UBS Shareholder Engagement Presentation Deck

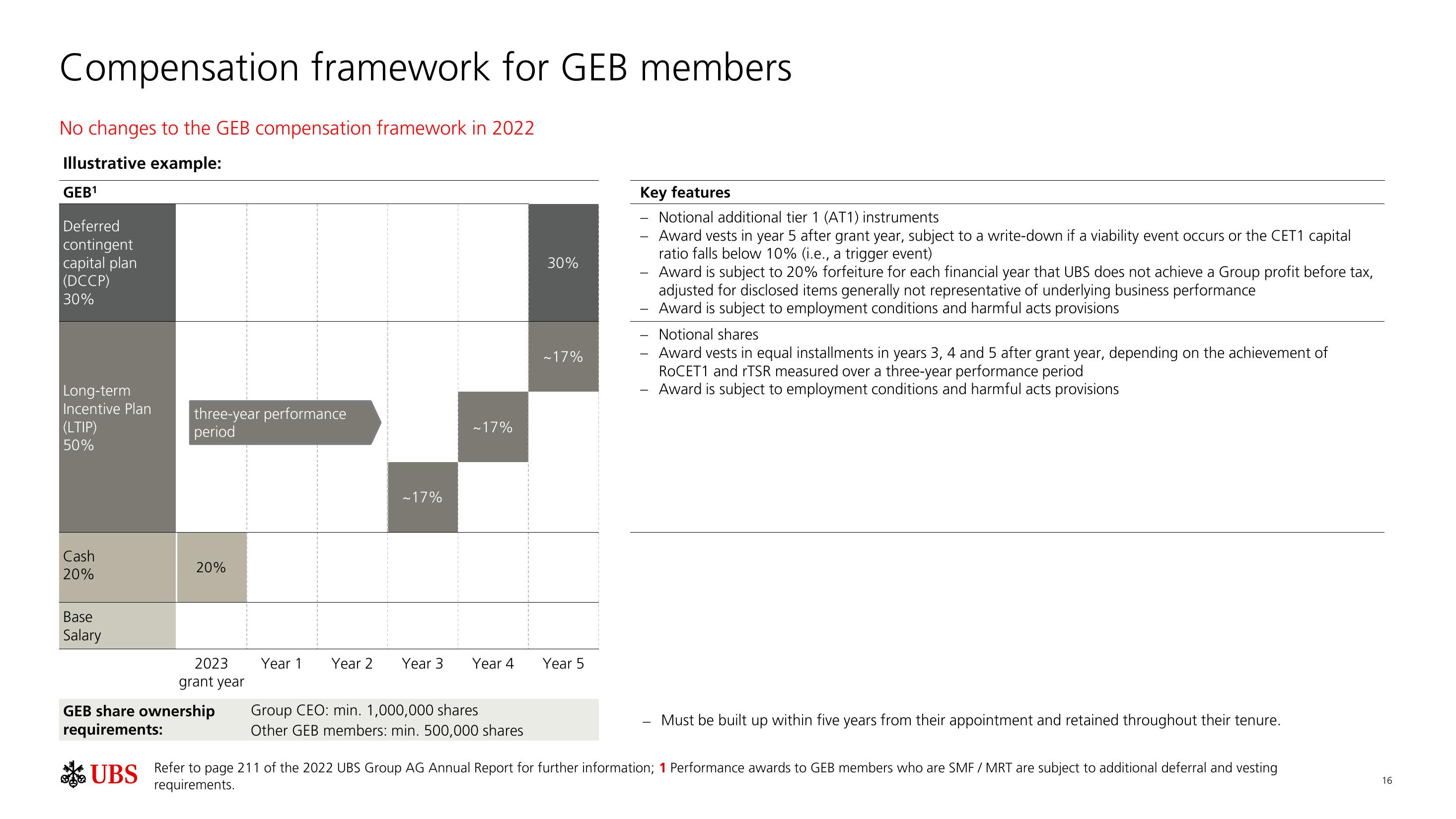

Compensation framework for GEB members

No changes to the GEB compensation framework in 2022

Illustrative example:

GEB¹

Deferred

contingent

capital plan

(DCCP)

30%

Long-term

Incentive Plan three-year performance

(LTIP)

period

50%

Cash

20%

Base

Salary

20%

2023

grant year

GEB share ownership

requirements:

UBS

Year 1 Year 2

~17%

Year 3

~17%

Year 4

Group CEO: min. 1,000,000 shares

Other GEB members: min. 500,000 shares

30%

~17%

Year 5

Key features

Notional additional tier 1 (AT1) instruments

Award vests in year 5 after grant year, subject to a write-down if a viability event occurs or the CET1 capital

ratio falls below 10% (i.e., a trigger event)

-

Award is subject to 20% forfeiture for each financial year that UBS does not achieve a Group profit before tax,

adjusted for disclosed items generally not representative of underlying business performance

Award is subject to employment conditions and harmful acts provisions

Notional shares

Award vests in equal installments in years 3, 4 and 5 after grant year, depending on the achievement of

ROCET1 and rTSR measured over a three-year performance period

Award is subject to employment conditions and harmful acts provisions

Must be built up within five years from their appointment and retained throughout their tenure.

Refer to page 211 of the 2022 UBS Group AG Annual Report for further information; 1 Performance awards to GEB members who are SMF/MRT are subject to additional deferral and vesting

requirements.

16View entire presentation