VICI Investor Presentation

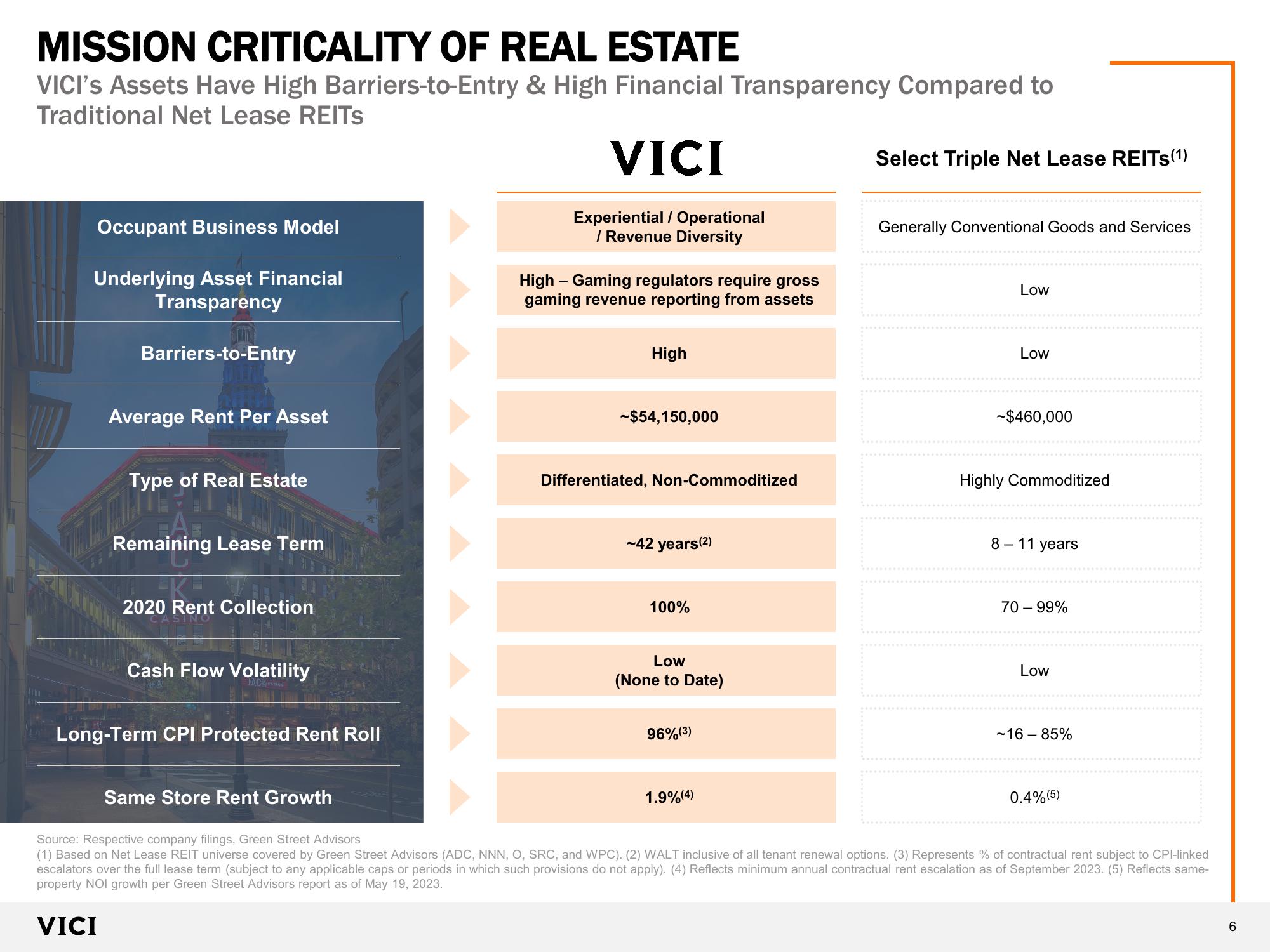

MISSION CRITICALITY OF REAL ESTATE

VICI's Assets Have High Barriers-to-Entry & High Financial Transparency Compared to

Traditional Net Lease REITS

Occupant Business Model

Underlying Asset Financial

Transparency

Barriers-to-Entry

Average Rent Per Asset

Type of Real Estate

Remaining Lease Term

2020 Rent Collection

SINO

Cash Flow Volatility

JACKENS

Long-Term CPI Protected Rent Roll

Same Store Rent Growth

VICI

Experiential / Operational

/ Revenue Diversity

High - Gaming regulators require gross

gaming revenue reporting from assets

High

-$54,150,000

Differentiated, Non-Commoditized

-42 years (²)

100%

Low

(None to Date)

96% (3)

1.9% (4)

Select Triple Net Lease REITS (1)

Generally Conventional Goods and Services

Low

Low

-$460,000

Highly Commoditized

8-11 years

70 - 99%

Low

-16-85%

0.4% (5)

Source: Respective company filings, Green Street Advisors

(1) Based on Net Lease REIT universe covered by Green Street Advisors (ADC, NNN, O, SRC, and WPC). (2) WALT inclusive of all tenant renewal options. (3) Represents % of contractual rent subject to CPI-linked

escalators over the full lease term (subject to any applicable caps or periods in which such provisions do not apply). (4) Reflects minimum annual contractual rent escalation as of September 2023. (5) Reflects same-

property NOI growth per Green Street Advisors report as of May 19, 2023.

VICI

6View entire presentation