Navient to Acquire Earnest

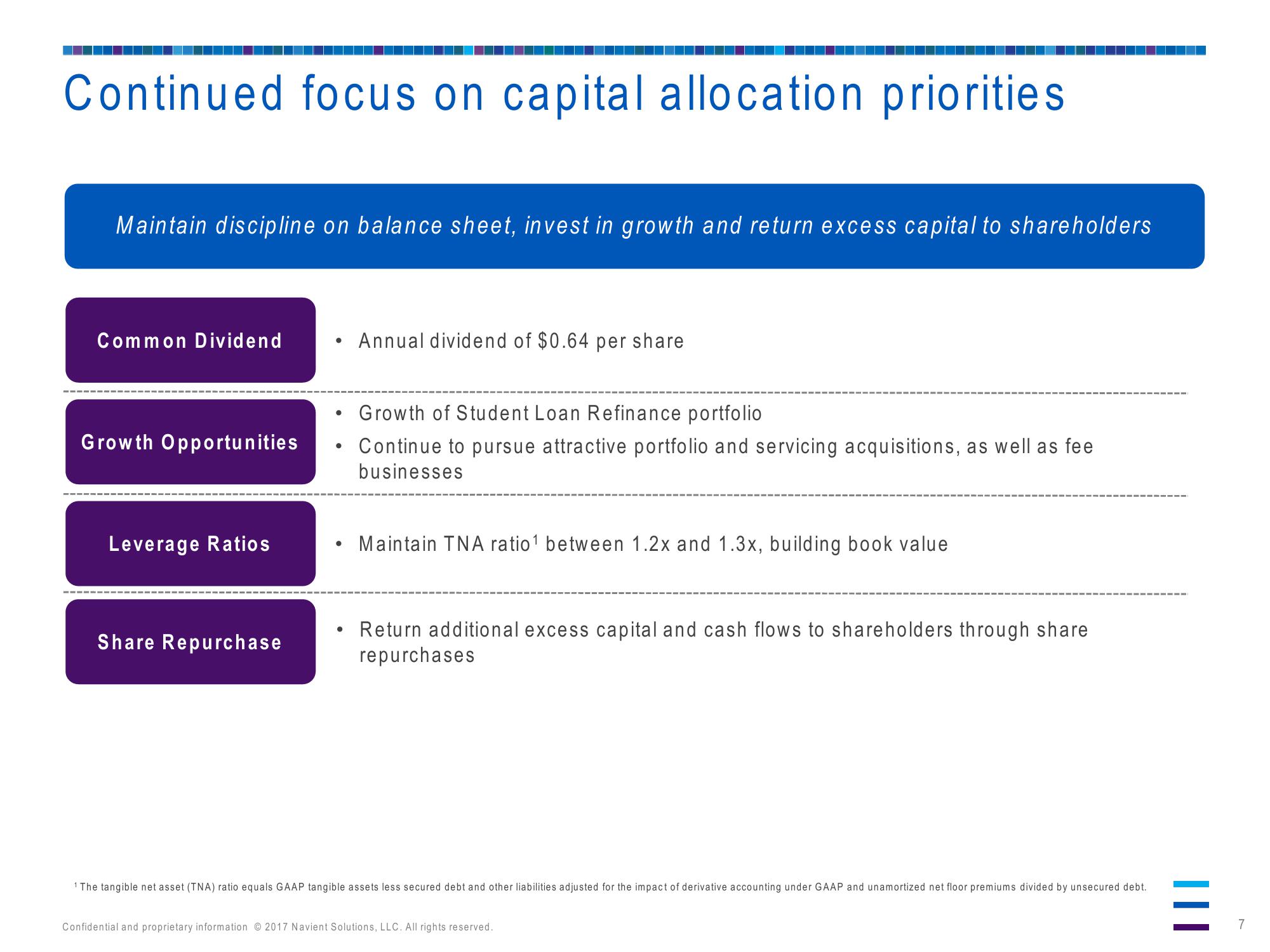

Continued focus on capital allocation priorities

Maintain discipline on balance sheet, invest in growth and return excess capital to shareholders

Common Dividend

Growth Opportunities

Leverage Ratios

Share Repurchase

●

Growth of Student Loan Refinance portfolio

• Continue to pursue attractive portfolio and servicing acquisitions, as well as fee

businesses

Annual dividend of $0.64 per share

●

Maintain TNA ratio ¹ between 1.2x and 1.3x, building book value

Return additional excess capital and cash flows to shareholders through share

repurchases

1 The tangible net asset (TNA) ratio equals GAAP tangible assets less secured debt and other liabilities adjusted for the impact of derivative accounting under GAAP and unamortized net floor premiums divided by unsecured debt.

Confidential and proprietary information 2017 Navient Solutions, LLC. All rights reserved.

|||

7View entire presentation