Flutter Investor Day Presentation Deck

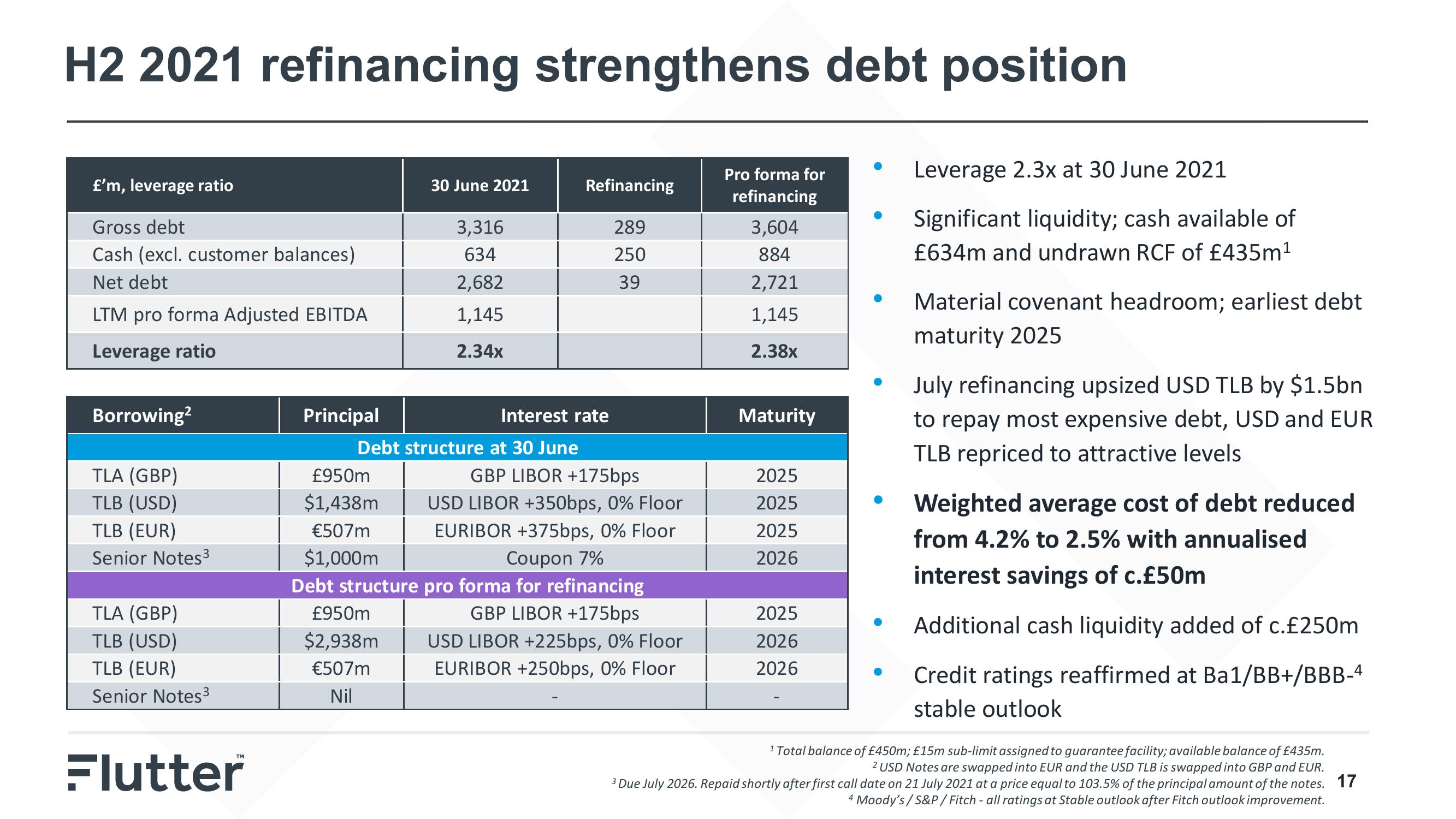

H2 2021 refinancing strengthens debt position

£'m, leverage ratio

Gross debt

Cash (excl. customer balances)

Net debt

LTM pro forma Adjusted EBITDA

Leverage ratio

Borrowing2

TLA (GBP)

TLB (USD)

TLB (EUR)

Senior Notes³

TLA (GBP)

TLB (USD)

TLB (EUR)

Senior Notes ³

Flutter

Principal

30 June 2021

3,316

634

2,682

1,145

2.34x

£950m

$2,938m

€507m

Nil

Debt structure at 30 June

Refinancing

289

250

39

Interest rate

£950m

GBP LIBOR +175bps

$1,438m

€507m

USD LIBOR +350bps, 0% Floor

EURIBOR +375bps, 0% Floor

$1,000m

Coupon 7%

Debt structure pro forma for refinancing

GBP LIBOR +175bps

USD LIBOR +225bps, 0% Floor

EURIBOR +250bps, 0% Floor

Pro forma for

refinancing

3,604

884

2,721

1,145

2.38x

Maturity

2025

2025

2025

2026

2025

2026

2026

Leverage 2.3x at 30 June 2021

Significant liquidity; cash available of

£634m and undrawn RCF of £435m¹

Material covenant headroom; earliest debt

maturity 2025

July refinancing upsized USD TLB by $1.5bn

to repay most expensive debt, USD and EUR

TLB repriced to attractive levels

Weighted average cost of debt reduced

from 4.2% to 2.5% with annualised

interest savings of c.£50m

Additional cash liquidity added of c.£250m

Credit ratings reaffirmed at Ba1/BB+/BBB-4

stable outlook

¹ Total balance of £450m; £15m sub-limit assigned to guarantee facility; available balance of £435m.

2 USD Notes are swapped into EUR and the USD TLB is swapped into GBP and EUR.

3 Due July 2026. Repaid shortly after first call date on 21 July 2021 at a price equal to 103.5% of the principal amount of the notes.

4 Moody's/S&P/Fitch - all ratings at Stable outlook after Fitch outlook improvement.

17View entire presentation