Baird Investment Banking Pitch Book

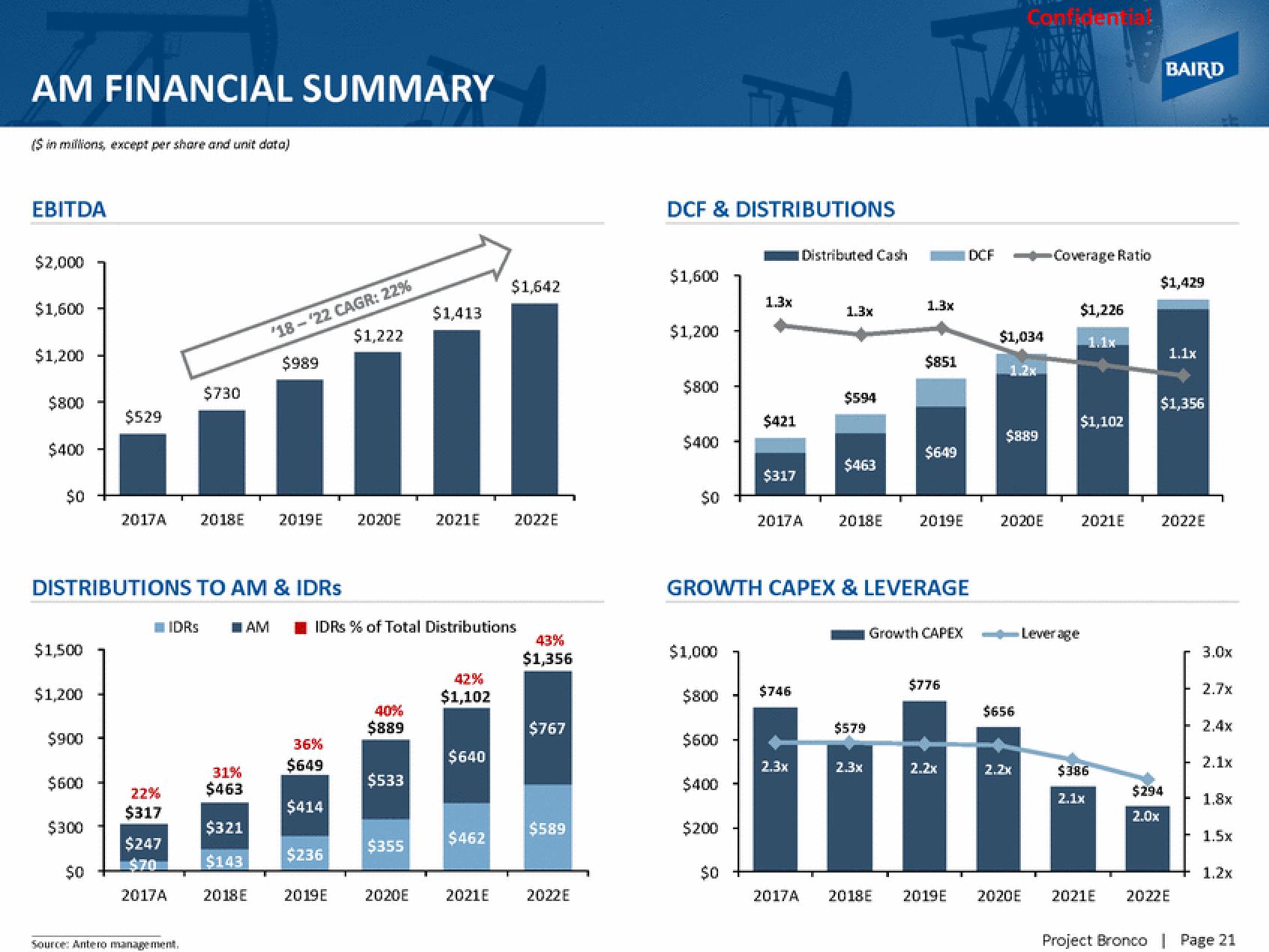

AM FINANCIAL SUMMARY

($ in millions, except per share and unit data)

EBITDA

$2,000

$1,600

$1,200

$800

$400

$0

$1,500

$1,200

$900

$600

DISTRIBUTIONS TO AM & IDRs

$300

$529

$0

2017A 2018E

22%

$317

$247

$70

2017A

$730

IDRS

Source: Antero management.

31%

$463

'18-'22 CAGR: 22%

$1,222

$989

AM

$321

$143

2018 E

2019E 2020E

36%

$649

$414

IDRs % of Total Distributions

$236

2019E

40%

$889

$533

$355

$1,413

2020E

2021E 2022E

42%

$1,102

$640

$1,642

$462

2021E

43%

$1,356

$767

$589

2022E

DCF & DISTRIBUTIONS

$1,600

$1,200

$800

$400

$0

$1,000

$800

$600

$400

$200

1.3x

$0

$421

$317

2017A

Distributed Cash

$746

2.3x

1.3x

GROWTH CAPEX & LEVERAGE

$594

$463

2018E

$579

2.3x

1.3x

$851

2017A 2018E

$649

2019E

Growth CAPEX

$776

2.2x

DCF

$1,034

1.2x

Confidential

$889

2020E

$656

2.2x

2019E 2020E

Coverage Ratio

$1,226

1.1x

$1,102

Leverage

2021E

$386

2.1x

BAIRD

$1,429

1.1x

$1,356

$294

2.0x

2022E

2021E 2022E

3.0x

2.7x

2.4x

2.1x

1.8x

1.5x

1.2x

Project Bronco | Page 21View entire presentation