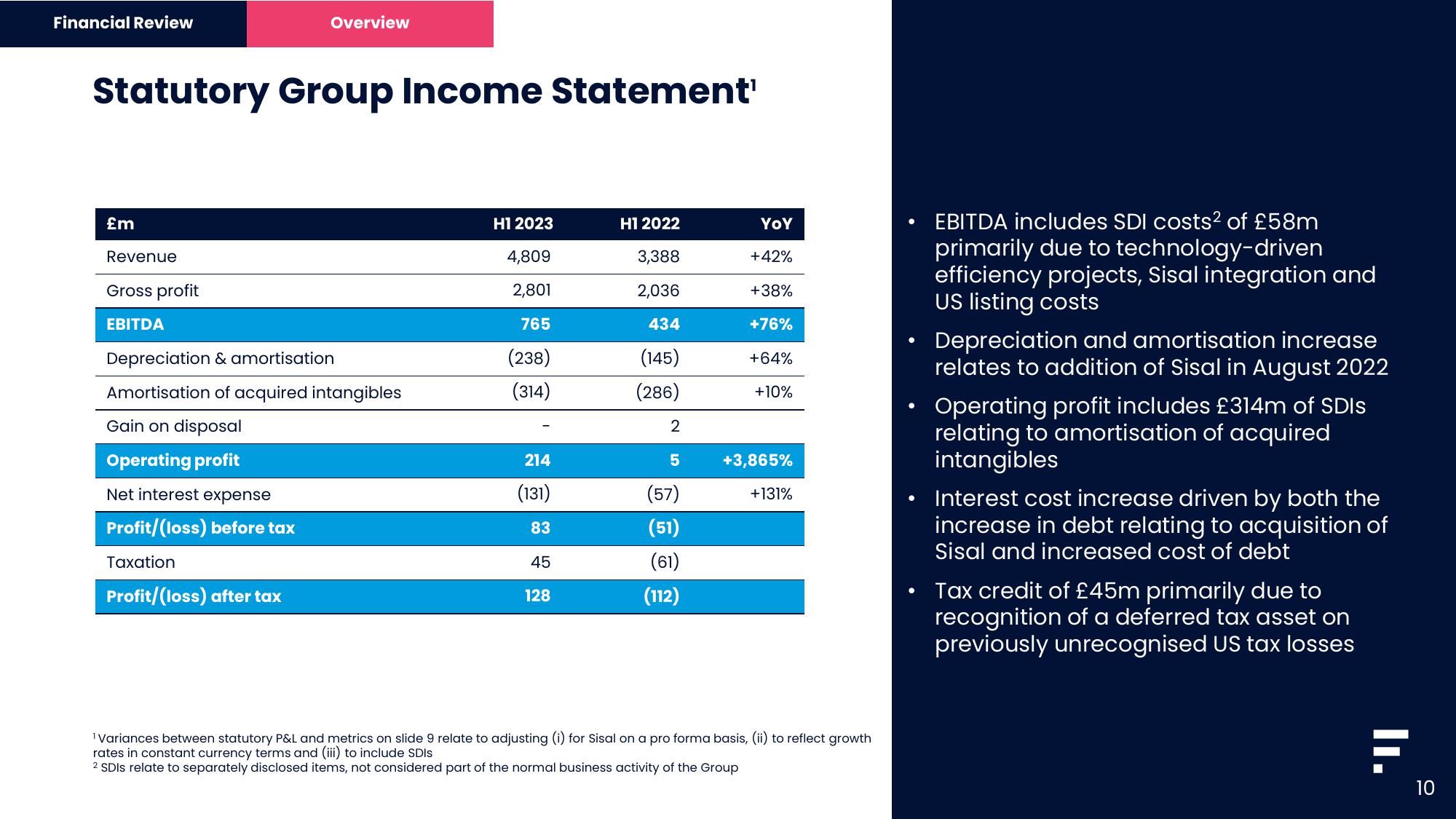

Statutory Group Income Statement¹

£m

Revenue

Gross profit

EBITDA

Overview

Depreciation & amortisation

Amortisation of acquired intangibles

Gain on disposal

Operating profit

Net interest expense

Profit/(loss) before tax

Taxation

Profit/(loss) after tax

H1 2023

4,809

2,801

765

(238)

(314)

214

(131)

83

45

128

H1 2022

3,388

2,036

434

(145)

(286)

2

5

(57)

(51)

(61)

(112)

YOY

+42%

+38%

+76%

+64%

+10%

+3,865%

+131%

¹ Variances between statutory P&L and metrics on slide 9 relate to adjusting (i) for Sisal on a pro forma basis, (ii) to reflect growth

rates in constant currency terms and (iii) to include SDIS

2 SDIS relate to separately disclosed items, not considered part of the normal business activity of the Group

EBITDA includes SDI costs² of £58m

primarily due to technology-driven

efficiency projects, Sisal integration and

US listing costs

Depreciation and amortisation increase

relates to addition of Sisal in August 2022

Operating profit includes £314m of SDIS

relating to amortisation of acquired

intangibles

Interest cost increase driven by both the

increase in debt relating to acquisition of

Sisal and increased cost of debt

Tax credit of £45m primarily due to

recognition of a deferred tax asset on

previously unrecognised US tax losses

II.

10View entire presentation