LanzaTech Investor Presentation Deck

LanzaTech Unit Level Economics

($ in millions)

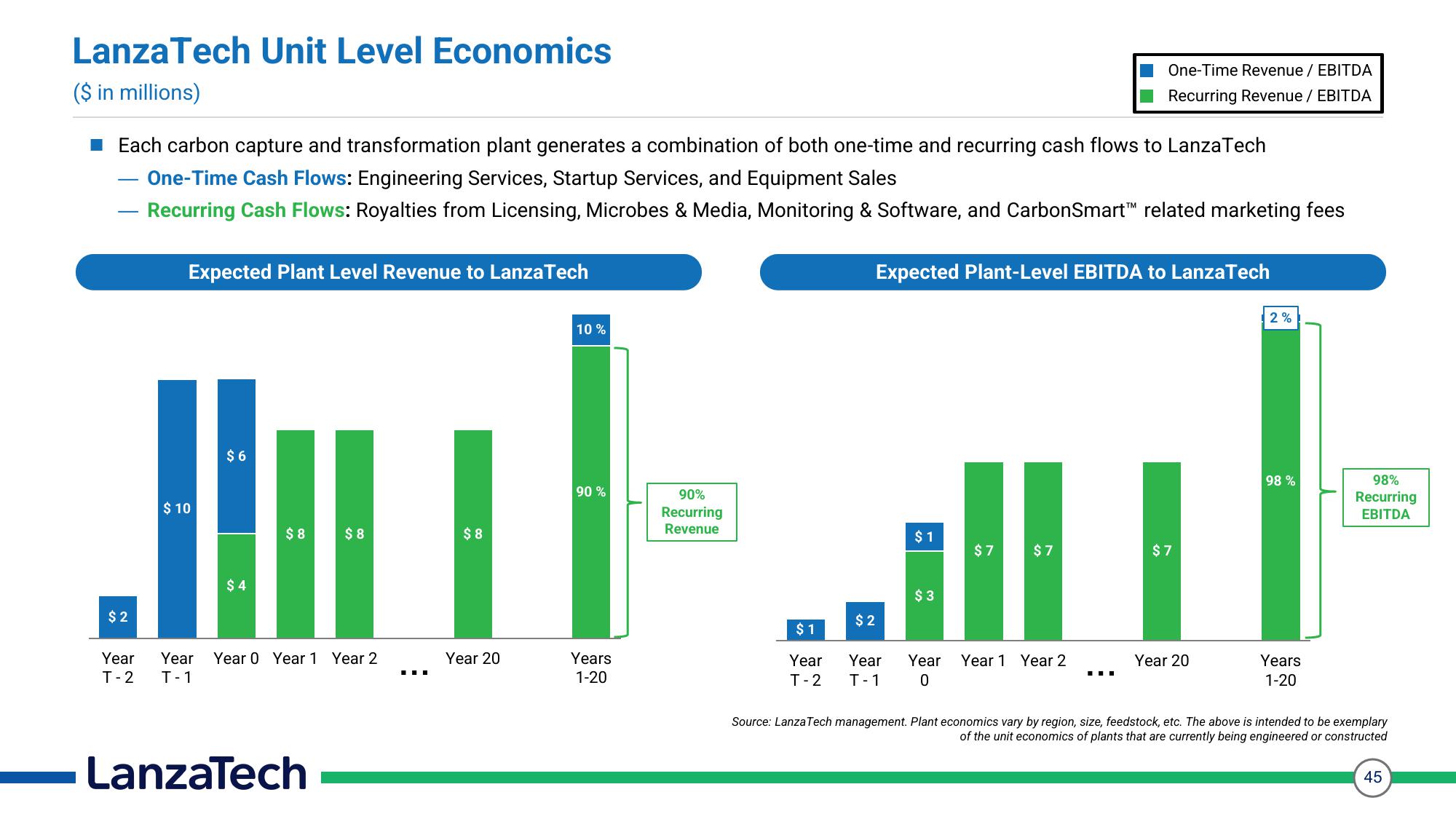

Each carbon capture and transformation plant generates a combination of both one-time and recurring cash flows to LanzaTech

One-Time Cash Flows: Engineering Services, Startup Services, and Equipment Sales

Recurring Cash Flows: Royalties from Licensing, Microbes & Media, Monitoring & Software, and CarbonSmart™ related marketing fees

$2

Expected Plant Level Revenue to LanzaTech

$ 10

$6

$4

$8

$8

Year Year Year 0 Year 1 Year 2

T-2 T-1

LanzaTech

$8

Year 20

10%

90 %

Years

1-20

90%

Recurring

Revenue

Expected Plant-Level EBITDA to LanzaTech

$2

$1

Year

Year

T-2 T-1

$1

$3

Year

0

$7

One-Time Revenue / EBITDA

Recurring Revenue / EBITDA

$7

Year 1 Year 2

$7

Year 20

2%

98 %

Years

1-20

98%

Recurring

EBITDA

Source: LanzaTech management. Plant economics vary by region, size, feedstock, etc. The above is intended to be exemplary

of the unit economics of plants that are currently being engineered or constructed

45View entire presentation