jetBlue Results Presentation Deck

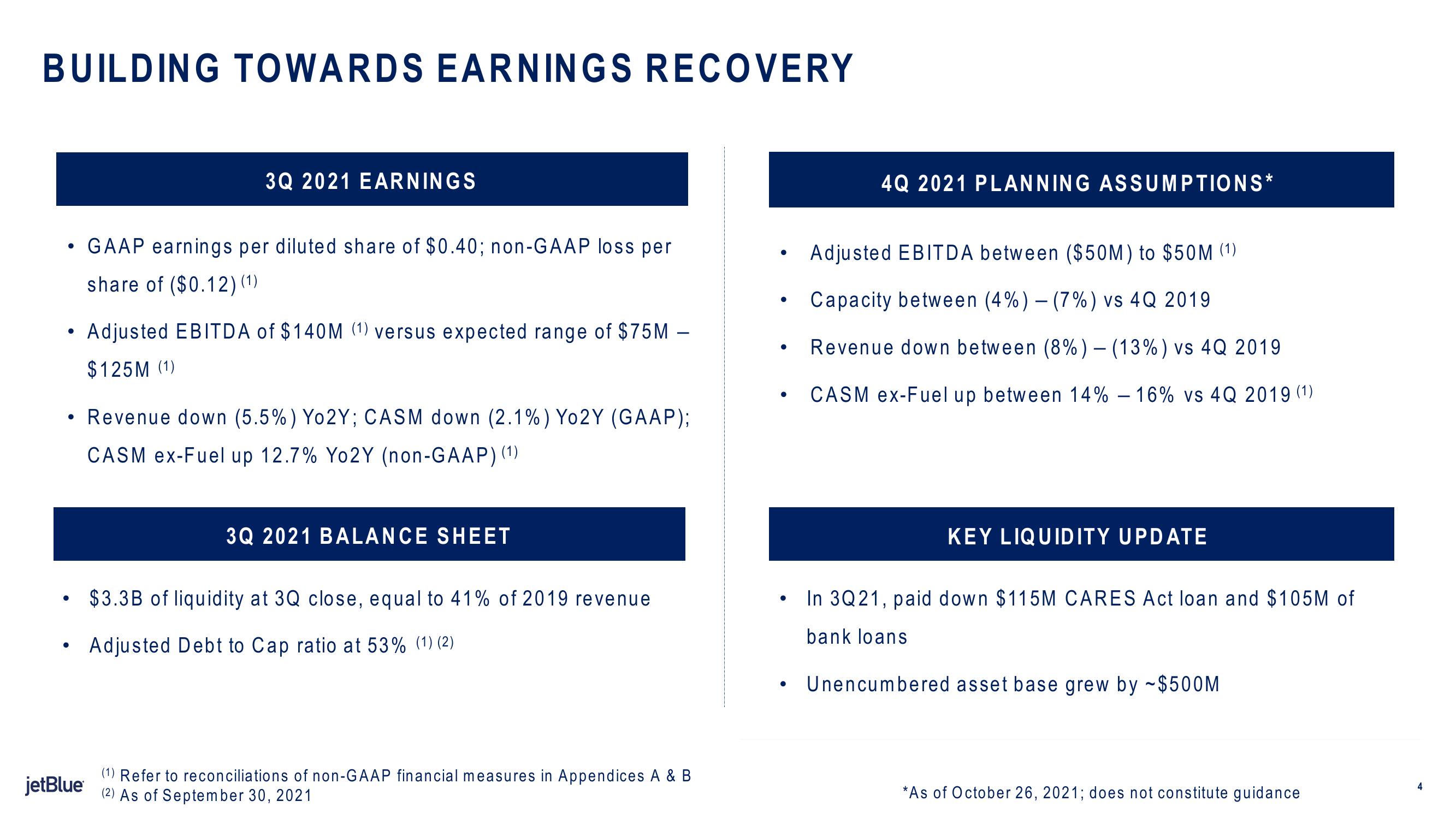

BUILDING TOWARDS EARNINGS RECOVERY

●

●

3Q 2021 EARNINGS

jetBlue

GAAP earnings per diluted share of $0.40; non-GAAP loss per

share of ($0.12) (1)

• Revenue down (5.5%) Yo2Y; CASM down (2.1%) Yo2Y (GAAP);

CASM ex-Fuel up 12.7% Yo2Y (non-GAAP) (1)

Adjusted EBITDA of $140M (1) versus expected range of $75M -

$125M (1)

3Q 2021 BALANCE SHEET

$3.3B of liquidity at 3Q close, equal to 41% of 2019 revenue

Adjusted Debt to Cap ratio at 53% (1) (2)

(1) Refer to reconciliations of non-GAAP financial measures in Appendices A & B

(2) As of September 30, 2021

●

●

●

●

●

4Q 2021 PLANNING ASSUMPTIONS*

Adjusted EBITDA between ($50M) to $50M (1)

Capacity between (4%) - (7%) vs 4Q 2019

Revenue down between (8%) - (13%) vs 4Q 2019

CASM ex-Fuel up between 14% -16% vs 4Q 2019 (¹)

KEY LIQUIDITY UPDATE

In 3Q21, paid down $115M CARES Act loan and $105M of

bank loans

Unencumbered asset base grew by ~$500M

*As of October 26, 2021; does not constitute guidanceView entire presentation