Bed Bath & Beyond Results Presentation Deck

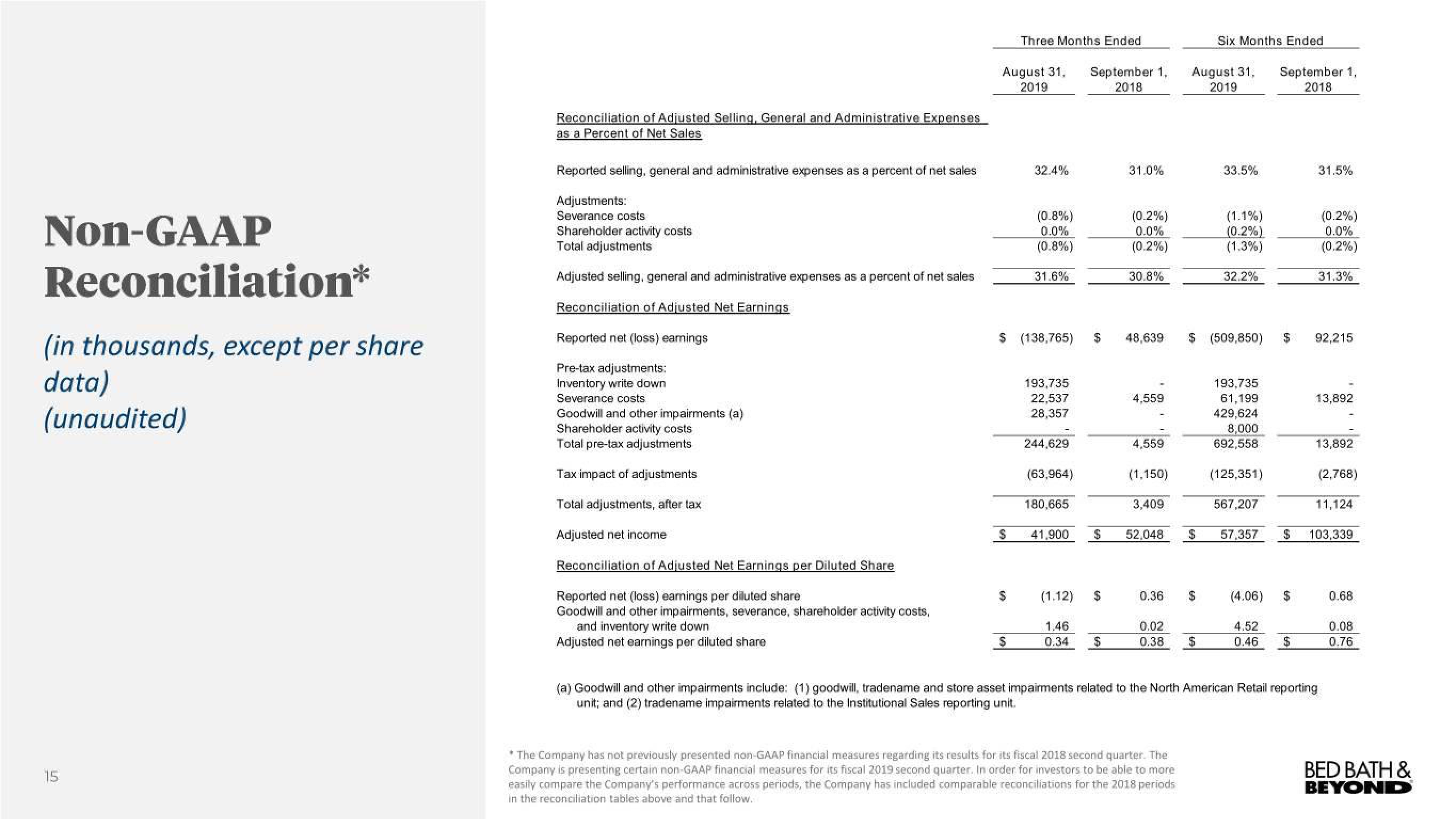

Non-GAAP

Reconciliation*

(in thousands, except per share

data)

(unaudited)

15

Reconciliation of Adjusted Selling, General and Administrative Expenses

as a Percent of Net Sales

Reported selling, general and administrative expenses as a percent of net sales

Adjustments:

Severance costs

Shareholder activity costs

Total adjustments

Adjusted selling, general and administrative expenses as a percent of net sales

Reconciliation of Adjusted Net Earnings

Reported net (loss) earnings

Pre-tax adjustments:

Inventory write down

Severance costs.

Goodwill and other impairments (a)

Shareholder activity costs

Total pre-tax adjustments

Tax impact of adjustments

Total adjustments, after tax

Adjusted net income

Reconciliation of Adjusted Net Earnings per Diluted Share

Reported net (loss) eamings per diluted share

Goodwill and other impairments, severance, shareholder activity costs,

and inventory write down

Adjusted net earnings per diluted share

August 31, September 1,

2019

2018

Three Months Ended

$

$

32.4%

(0.8%)

0.0%

(0.8%

$ (138,765)

31.6%

193,735

22,537

28,357

244,629

(63,964)

180,665

41,900

(1.12)

1.46

0.34

$

$

$

31.0%

(0.2%)

0.0%

(0.2%)

30.8%

48,639

4,559

4,559

(1,150)

3,409

52,048

August 31, September 1,

2019

2018

$

0.36 $

* The Company has not previously presented non-GAAP financial measures regarding its results for its fiscal 2018 second quarter. The

Company is presenting certain non-GAAP financial measures for its fiscal 2019 second quarter. In order for investors to be able to more

easily compare the Company's performance across periods, the Company has included comparable reconciliations for the 2018 periods

in the reconciliation tables above and that follow..

Six Months Ended

0.02

0.38 $

33.5%

$ (509,850)

(1.1%)

(0.2%)

(1.3%)

32.2%

193,735

61,199

429,624

8,000

692,558

(125,351)

567,207

57,357

(4.06) $

4.52

0.46

$

31.5%

(0.2%)

0.0%

(0.2%)

31.3%

92,215

13,892

(a) Goodwill and other impairments include: (1) goodwill, tradename and store asset impairments related to the North American Retail reporting

unit; and (2) tradename impairments related to the Institutional Sales reporting unit.

13,892

(2,768)

11,124

103,339

0.68

0.08

0.76

BED BATH &

BEYONDView entire presentation