Karat IPO Presentation Deck

VIE OVERVIEW

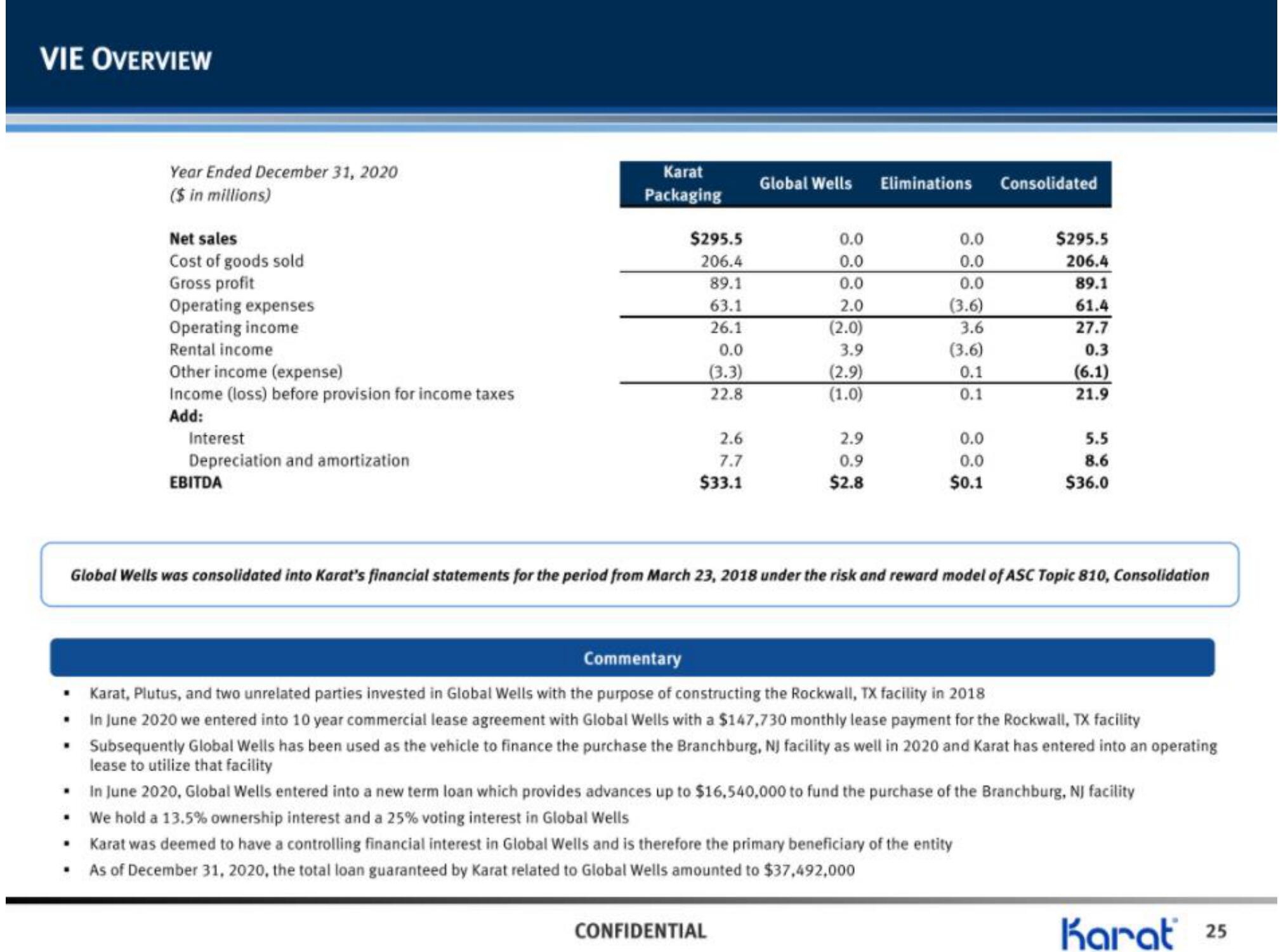

Year Ended December 31, 2020

($ in millions)

•

•

Net sales

Cost of goods sold

Gross profit

•

.

Operating expenses

Operating income

Rental income

Other income (expense)

Income (loss) before provision for income taxes

Add:

Interest

Depreciation and amortization

EBITDA

Karat

Packaging

$295.5

206.4

89.1

63.1

26.1

0.0

(3.3)

22.8

2.6

7.7

$33.1

Global Wells Eliminations Consolidated

0.0

0.0

0.0

2.0

(2.0)

3.9

(2.9)

(1.0)

CONFIDENTIAL

2.9

0.9

$2.8

0.0

0.0

0.0

(3.6)

3.6

(3.6)

0.1

0.1

0.0

0.0

$0.1

Global Wells was consolidated into Karat's financial statements for the period from March 23, 2018 under the risk and reward model of ASC Topic 810, Consolidation

$295.5

206.4

89.1

61.4

27.7

0.3

(6.1)

21.9

Commentary

Karat, Plutus, and two unrelated parties invested in Global Wells with the purpose of constructing the Rockwall, TX facility in 2018

In June 2020 we entered into 10 year commercial lease agreement with Global Wells with a $147,730 monthly lease payment for the Rockwall, TX facility

Subsequently Global Wells has been used as the vehicle to finance the purchase the Branchburg, NJ facility as well in 2020 and Karat has entered into an operating

lease to utilize that facility

In June 2020, Global Wells entered into a new term loan which provides advances up to $16,540,000 to fund the purchase of the Branchburg, NJ facility

We hold a 13.5% ownership interest and a 25% voting interest in Global Wells

Karat was deemed to have a controlling financial interest in Global Wells and is therefore the primary beneficiary of the entity

• As of December 31, 2020, the total loan guaranteed by Karat related to Global Wells amounted to $37,492,000

5.5

8.6

$36.0

Karat 25View entire presentation