APTIV WNDRVR Acquisition

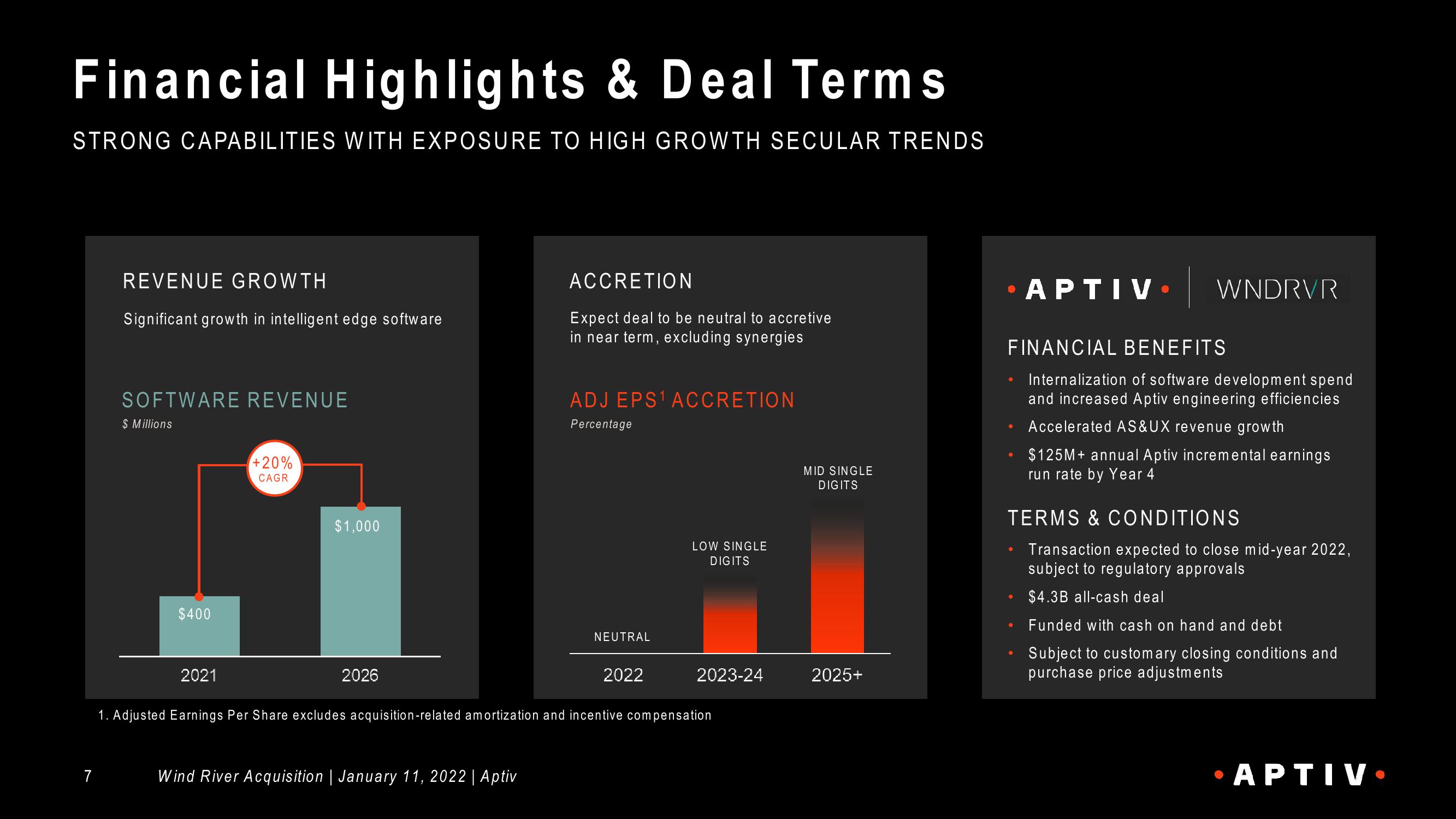

Financial Highlights & Deal Terms

STRONG CAPABILITIES WITH EXPOSURE TO HIGH GROWTH SECULAR TRENDS

7

REVENUE GROWTH

Significant growth in intelligent edge software

SOFTWARE REVENUE

$ Millions

$400

2021

+20%

CAGR

$1,000

2026

ACCRETION

Expect deal to be neutral to accretive

in near term, excluding synergies

Wind River Acquisition | January 11, 2022 | Aptiv

ADJ EPS¹ ACCRETION

Percentage

NEUTRAL

2022

LOW SINGLE

DIGITS

2023-24

1. Adjusted Earnings Per Share excludes acquisition-related amortization and incentive compensation

MID SINGLE

DIGITS

2025+

APTIV

●

WNDRVR

FINANCIAL BENEFITS

Internalization of software development spend

and increased Aptiv engineering efficiencies

Accelerated AS&UX revenue growth

$125M+ annual Aptiv incremental earnings

run rate by Year 4

TERMS & CONDITIONS

Transaction expected to close mid-year 2022,

subject to regulatory approvals

$4.3B all-cash deal

Funded with cash on hand and debt

Subject to customary closing conditions and

purchase price adjustments

APTIV.View entire presentation