Pershing Square Activist Presentation Deck

Best-in-Class Unit Economics

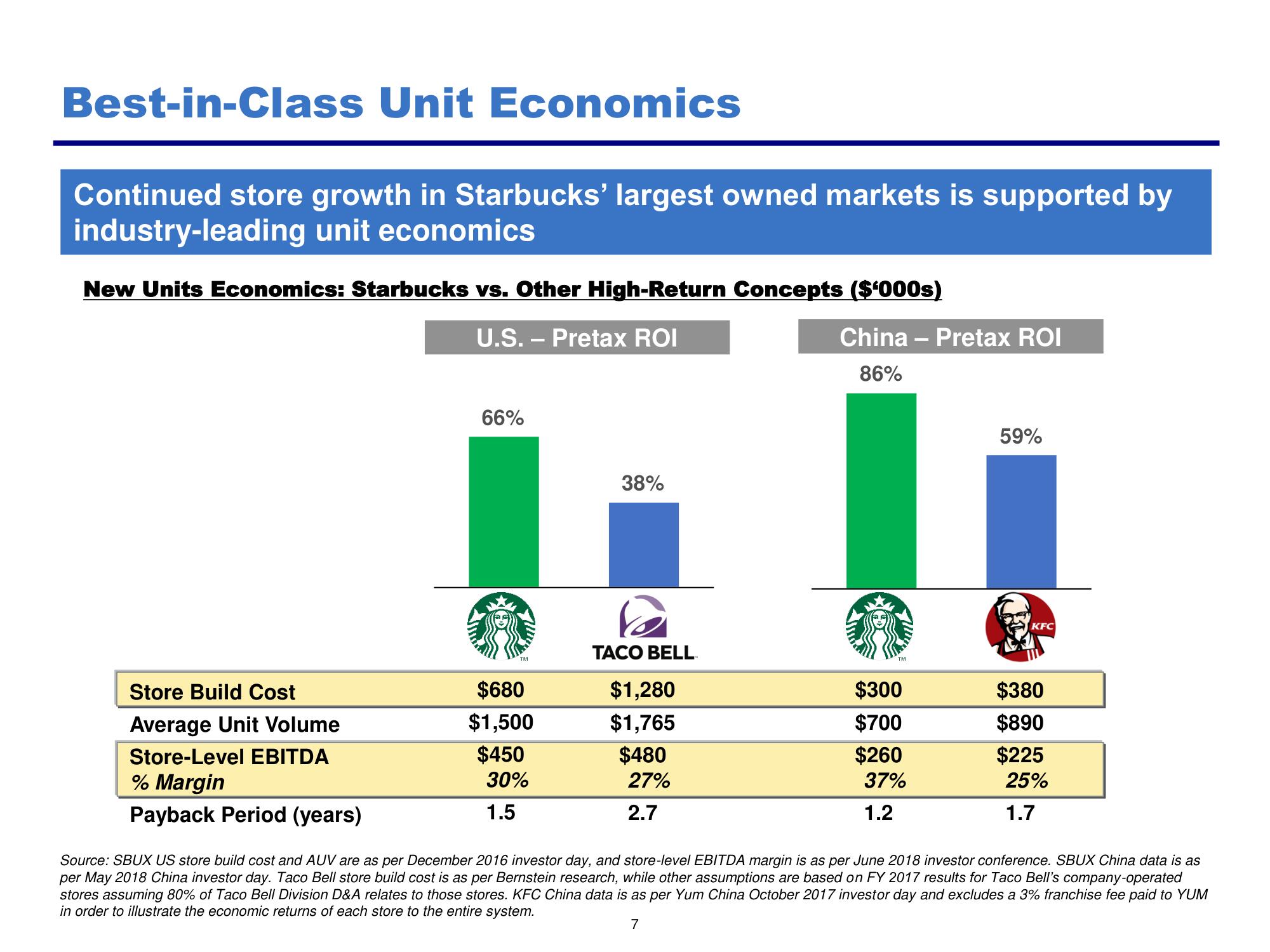

Continued store growth in Starbucks' largest owned markets is supported by

industry-leading unit economics

New Units Economics: Starbucks vs. Other High-Return Concepts ($¹000s)

U.S. - Pretax ROI

Store Build Cost

Average Unit Volume

Store-Level EBITDA

% Margin

Payback Period (years)

66%

TM

$680

$1,500

$450

30%

1.5

38%

TACO BELL

$1,280

$1,765

$480

27%

2.7

China - Pretax ROI

86%

TM

$300

$700

$260

37%

1.2

59%

KFC

$380

$890

$225

25%

1.7

Source: SBUX US store build cost and AUV are as per December 2016 investor day, and store-level EBITDA margin is as per June 2018 investor conference. SBUX China data is as

per May 2018 China investor day. Taco Bell store build cost is as per Bernstein research, while other assumptions are based on FY 2017 results for Taco Bell's company-operated

stores assuming 80% of Taco Bell Division D&A relates to those stores. KFC China data is as per Yum China October 2017 investor day and excludes a 3% franchise fee paid to YUM

in order to illustrate the economic returns of each store to the entire system.

7View entire presentation