Barclays Investment Banking Pitch Book

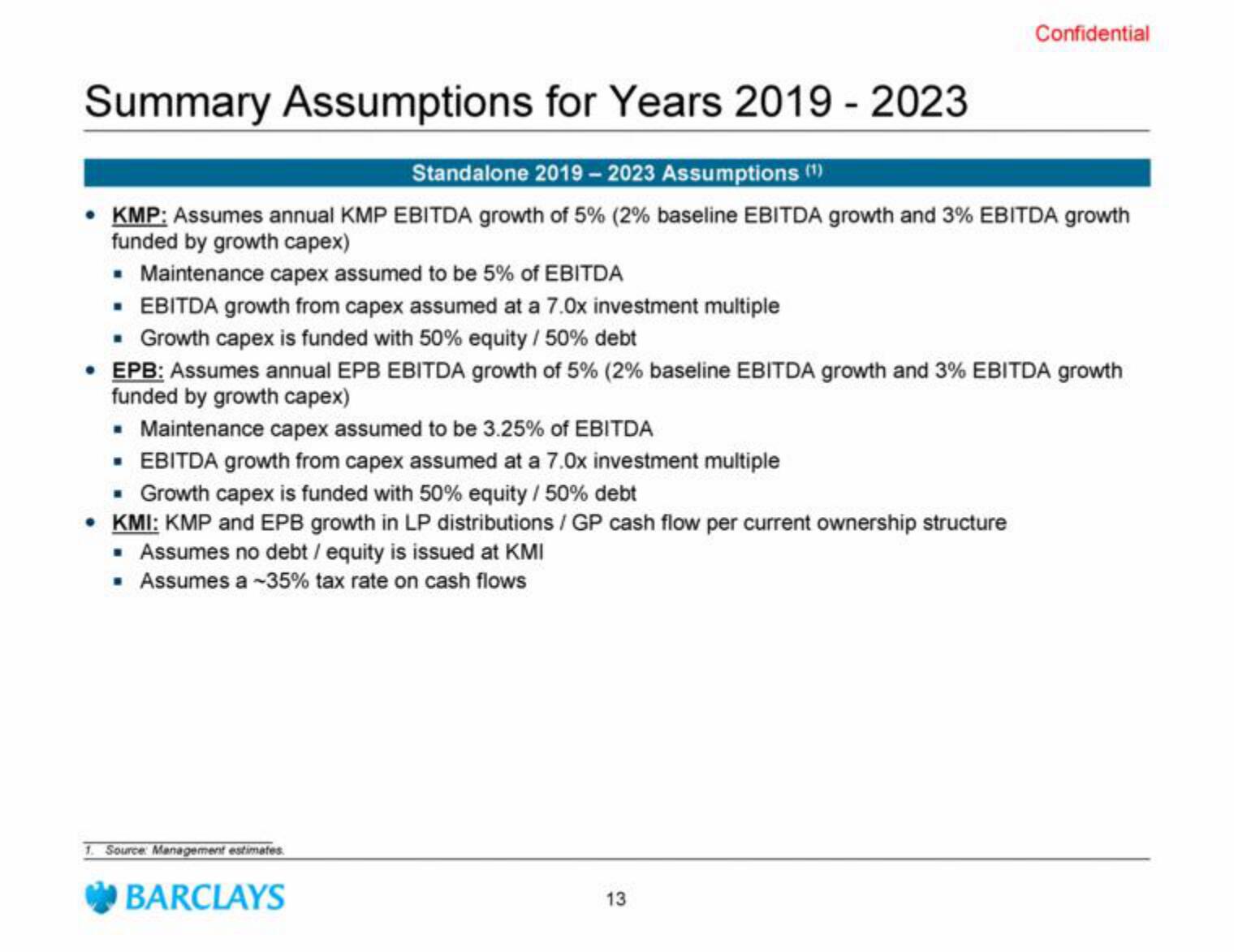

Summary Assumptions for Years 2019-2023

Standalone 2019-2023 Assumptions (¹)

• KMP: Assumes annual KMP EBITDA growth of 5% (2% baseline EBITDA growth and 3% EBITDA growth

funded by growth capex)

▪ Maintenance capex assumed to be 5% of EBITDA

■ EBITDA growth from capex assumed at a 7.0x investment multiple

▪ Growth capex is funded with 50% equity / 50% debt

• EPB: Assumes annual EPB EBITDA growth of 5% (2% baseline EBITDA growth and 3% EBITDA growth

funded by growth capex)

▪ Maintenance capex assumed to be 3.25% of EBITDA

■ EBITDA growth from capex assumed at a 7.0x investment multiple

▪ Growth capex is funded with 50% equity / 50% debt

• KMI: KMP and EPB growth in LP distributions / GP cash flow per current ownership structure

■ Assumes no debt / equity is issued at KMI

▪ Assumes a ~35% tax rate on cash flows

1. Source: Management estimates.

Confidential

BARCLAYS

13View entire presentation