Pershing Square Activist Presentation Deck

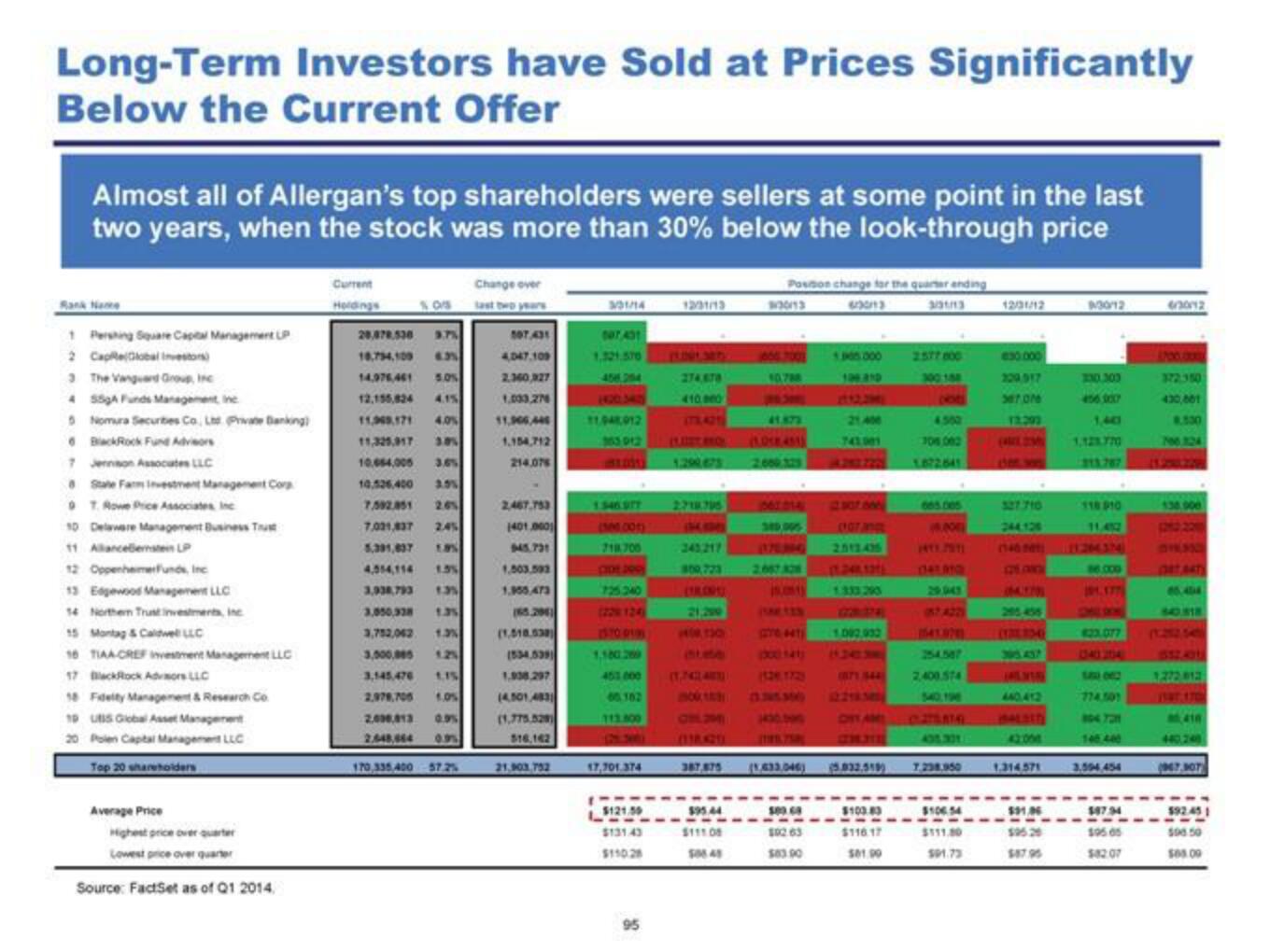

Long-Term Investors have Sold at Prices Significantly

Below the Current Offer

Almost all of Allergan's top shareholders were sellers at some point in the last

two years, when the stock was more than 30% below the look-through price

1 Pershing Square Capital Management P

2 Cape Global Investors)

3 The Vanguard Group, Inc

4 55gA Funds Management, inc

5 Nomura Securities Co., Ltd Private Banking)

6 BlackRock Fund Advisors

7 Jenson Associates LLC

8 State Farm Investment Management Corp

9 T. Rowe Price Associates, Inc

10 Delaware Management Business Trust

11 Allancebenstein LP

12 OppenheimerFunds, Inc

13 Edgewood Management LLC

14 Northern Trust investments, inc

15 Montag & Caldwell LLC

16 TIAA CREF investment Management LLC

17 BlackRock Advisors LLC

18 Fidelity Management & Research Co

19 UBS Global Asset Management

20 Polen Capital Management LLC

Top 20 shareholders

Average Price

Highest price over quarter

Lowest price over quarter

Source: FactSet as of Q1 2014.

Current

Change over

SOS last two years

20,878.530 3.7%

18,794,109 E

14,976,461 5.0%

12,155,824

11,949.171 4.0%

11,325,917 3.81

10.654,005 3.6%

10,526.400 3.5%

7.592.851 2.65

7,031,837 2.45

5,391,637 US

4,554,114 1.3%

3.938.793 1.35

3,050,338 1.35

3,752,042 1.3%

3,000,005

1.25

3,145,476 1.15

2.979,705 1.0%

2.000,013 0.9%

2.648,064

170,335,400 57.2%

4,047.109

2.360,327

1,003,276

11,906,446

1.154,712

214.075

2,467,753

1401.000

945.731

1,503.593

1.955,473

(65.294)

(1,018.538)

(534,539)

1,938,297

(4.501,483)

(1,775.529)

$16,162

21.903.752

3/31/14

107 401

1,321.570

456,284

11,948012

363 012

1.546 STF

(MM0.005)

718.700

1,180 209

453 000

60.302

113.800

17,701 374

$121.50

$131.43

$110.28

12/31/13

95

274,878

410.000

1.290,675

2.718.795

21,299

(1,744)

387,875

$95.44

$111.08

50648

------

Position change for the quarter ending

6:3013

3/31/113

1/2013

1666.700

10.788

15.01)

70 441)

1.305.000

106.810

503.68

102.63

$83.90

21,400

741.001

1.002.032

(871 844)

(1.633.046) (5.832.518)

$103.83

$116.17

$81.90

2577 800

4500

306 002

1.872641

665.ces

1.800

1411.7911

(141 910)

29.043

1541.92

254.587

2,400.574

401.301

7.298.950

$106.54

$111.80

501.73

12/31/12

830.000

309,917

367 076

(42M

327.710

(4.320

42:00

1.314.571

$31,06

$95.29

8/30/12

3:30.303

1,40

1,121.770

315.787

118 910

86.000

91.377

623.077

114.501

8047211

3.594,454

$47.34

$9505

$82.07

372-350

430,001

8.530

706.324

138.000

016350

86.404

1272 812

410

(9467.907

192.45 1

506 50

505.00View entire presentation