DraftKings Results Presentation Deck

DRAFTKINGS P&L AND ADJUSTED EBITDA RECONCILIATION

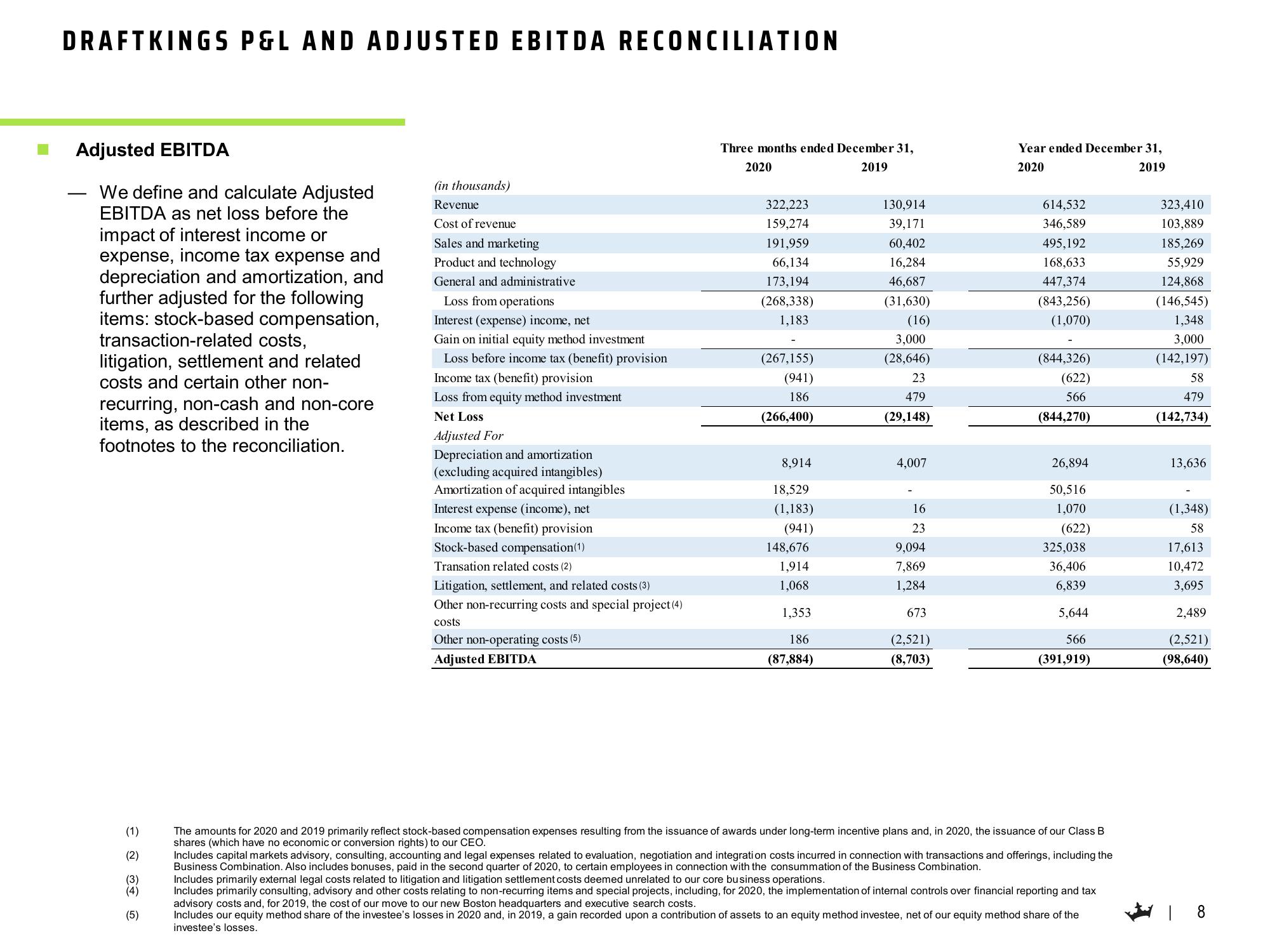

Adjusted EBITDA

We define and calculate Adjusted

EBITDA as net loss before the

impact of interest income or

expense, income tax expense and

depreciation and amortization, and

further adjusted for the following

items: stock-based compensation,

transaction-related costs,

litigation, settlement and related

costs and certain other non-

recurring, non-cash and non-core

items, as described in the

footnotes to the reconciliation.

(1)

(2)

(3)

(4)

(5)

(in thousands)

Revenue

Cost of revenue

Sales and marketing

Product and technology

General and administrative

Loss from operations

Interest (expense) income, net

Gain on initial equity method investment

Loss before income tax (benefit) provision

Income tax (benefit) provision

Loss from equity method investment

Net Loss

Adjusted For

Depreciation and amortization

(excluding acquired intangibles)

Amortization of acquired intangibles

Interest expense (income), net

Income tax (benefit) provision

Stock-based compensation(1)

Transation related costs (2)

Litigation, settlement, and related costs (3)

Other non-recurring costs and special project (4)

costs

Other non-operating costs (5)

Adjusted EBITDA

Three months ended December 31,

2019

2020

322,223

159,274

191,959

66,134

173,194

(268,338)

1,183

(267,155)

(941)

186

(266,400)

8,914

18,529

(1,183)

(941)

148,676

1,914

1,068

1,353

186

(87,884)

130,914

39,171

60,402

16,284

46,687

(31,630)

(16)

3,000

(28,646)

23

479

(29,148)

4,007

16

23

9,094

7,869

1,284

673

(2,521)

(8,703)

Year ended December 31,

2020

2019

614,532

346,589

495,192

168,633

447,374

(843,256)

(1,070)

(844,326)

(622)

566

(844,270)

26,894

50,516

1,070

(622)

325,038

36,406

6,839

5,644

566

(391,919)

The amounts for 2020 and 2019 primarily reflect stock-based compensation expenses resulting from the issuance of awards under long-term incentive plans and, in 2020, the issuance of our Class B

shares (which have no economic or conversion rights) to our CEO.

Includes capital markets advisory, consulting, accounting and legal expenses related to evaluation, negotiation and integration costs incurred in connection with transactions and offerings, including the

Business Combination. Also includes bonuses, paid in the second quarter of 2020, to certain employees in connection with the consummation of the Business Combination.

Includes primarily external legal costs related to litigation and litigation settlement costs deemed unrelated to our core business operations.

Includes primarily consulting, advisory and other costs relating to non-recurring items and special projects, including, for 2020, the implementation of internal controls over financial reporting and tax

advisory costs and, for 2019, the cost of our move to our new Boston headquarters and executive search costs.

Includes our equity method share of the investee's losses in 2020 and, in 2019, a gain recorded upon a contribution of assets to an equity method investee, net of our equity method share of the

investee's losses.

323,410

103,889

185,269

55,929

124,868

(146,545)

1,348

3,000

(142,197)

58

479

(142,734)

13,636

(1,348)

58

17,613

10,472

3,695

2,489

(2,521)

(98,640)

8View entire presentation