Allwyn Investor Presentation Deck

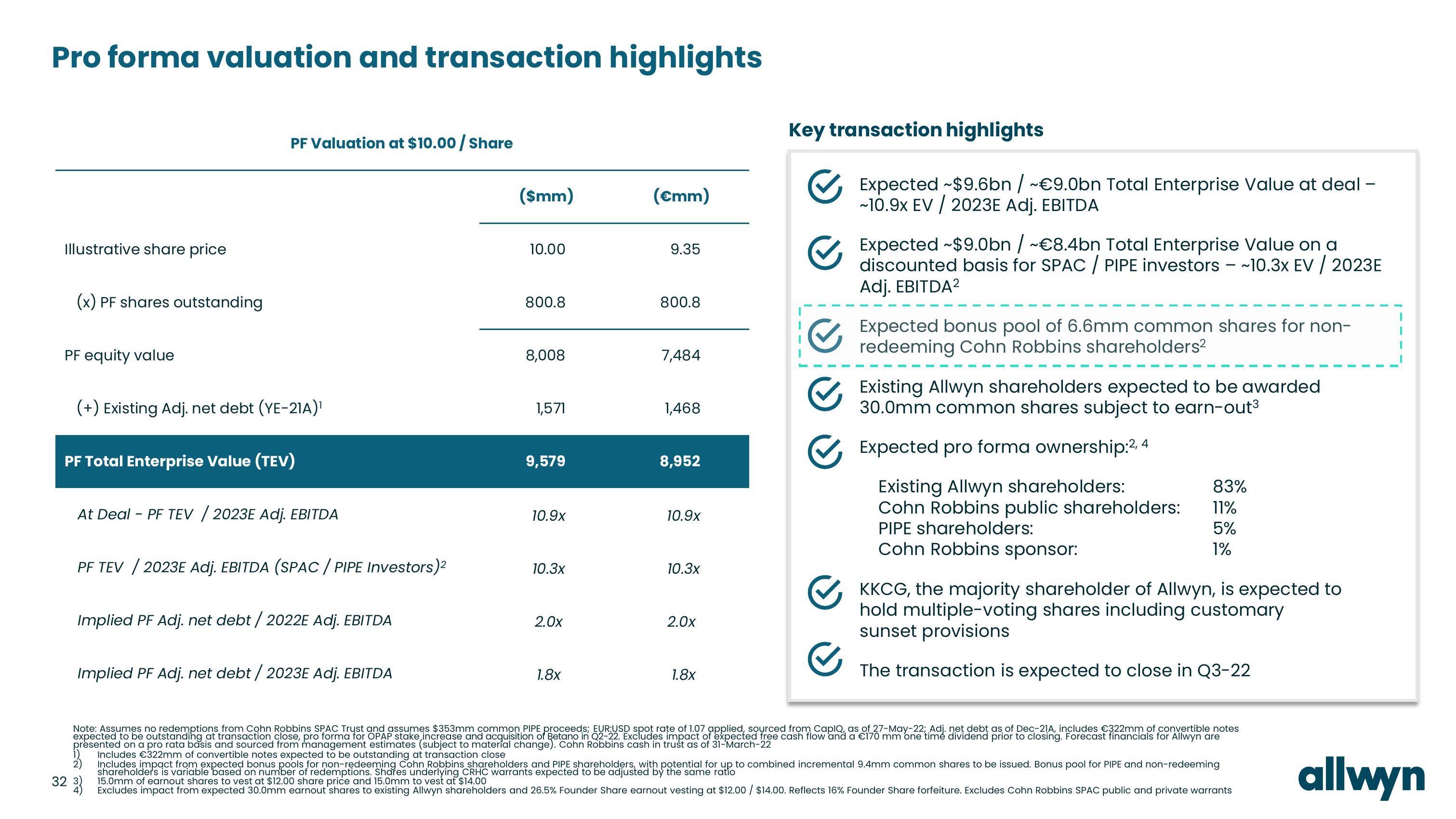

Pro forma valuation and transaction highlights

Illustrative share price

(x) PF shares outstanding

PF equity value

PF Valuation at $10.00 / Share

(+) Existing Adj. net debt (YE-21A)¹

PF Total Enterprise Value (TEV)

At Deal - PF TEV / 2023E Adj. EBITDA

PF TEV / 2023E Adj. EBITDA (SPAC/PIPE Investors)²

Implied PF Adj. net debt / 2022E Adj. EBITDA

Implied PF Adj. net debt / 2023E Adj. EBITDA

2)

32 3

($mm)

10.00

800.8

8,008

1,571

9,579

10.9x

10.3x

2.0x

1.8x

(€mm)

9.35

800.8

7,484

1,468

8,952

10.9x

10.3x

2.0x

1.8x

Key transaction highlights

✔ Expected ~$9.6bn / ~€9.0bn Total Enterprise Value at deal -

~10.9X EV / 2023E Adj. EBITDA

✔ Total Value

discounted basis for SPAC/ PIPE investors - ~10.3x EV / 2023E

Adj. EBITDA²

✔ Expected bonus pool of 6.6mm common shares for non-

redeeming Cohn Robbins shareholders²

✔ Existing Allwyn shareholders expected to be awarded

common shares subject to earn-out³

✔ Expected pro forma ownership:2, 4

Existing Allwyn shareholders:

Cohn Robbins public shareholders:

PIPE shareholders:

Cohn Robbins sponsor:

✔

83%

11%

5%

1%

✔✔ KKCG, the majority shareholder of Allwyn, is expected to

hold multiple-voting shares including customary

sunset provisions

The transaction is expected to close in Q3-22

Note: Assumes no redemptions from Cohn Robbins SPAC Trust and assumes $353mm common PIPE proceeds; EUR:USD spot rate of 1.07 applied, sourced from CapIQ, as of 27-May-22; Adj. net debt as of Dec-21A, includes €322mm of convertible notes

expected to be outstanding at transaction close, pro forma for OPAP stake increase and acquisition of Betano in Q2-22. Excludes impact of expected free cash flow and a €170 mm one time dividend prior to closing. Forecast financials for Allwyn are

presented on a pro rata basis and sourced from management estimates (subject to material change). Cohn Robbins cash in trust as of 31-March-22

Includes €322mm of convertible notes expected to be outstanding at transaction close

Includes impact from expected bonus pools for non-redeeming Cohn Robbins shareholders and PIPE shareholders, with potential for up to combined incremental 9.4mm common shares to be issued. Bonus pool for PIPE and non-redeeming

shareholders is variable based on number of redemptions. Shares underlying CRHC warrants expected to be adjusted by the same ratio

15.0mm of earnout shares to vest at $12.00 share price and 15.0mm to vest at $14.00

Excludes impact from expected 30.0mm earnout shares to existing Allwyn shareholders and 26.5% Founder Share earnout vesting at $12.00 / $14.00. Reflects 16% Founder Share forfeiture. Excludes Cohn Robbins SPAC public and private warrants

allwynView entire presentation