Flutter Results Presentation Deck

Sustainable revenue growth

+ margin benefits

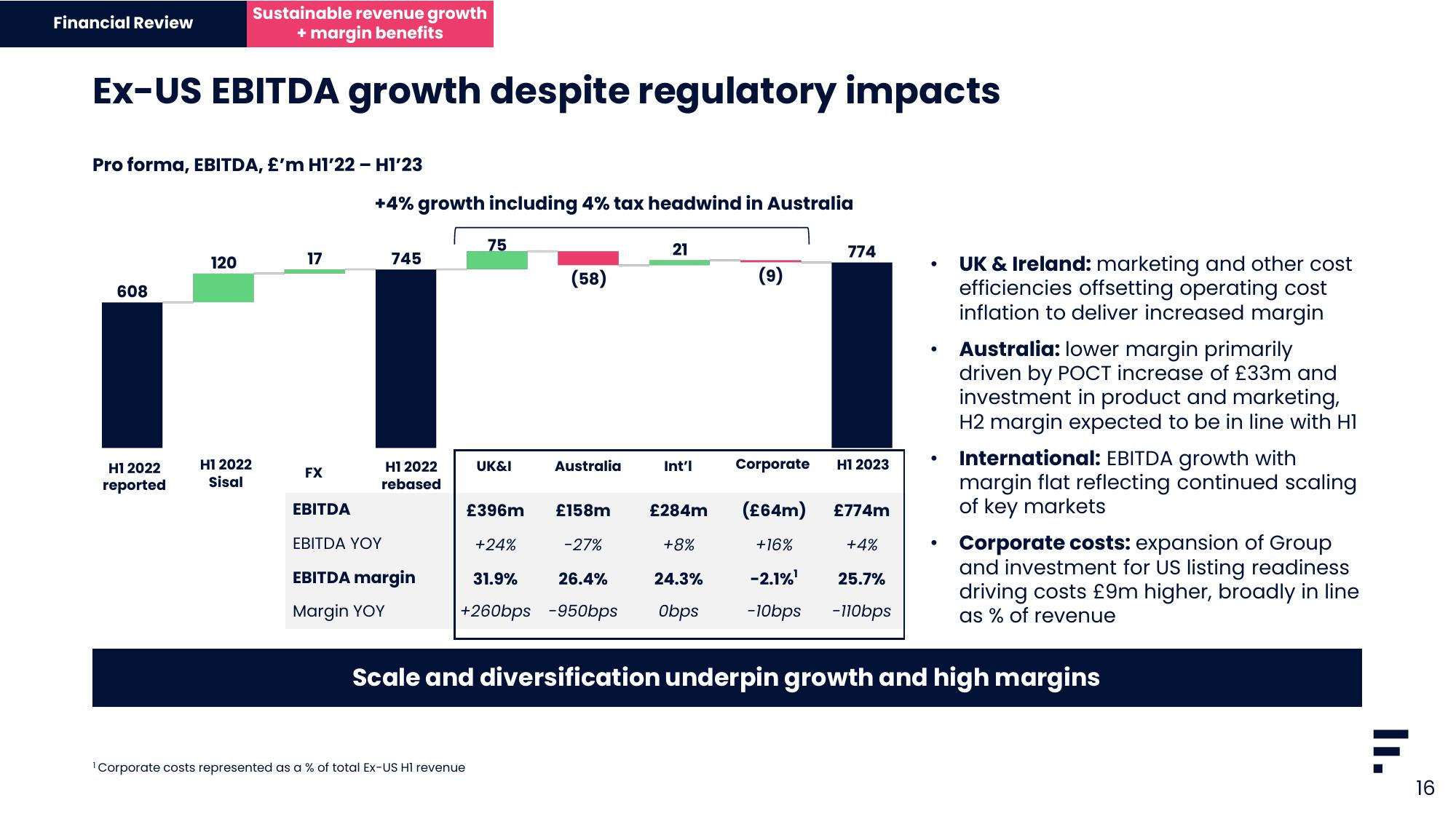

Ex-US EBITDA growth despite regulatory impacts

Financial Review

Pro forma, EBITDA, £'m H1'22 - H1'23

608

H1 2022

reported

120

H12022

Sisal

17

FX

+4% growth including 4% tax headwind in Australia

745

H1 2022

rebased

EBITDA

EBITDA YOY

EBITDA margin

Margin YOY

75

¹Corporate costs represented as a % of total Ex-US H1 revenue

UK&I

(58)

Australia

21

Int'l

(9)

Corporate

774

H1 2023

(£64m)

+16%

-2.1%¹ 25.7%

-10bps -110bps

£774m

●

+4%

●

●

£396m £158m

+24%

-27%

£284m

+8%

31.9% 26.4% 24.3%

+260bps -950bps Obps

Scale and diversification underpin growth and high margins

UK & Ireland: marketing and other cost

efficiencies offsetting operating cost

inflation to deliver increased margin

Australia: lower margin primarily

driven by POCT increase of £33m and

investment in product and marketing,

H2 margin expected to be in line with HI

International: EBITDA growth with

margin flat reflecting continued scaling

of key markets

Corporate costs: expansion of Group

and investment for US listing readiness

driving costs £9m higher, broadly in line

as % of revenue

F

II.

16View entire presentation