OpenText Investor Presentation Deck

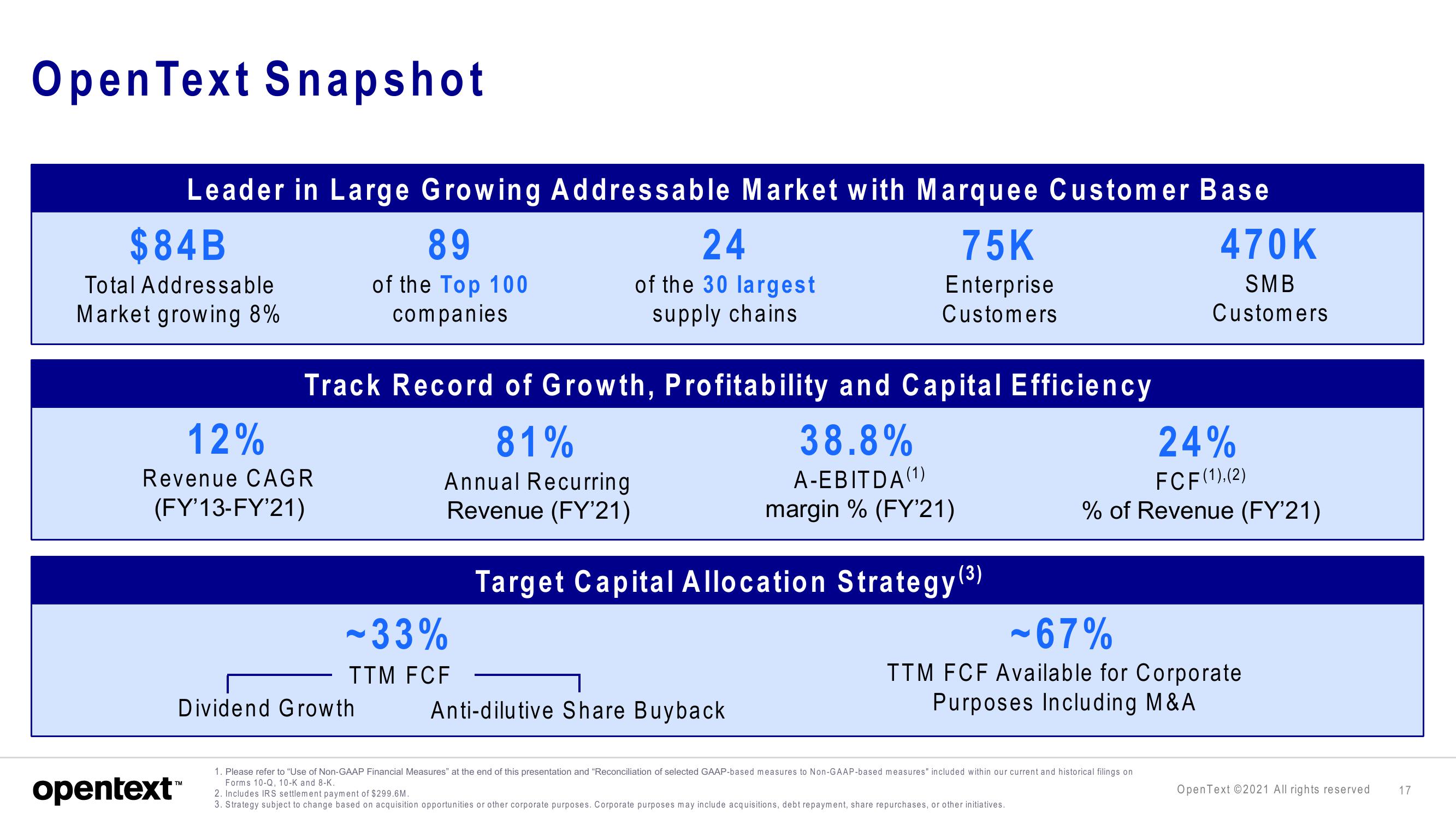

OpenText Snapshot

Leader in Large Growing Addressable Market with Marquee Customer Base

75K

Enterprise

Customers

$84B

Total Addressable

Market growing 8%

12%

Revenue CAGR

(FY'13-FY'21)

opentext™

89

of the Top 100

companies

Track Record of Growth, Profitability and Capital Efficiency

81%

38.8%

A-EBITDA (1)

margin % (FY'21)

Dividend Growth

24

of the 30 largest

supply chains

-33%

TTM FCF

Annual Recurring

Revenue (FY'21)

Target Capital Allocation Strategy (³)

Anti-dilutive Share Buyback.

470K

SMB

Customers

24%

FCF (1), (2)

% of Revenue (FY'21)

~67%

TTM FCF Available for Corporate

Purposes Including M&A

1. Please refer to "Use of Non-GAAP Financial Measures" at the end of this presentation and "Reconciliation of selected GAAP-based measures to Non-GAAP-based measures" included within our current and historical filings on

Forms 10-Q, 10-K and 8-K.

2. Includes IRS settlement payment of $299.6M.

3. Strategy subject to change based on acquisition opportunities or other corporate purposes. Corporate purposes may include acquisitions, debt repayment, share repurchases, or other initiatives.

OpenText ©2021 All rights reserved

17View entire presentation