Baird Investment Banking Pitch Book

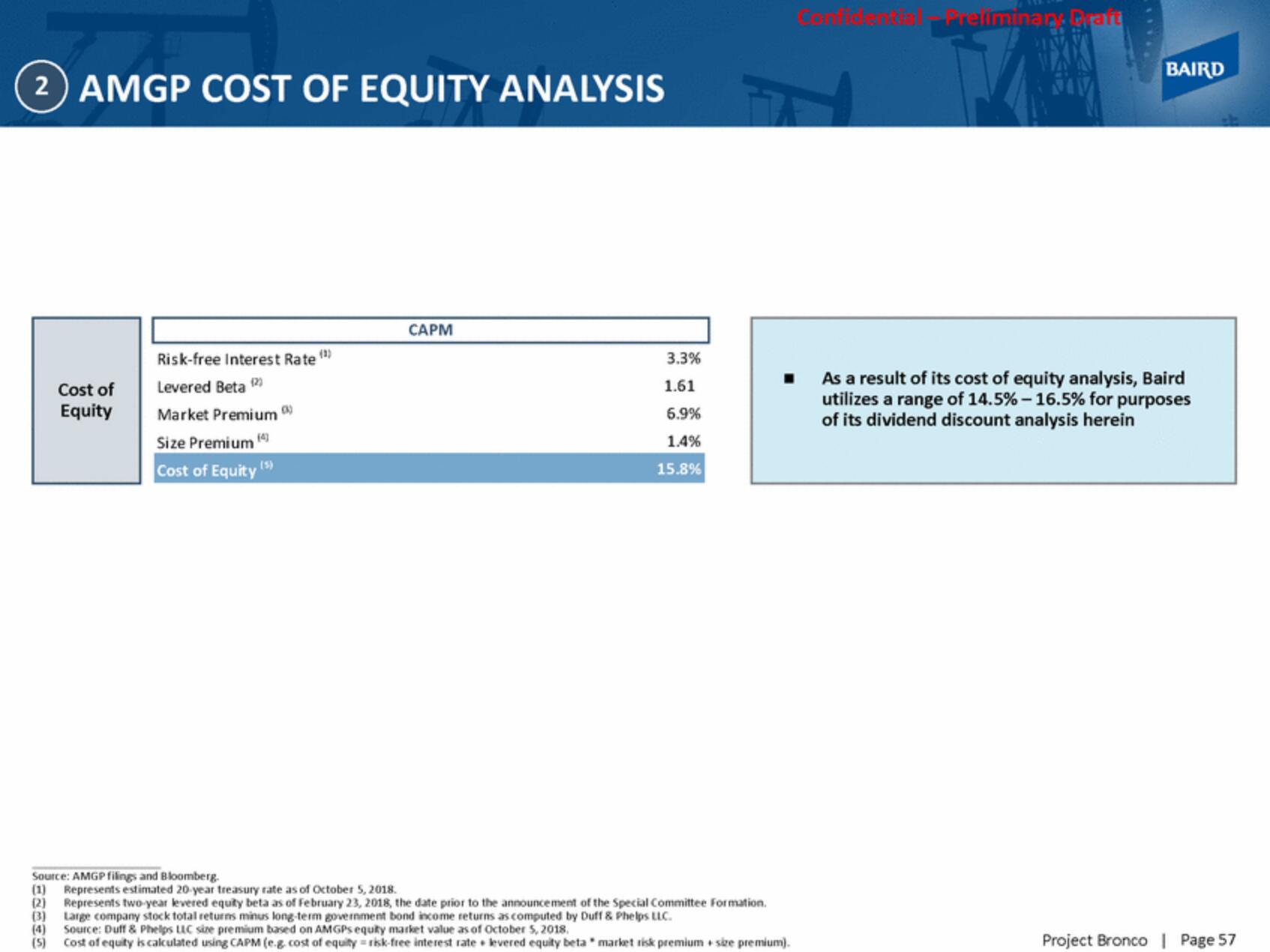

2 AMGP COST OF EQUITY ANALYSIS

(2)

(3)

Cost of

Equity

(4)

(5)

Risk-free Interest Rate

(3)

Levered Beta ¹2

Market Premium)

Size Premium (4)

Cost of Equity (5)

CAPM

Source: AMGP filings and Bloomberg.

(1) Represents estimated 20-year treasury rate as of October 5, 2018.

Represents two-year levered equity beta as of February 23, 2018, the date prior to the announcement of the Special Committee Formation.

Large company stock total returns minus long-term government bond income returns as computed by Duff & Phelps LLC.

Source: Duff & Phelps LLC size premium based on AMGPs equity market value as of October 5, 2018.

Cost of equity is calculated using CAPM (e.g. cost of equity risk-free interest rate levered equity beta market risk premium size premium).

3.3%

1.61

6.9%

1.4%

15.8%

Preliminan. Draft

BAIRD

As a result of its cost of equity analysis, Baird

utilizes a range of 14.5% -16.5 % for purposes

of its dividend discount analysis herein

Project Bronco | Page 57View entire presentation