Despegar Mergers and Acquisitions Presentation Deck

DESPEGAR

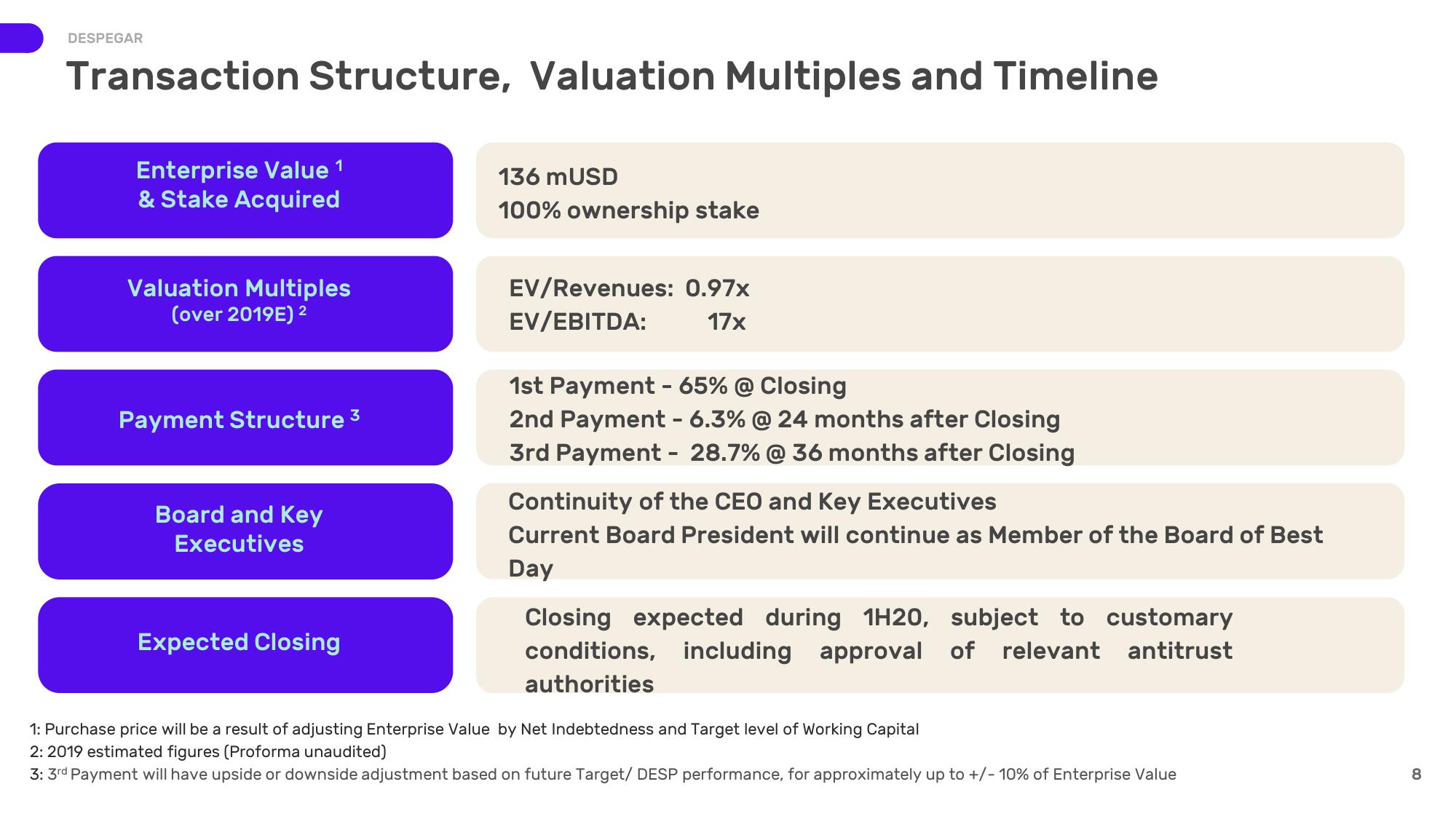

Transaction Structure, Valuation Multiples and Timeline

Enterprise Value 1

& Stake Acquired

Valuation Multiples

(over 2019E) 2

Payment Structure 3

Board and Key

Executives

Expected Closing

136 mUSD

100% ownership stake

EV/Revenues: 0.97x

EV/EBITDA: 17x

1st Payment - 65% @ Closing

2nd Payment - 6.3% @ 24 months after Closing

3rd Payment - 28.7% @ 36 months after Closing

Continuity of the CEO and Key Executives

Current Board President will continue as Member of the Board of Best

Day

Closing expected during 1H20, subject to customary

conditions, including approval of relevant antitrust

authorities

1: Purchase price will be a result of adjusting Enterprise Value by Net Indebtedness and Target level of Working Capital

2: 2019 estimated figures (Proforma unaudited)

3: 3rd Payment will have upside or downside adjustment based on future Target/ DESP performance, for approximately up to +/- 10% of Enterprise Value

8View entire presentation