Pershing Square Activist Presentation Deck

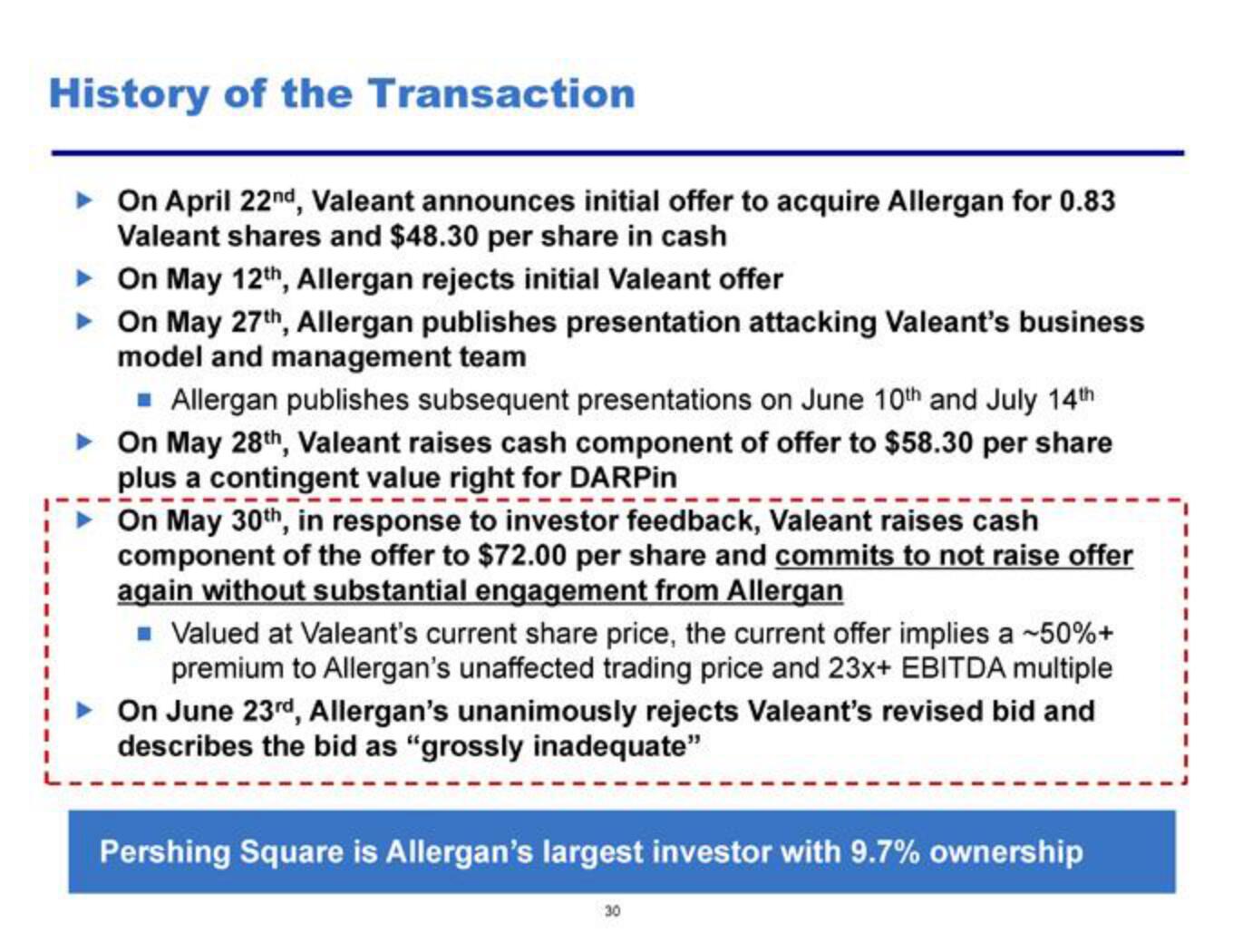

History of the Transaction

On April 22nd, Valeant announces initial offer to acquire Allergan for 0.83

Valeant shares and $48.30 per share in cash

▸

On May 12th, Allergan rejects initial Valeant offer

▸ On May 27th, Allergan publishes presentation attacking Valeant's business

model and management team

■ Allergan publishes subsequent presentations on June 10th and July 14th

On May 28th, Valeant raises cash component of offer to $58.30 per share

plus a contingent value right for DARPin

On May 30th, in response to investor feedback, Valeant raises cash

component of the offer to $72.00 per share and commits to not raise offer

again without substantial engagement from Allergan

■ Valued at Valeant's current share price, the current offer implies a ~50%+

premium to Allergan's unaffected trading price and 23x+ EBITDA multiple

On June 23rd, Allergan's unanimously rejects Valeant's revised bid and

describes the bid as "grossly inadequate"

Pershing Square is Allergan's largest investor with 9.7% ownership

30View entire presentation