Axos Financial, Inc. Fixed Income Investor Presentation

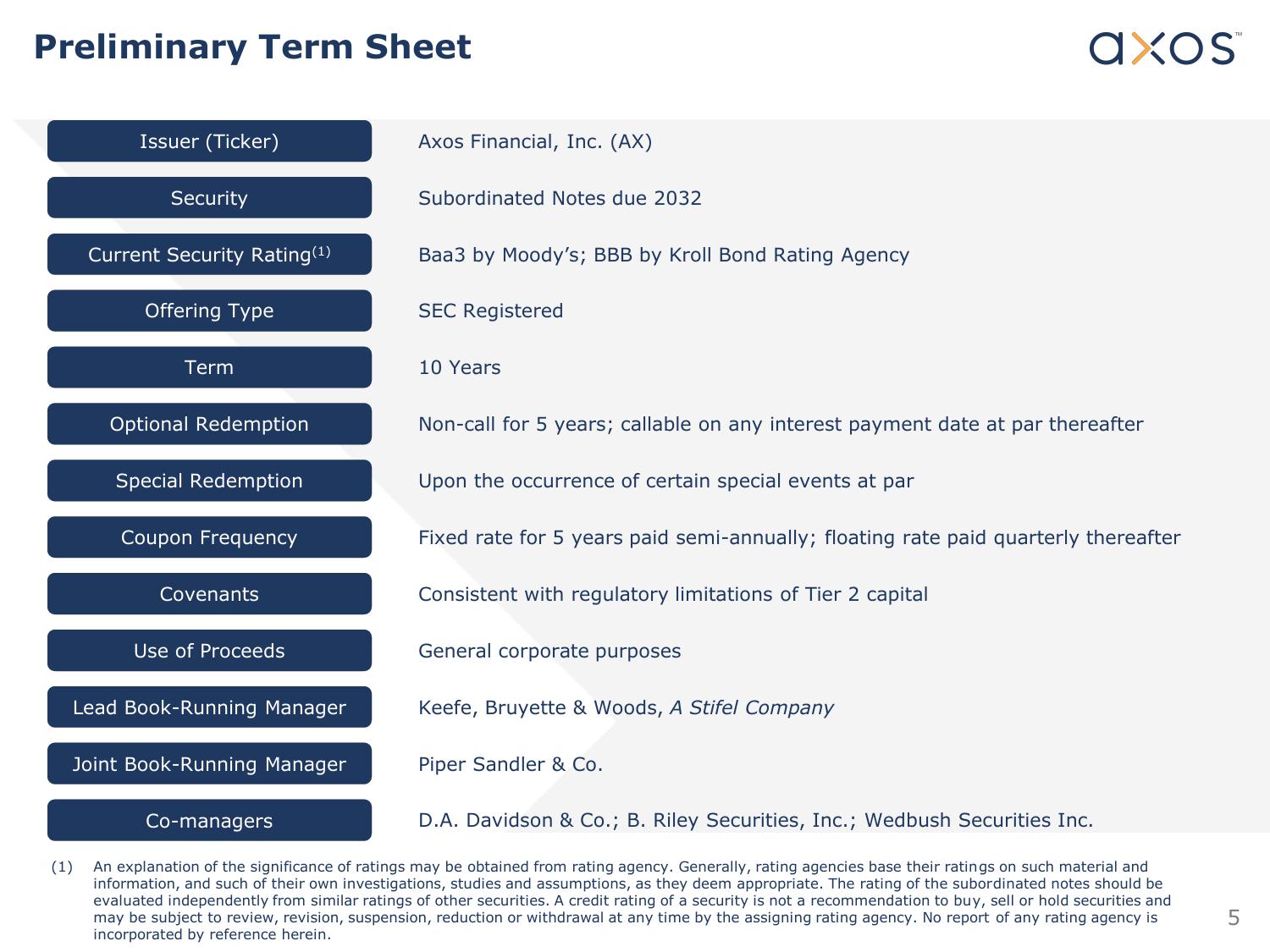

Preliminary Term Sheet

Issuer (Ticker)

Security

Current Security Rating (¹)

Offering Type

Term

Optional Redemption

Special Redemption

Coupon Frequency

Covenants

Use of Proceeds

Lead Book-Running Manager

Joint Book-Running Manager

Axos Financial, Inc. (AX)

Subordinated Notes due 2032

Baa3 by Moody's; BBB by Kroll Bond Rating Agency

SEC Registered

10 Years

Non-call for 5 years; callable on any interest payment date at par thereafter

Upon the occurrence of certain special events at par

Fixed rate for 5 years paid semi-annually; floating rate paid quarterly thereafter

Consistent with regulatory limitations of Tier 2 capital

General corporate purposes

axos

Keefe, Bruyette & Woods, A Stifel Company

Piper Sandler & Co.

Co-managers

D.A. Davidson & Co.; B. Riley Securities, Inc.; Wedbush Securities Inc.

(1) An explanation of the significance of ratings may be obtained from rating agency. Generally, rating agencies base their ratings on such material and

information, and such of their own investigations, studies and assumptions, as they deem appropriate. The rating of the subordinated notes should be

evaluated independently from similar ratings of other securities. A credit rating of a security is not a recommendation to buy, sell or hold securities and

may be subject to review, revision, suspension, reduction or withdrawal at any time by the assigning rating agency. No report of any rating agency is

incorporated by reference herein.

5View entire presentation