Pershing Square Activist Presentation Deck

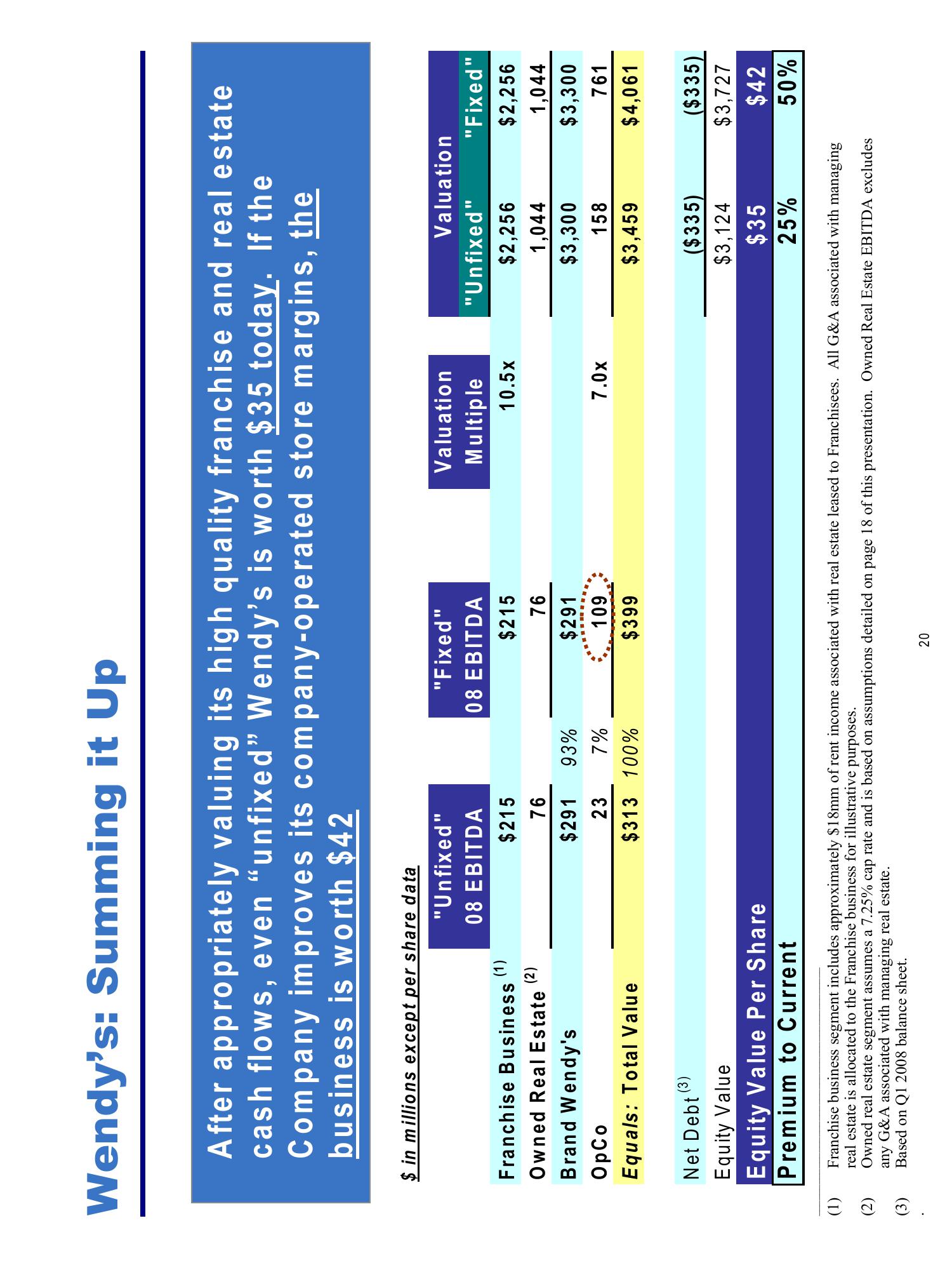

Wendy's: Summing it Up

(1)

(2)

(3)

After appropriately valuing its high quality franchise and real estate

cash flows, even "unfixed" Wendy's is worth $35 today. If the

Company improves its company-operated store margins, the

business is worth $42

$ in millions except per share data

Franchise Business (1)

Owned Real Estate (2)

Brand Wendy's

Орсо

Equals: Total Value

"Unfixed"

08 EBITDA

Net Debt (³)

Equity Value

Equity Value Per Share

Premium to Current

$215

76

$291

93%

23

7%

$313 100%

"Fixed"

08 EBITDA

$215

76

$291

109

$399

Valuation

Multiple

20

10.5x

7.0x

Valuation

"Unfixed"

$2,256

1,044

$3,300

158

$3,459

($335)

$3,124

$35

25%

"Fixed"

$2,256

1,044

$3,300

761

$4,061

Franchise business segment includes approximately $18mm of rent income associated with real estate leased to Franchisees. All G&A associated with managing

real estate is allocated to the Franchise business for illustrative purposes.

Owned real estate segment assumes a 7.25% cap rate and is based on assumptions detailed on page 18 of this presentation. Owned Real Estate EBITDA excludes

any G&A associated with managing real estate.

Based on Q1 2008 balance sheet.

($335)

$3,727

$42

50%View entire presentation