jetBlue Results Presentation Deck

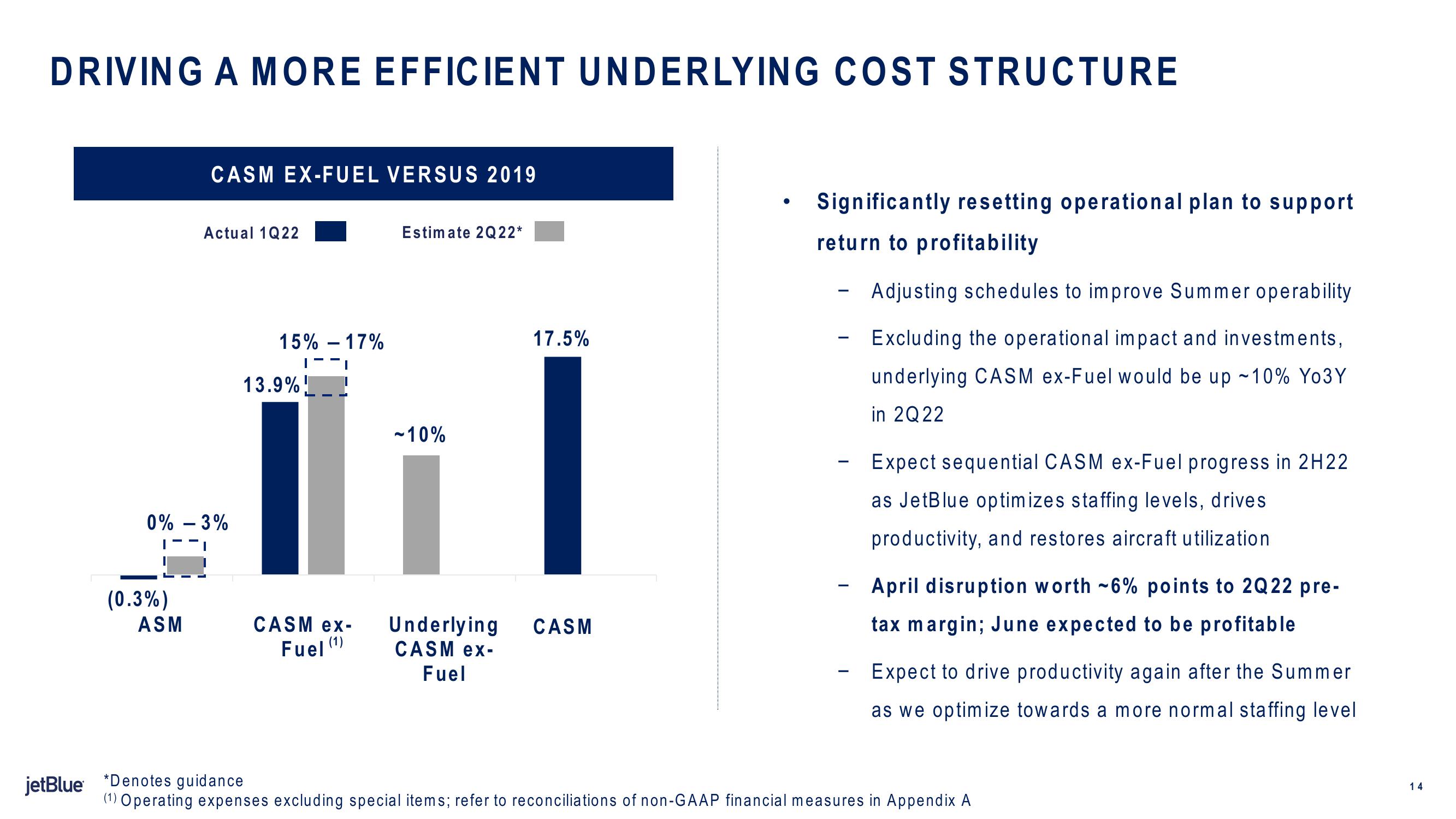

DRIVING A MORE EFFICIENT UNDERLYING COST STRUCTURE

(0.3%)

CASM EX-FUEL VERSUS 2019

0% -3%

I

ASM

Actual 1Q22

15% -17%

13.9%

CASM ex-

Fuel (¹)

Estimate 2Q 22*

-10%

17.5%

Underlying CASM

CASM ex-

Fuel

●

Significantly resetting operational plan to support

return to profitability

-

Adjusting schedules to improve Summer operability

Excluding the operational impact and investments,

underlying CASM ex-Fuel would be up ~10% Yo3Y

in 2Q22

Expect sequential CASM ex-Fuel progress in 2H22

as JetBlue optimizes staffing levels, drives

productivity, and restores aircraft utilization

April disruption worth ~6% points to 2Q22 pre-

tax margin; June expected to be profitable

Expect to drive productivity again after the Summer

as we optimize towards a more normal staffing level

jetBlue *Denotes guidance

(1) Operating expenses excluding special items; refer to reconciliations of non-GAAP financial measures in Appendix A

14View entire presentation